India emerged as the only major global market to close the week in positive territory, albeit by a slim margin. However, beneath this superficial strength lay a structural weakness that revealed itself across the broader market landscape.

While headline indices posted modest gains, underlying market sentiment remained decidedly fragile. The midcap and small-cap indices bore the brunt of profit-taking, declining by 1-2 percent and lagging their respective benchmarks.

Several factors conspired to dampen market enthusiasm. Global markets experienced a widespread selloff following robust US employment data, which effectively extinguished hopes of a Federal Reserve rate cut in December. Closer to home, the Indian rupee tumbled to a record low, while lingering uncertainty surrounding potential US-India trade agreements added another layer of concern for investors.

Sectoral performance painted a mixed picture. The IT sector led gainers with a healthy 1.6 percent advance, while auto stocks posted a respectable 1 percent increase. In contrast, certain sectors faced significant pressure: realty stocks plunged 3.7 percent, metal stocks retreated 3.3 percent, and media stocks fell 2.4 percent.

American and other developed markets reacted sharply to stronger-than-anticipated non-farm payroll figures, which effectively reduced the likelihood of a December rate cut by the Federal Reserve.

Despite receiving encouraging news from both corporate earnings releases and government economic indicators throughout the week, US equity markets ultimately finished lower. The decline appeared driven by two primary concerns: elevated stock valuations that seemed increasingly difficult to justify, and mounting questions about whether artificial intelligence investments would generate sufficient returns to warrant the enormous capital expenditure companies have committed to the technology.

The tech-heavy Nasdaq Composite suffered the steepest losses among major US indices. Even NVIDIA's record-breaking earnings announcement failed to inspire confidence, as the stock ended the session lower and dragged the broader market down with it.

Global markets remain volatile, particularly as prospects for near-term interest rate reductions have diminished. However, a glimmer of hope has emerged with US President Donald Trump's peace proposal to resolve the Russia-Ukraine conflict. Should both nations accept the terms, markets could find renewed momentum and direction.

Caution aheadThe Nifty has completed two weeks of recovery and reached a new high, though it remains short of its all-time peak. With weekly and daily momentum indicators showing positive signals, why does sentiment remain so poor?

The answer lies in several troubling factors. Global news flow and events, such as the USD-INR spike, have weighed on investor psychology. Most concerning is the market's weak internal structure—breadth has been notably poor, with small-cap stocks lagging their large-cap counterparts by a considerable margin in recent weeks. This divergence has left investors questioning the rally's sustainability and the market's underlying strength.

Poor breadth can transform into strong participation during a rising market, so the current trade setup remains key—and it has not yet reversed. However, investors should watch for a pattern of lower highs and lower lows, which could signal a trend reversal according to Dow Theory.

The weakness becomes clear in the 20-day advance/decline ratio, which tracks all BSE-listed stocks. This indicator has been falling throughout the month, even as the market bounced back, and is now entering oversold territory. Markets rarely fall from oversold readings. While it's unusual for prices to rise amid oversold breadth conditions, historical patterns suggest breadth typically improves before markets ultimately fail.

In other words, the market should experience near-term relief from its current pessimism, and breadth may begin to pick up.

Source: web.strike.money

The Open Interest Put/Call ratio has reached the red line that has historically served as an overbought threshold over the past two years. However, context matters: during earlier periods characterised by stronger trending markets, the ratio climbed significantly—approaching the yellow line and even reaching the dotted red line before that.

This raises an important question: when will market momentum become sufficiently robust to push the PCR back into those elevated ranges? Only time will provide the answer.

Source: web.strike.money

One indicator continues to provide reassurance that downside risk in the markets remains limited. Following this week's reading, it appears increasingly likely that markets could surge higher despite prevailing headwinds.

The chart reveals that Domestic Institutions are holding their second-highest long positions in index futures on record. Remarkably, most of these positions were accumulated over the past two weeks during a rising market—a pattern that runs counter to typical behaviour, as institutional players usually reduce exposure when markets advance.

Historical precedent shows that Domestic Institutions often hold record-long positions near significant market bottoms, providing crucial support during periods of distress. What makes the current situation extraordinary is that these near-record positions have been established close to all-time highs rather than at depressed levels.

What are they betting on that could potentially force Foreign Institutional Investors to cover their short positions? Only time will reveal the catalyst driving this exceptional conviction.

