Strong corporate performance in the March quarter along with positive management signals have cheered the market and can lead to earnings upgrades if the pandemic-hit economy revives quickly and the vaccination drive accelerates, analysts said.

"The probability for earnings upgrades will be good, but for that, we need to see a higher rate of economic growth coming back because earnings are closely linked to the rate of GDP growth. Also, for benefits in valuations like the expansion of valuation, easy liquidity and lower interest rates are a must," Joseph Thomas, Head of Research at Emkay Wealth Management told Moneycontrol.

The progress of vaccination and the unwinding of lockdowns is also a factor, said Gautam Duggad, Head of Research, Institutional Equities at Motilal Oswal Financial Services. “For earnings to see an upgrade, the pace of unlock and economic recovery has to be far better than what is currently envisaged," he said.

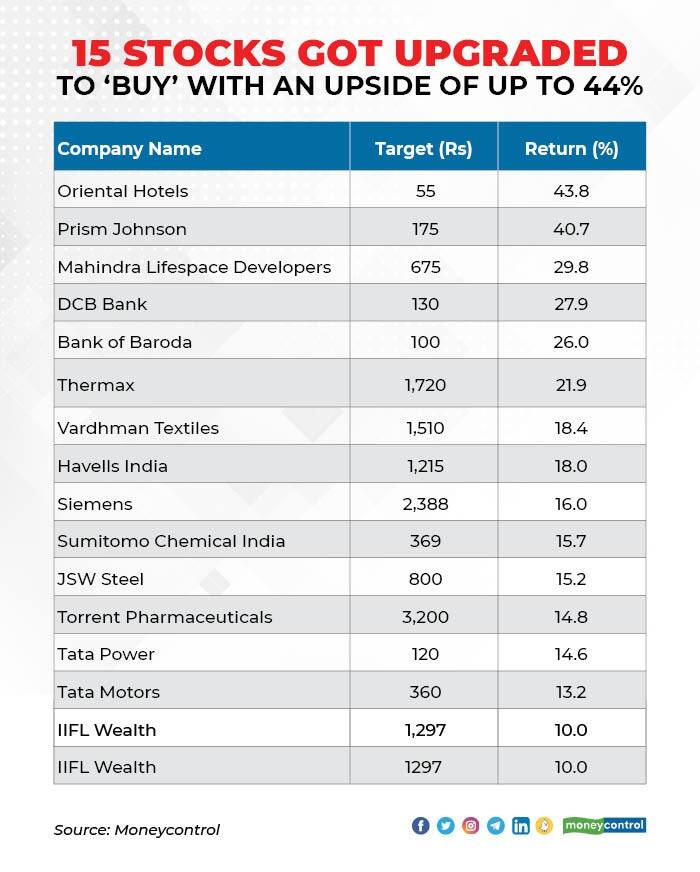

Ratings of more than 75 companies were upgraded to ‘buy’ after March quarter earnings as per the brokerage reports available with the Moneycontrol from the beginning of quarterly earnings season from the second week of April 2021.

Oriental Hotels, Prism Johnson, Mahindra Lifespace Developers, DCB Bank, Bank of Baroda, Thermax, Vardhman Textiles, Havells India, Siemens, Sumitomo Chemical India, JSW Steel, Torrent Pharmaceuticals, Tata Power, Tata Motors, and IIFL Wealth are 15 companies in the lastest list of upgrades. Some of them including Sumitomo Chemical India, JSW Steel, Vardhman Textiles, Oriental Hotels, Bank of Baroda, and Mahindra Lifespace Developers also saw increase in target price after earnings.

Here is the list of these 15 stocks that were upgraded to ‘buy’.Here is the list of these 15 stocks which saw upgrade in rating to buy:DCB Bank: Buy | Target: Rs 130 | Return: 27.9 percent

"With DCB Bank's target portfolio (over 50 percent mortgages/SME - Small & Medium Enterprise) and most customers being self-employed, FY21 was anticipated to be a very tough year for the bank, given the underlying stress in small businesses at the macro level. With a slippage rate for FY21 in line with FY20 and a net restructured book contained below 4 percent, the bank has done a commendable job, given the trying economic environment," said Anand Rathi.

The brokerage expects business activities and recoveries of DCB Bank to pick up once pandemic-related restrictions are lifted, and earnings to normalise in the medium term.

Thermax: Buy | Target: Rs 1,720 | Return: 21.9 percent

Sharekhan upgraded Thermax to buy with a revised target price of Rs 1,720 led by improving visibility for new orders due to positive business environment.

"Thermax reported healthy Q4FY21 performance led by strong execution across segments and improvement in margins leading to beat on net profit. Order inflow remained strong despite absence of large size orders while order book healthy well spread across sectors. Enquiry pipeline strong across food processing, chemical and pharma including large size orders from Oil & Gas, FGD, refinery and chemicals," said the brokerage.

"A strong balance sheet and net cash position provide comfort in the present environment. The company's focus on newer technologies is expected to provide next leg of growth in the near-future," the brokerage added.

Tata Motors: Buy | Target: Rs 360 | Return: 13.2 percent

"The business scenario is fluid with the second wave of the pandemic hitting the country resulting in multiple lockdowns. Sequential improvement in overall performance is expected from the second quarter of FY22. Tata Motors has launched the Business Agility Plan to manage this fluid situation," said KR Choksey.

"In commercial vehicles, the focus remains on growing market share and protecting margins amidst this dynamic environment while in passenger vehicles, the company will continue to enhance the sales momentum by leveraging its front end. In electric vehicle, company will drive up penetration through portfolio expansion and accelerating charging infrastructure. The company is targeting to deliver over 2.5 percent EBIT (earnings before interest and tax) with positive free cash flows," the brokerage added.

With improving volume demand domestically and on international front backed by cost optimization and cash saving initiative, KR Choksey expects Tata Motors to grow at CAGR of 13.4 percent & 10.9 percent in topline & EBITDA respectively over FY21/23.

Prism Johnson: Buy | Target: Rs 175 | Return: 40.7 percent

"Robust demand and cost optimisation aided the better performances in all Prism's divisions; the cement division's volume and the RMC's (ready-mixed concrete) EBIT were the highest ever. Debt is expected to be in check despite the coming expansion in cement and tiles. The restructuring and greater renewable power capacity are other positives," said Anand Rathi.

IIFL Wealth: Buy | Target: Rs 1,297 | Return: 10 percent

"Driven by AMC (asset management company) and good third-party product sale, recurring assets grew 63 percent, pushing up IIFL Wealth's Q4 FY21 AUM (assets under management) 32 percent YoY. On the upbeat guidance and strong FY21, we raise our FY22/23 AUM growth and net profit. Senior management and client attrition were consistently low," said Anand Rathi.

Siemens: Buy | Target: Rs 2,388 | Return: 16 percent

"Aided by recovery in its short-cycle business, Siemens reported strong Q2 FY21 figures. Revenue, EBITDA (earnings before interest, tax, depreciation and amortisation) and PAT were up 32 percent, 107 percent, and 91 percent YoY, helped by broad-based recovery except in Mobility. Supply-chain issues (semi-conductor shortages), higher logistics costs and lower export incentives were key negatives; however, tight cost-controls improved profitability," said Anand Rathi.

"Management sounded optimistic on the order pipeline with a pickup in private capex and the government focus on infra. It is a key beneficiary of industrial recovery and optimistic about adoption of automation/digitisation," the brokerage added.

Tata Power: Buy | Target: Rs 120 | Return: 14.6 percent

"Its revenue grew by 53.0 percent YoY in Q4FY21 on all-round improvements seen in both B2B & B2C verticals and across its generation, transmission and distribution operations. EBITDA margins remained under pressure declining 11.3pps YoY to 15.2 percent on higher costs and lag in price hikes," said Geojit Financial Services.

"The company acquired four licenses for retail power distribution in Odisha, thereby expanding its total customer base to over 11.7 million," the brokerage added.

Torrent Pharmaceuticals: Buy | Target: Rs 3,200 | Return: 14.8 percent

"Torrent has reported a healthy performance for the quarter, largely backed by growth in the domestic and Europe business and the earnings were marginally better than estimates. The geographies of India, Brazil and Europe have a strong growth outlook while US revenues are likely to bottom out and stage a gradual improvement backed by new product launches," Sharekhan said.

"On the basis of encouraging commentary for the US and a healthy growth outlook for other geographies shared by the management, we have upgraded our recommendation to buy from hold," the brokerage added.

Havells India: Buy | Target: Rs 1,215 | Return: 18 percent

ICICI Direct believes Havells' robust balance sheet condition (net cash of Rs 1,438 crore) and its future plans to increase penetration in semi urban/rural markets will benefit it in the long term.

"We build in revenue, PAT CAGR (compound annual growth rate) of around 18 percent and 15 percent, respectively in FY21-23," said the brokerage.

Mahindra Lifespace Developers: Buy | Target: Rs 675 | Return: 29.8 percent

ICICI Direct likes Mahindra Lifespace given its strong parentage, management's focus on expanding its overall scale of operation and a comfortable balance sheet.