Source: web.strike.money

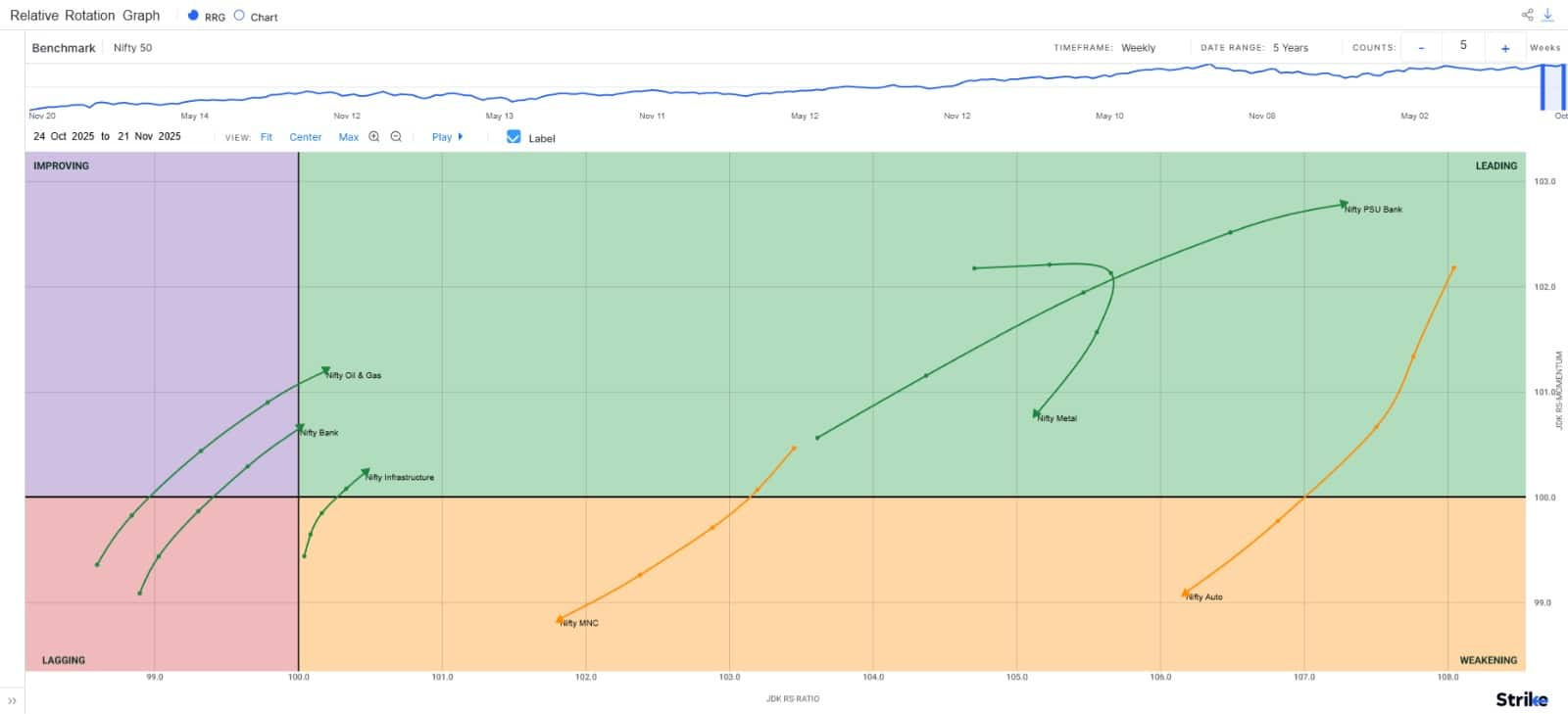

Sector RotationNifty 50 – The Benchmark Index ended higher by +0.61% this week and closed at 26068.15.

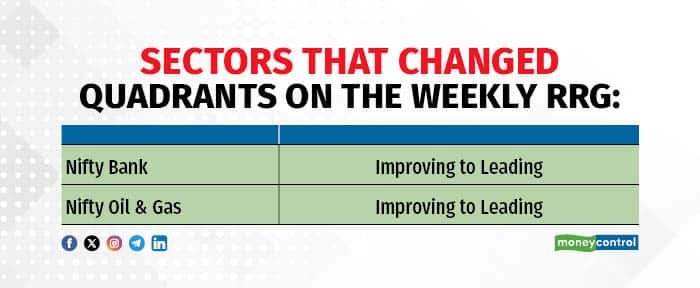

Leading Quadrant: Nifty Bank and Nifty Oil & Gas have entered the leading quadrant this week. Both indices are gaining momentum and relative strength. Nifty Infrastructure and Nifty PSU Bank also continue to gain momentum and relative strength. However, the Nifty Metal index has seen a significant dip in momentum in the last couple of weeks, and its relative strength has deteriorated as well, which is not a good sign.

Weakening Quadrant: Nifty MNC and Nifty Auto are witnessing deterioration in both momentum and relative strength.

Improving Quadrant: Many Nifty indices are in the improving quadrant. Nifty indices like Nifty Financial Services and Nifty Private Bank are gaining momentum and relative strength.

However, other Nifty indices, such as Nifty PSE, Nifty Energy, and Nifty Realty, have seen a decline in momentum and relative strength this week. If this trend persists, these indices may significantly underperform. So, keep these indices on your radar. After a marginal improvement in relative strength last week, this week’s momentum and relative strength have deteriorated once again for the Nifty IT index, and it is now on the verge of entering the lagging quadrant. The Nifty IT index needs a sustained period of outperformance to see some turnaround.

Lagging Quadrant: The momentum and relative strength of the Nifty Media, Nifty Consumer Durable, and Nifty FMCG indices continue to deteriorate. Nifty Pharma saw some improvement in momentum last week, but not this week. Instead, its relative strength deteriorated meaningfully this week, indicating that there are no signs of a turnaround yet.

Stocks to watchAmong the stocks expected to perform better during the week are SBI Life, Bharti Airtel, Hero MotoCo, Reliance, M&M, Axis Bank, LT, Eicher Motors, Titan, GMR Airport, Federal Bank and SBI.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.