"The change in management and execution has started to show initial signs of transformation with new land purchase. Group focus (expecting the overall size to expand to $1 billion versus around $375 million) also lends confidence. Hence, we upgraded Mahindra Lifespace to buy (versus hold earlier) recommendation with a target price of Rs 675 per share (earlier Rs 300)," said the brokerage.

Bank of Baroda: Buy | Target: Rs 100 | Return: 26 percent

"Bank of Baroda has shown an improved asset quality performance while legacy corporate stress has been mostly dealt with. We believe lower slippages and, thus, credit costs along with pick-up in loan growth should reflect positively on the operational performance of the bank. Also, benefit of new tax regime should add to earnings improvement," said ICICI Direct.

"Sufficient provisions on stressed book provide comfort while recent fund raising has improved overall capital position as well. Thus, we upgraded rating from hold to buy and revised target price to Rs 100 (Rs 70 earlier)," the brokerage added.

Oriental Hotels: Buy | Target: Rs 55 | Return: 43.8 percent

"Oriential Hotels (OHL) has seen its valuations decline owing to high leverage, weak operating performance and contracting returns. Now, the balance sheet and operations, both are expected to improve, going forward. Further, the ongoing crisis may lead to around 15 percent room inventory reduction, which augurs well for the company in the long run," said ICICI Direct.

"On a replacement basis, the stock is trading at EV (enterprise value) per room of Rs 1.1 crore. We value it at EV per room of Rs 1.5 crore with revised target of Rs 55 (earlier Rs 33). We upgraded the stock from hold to buy," the brokerage added.

Vardhman Textiles: Buy | Target: Rs 1,510 | Return: 18.4 percent

"Sustained improvement in yarn spreads and consequent improvement in margins would enable Vardhman Textiles (VTL) to improve its financial performance, going ahead. We expect Vardhman to report revenue, earnings CAGR of 13 percent, 61 percent, respectively, in FY21-23. The improved financial performance is expected to result in augmentation of RoCE (return on capital employed) profile (570 bps improvement in FY21-23 to 13.4 percent)," said ICICI Direct.

"We expect VTL to capitalise on the emerging demand scenario owing to its strong balance sheet and long standing relationship with marquee clients. We upgraded rating from hold to buy with a revised target price of Rs 1,510 (earlier Rs 1,100)," the brokerage added.

JSW Steel: Buy | Target: Rs 800 | Return: 15.2 percent

"JSW Steel reported a strong operational performance in Q4FY21, primarily on the back of healthy uptick in realisations. Going forward, for JSW Steel standalone operations, we model EBITDA per tonne of Rs 18,000 per tonne for FY22 and Rs 15,000 per tonne for FY23 (standalone EBITDA per tonne of Rs 12,943 per tonne in FY21) and model standalone sales volume of 17.4 MT (million tonnes) in FY22 and 20 MT in FY23 (standalone sales volume of 14.9 MT in FY21)," said ICICI Direct.

"We valued the stock on an SoTP basis and arrived at a target price of Rs 800 (earlier Rs 675). We upgraded the stock from hold to buy recommendation," the brokerage added.

Sumitomo Chemical India: Buy | Target: Rs 369 | Return: 15.7 percent

Prabhudas Lilladher (PL) upgraded the stock to 'buy' from accumulate with revised target price of Rs 369 (previous Rs 336) based on 38x FY23 EPS estimates of Rs 9.7.

"The company reported better-than-expected set of results driven by higher than anticipated demand. Gross margins expansion was lower than expected, but operating leverage benefit drove 393bps (PL estimates of 237 bps) improvement in EBITDA margin to 13.4 percent. Lower effective tax rate at 12 percent aided PAT growth," said the brokerage.

The brokerage further said, "The management plans to invest Rs 100-110 crore between FY22-FY23 for manufacturing 5 proprietary technical grade AIs (artificial intelligence) for SCC (Sumitomo Chemical Company). The revenue potential from these molecules is Rs 200-250 crore per annum, however these products have growing global demand and potential to add further capacities in the medium term. Molecule-wise commercialisation should commence FY23 onwards."

"Sumitomo Chemical India also planned to buy 2 land parcels of 70 acres in total for its future expansion plans. We increased topline, EBITDA and PAT estimates by 3 percent, 6 percent, and 5 percent respectively for FY22 and by 3 percent, 11 percent, and 10 percent for FY23 to factor in proprietary molecule commercialisation FY23 onwards," the brokerage added.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.