Dear Reader,

Indian markets faced significant pressure throughout the week, closing lower on all five trading days. Selling intensified by Friday following the US Federal Reserve’s hawkish stance, which indicated only two rate cuts are expected next year against the earlier expectation of four rate cuts. The BSE Sensex declined by 4.98 percent, while the Nifty50 fell by 4.76 percent, marking the largest weekly drop in two years. Broader indices decreased by 3 percent to 5 percent, with all sectoral indices ending in negative territory.

Foreign Institutional Investors (FIIs) resumed selling, offloading Rs 15,828.11 crore during the week, bringing the total net sales for December to Rs 4,121.22 crore. Although the Fed's rate cut aligned with expectations at 25 basis points, market sentiment soured after Fed Chair Jerome Powell emphasized a cautious approach moving forward. This led to a 3 percent drop in US benchmark indices on the policy announcement day, representing the second-worst performance of 2024.

The US markets continued their downward trend until Thursday, marking a 14-day losing streak, the longest since 1978. A subsequent rally allowed some recovery, but major indices ended approximately 2 percent lower. The European STOXX 600 also suffered a decline of 2.76 percent for the week, its most significant loss in over three months. Other European indices followed suit: DAX decreased by 2.55 percent, Italy's FTSE fell by 3.22 percent, CAC 40 dropped by 1.82 percent, and the UK's FTSE 100 slipped by 2.60 percent.

In the UK, the Bank of England maintained its interest rate at 4.75 percent as annual headline inflation rose to 2.6 percent in November from 2.3 percent in October. Meanwhile, Japan's Nikkei 225 saw a decline of about 2 percent as the Yen weakened against the dollar, dropping from 153.7 to 156. The Bank of Japan kept its interest rates steady at 0.25 percent, expecting a potential hike in January; Japan's core CPI rose by 2.7 percent year-on-year in November, exceeding consensus estimates.

China's market experienced a modest decline of 0.7 percent, while Hong Kong's Hang Seng index fell by 1.25 percent. Disappointing economic data contributed to selling pressure in China, particularly a 10.4 percent drop in real estate investment and continued declines in new home prices across 70 cities for the seventeenth consecutive month.

With a robust recovery in the US market on Friday, there is potential for a rebound in Indian markets. However, as long as US 10-year bond yields remain around 4.50 percent, Foreign Institutional Investors (FIIs) will likely continue withdrawing funds. The behaviour of the US bond market will significantly influence the short-term movements of Indian markets.

FIIs increase short positionNifty ended its four-week winning streak by relinquishing all its gains. The index has fallen below the 20-week and 40-week moving averages, suggesting a likely downward trend as weekly momentum indicators remain in sell mode. Breaking below 23,800 has opened the door for a potential move down to 23,200 in the coming weeks. Historically, bearish trends can persist for 4 to 6 weeks once they begin.

The net open interest in index futures held by Foreign Institutional Investors (FIIs) continues to reflect a short position. However, they had reduced their short positions in the previous week to around 30,000 contracts. This week’s sales have seen that number expand again to 148,000 contracts. Historical data indicates that extreme short positions have previously reached over 330,000 contracts, so we are still far from that level. This suggests considerable room for further FII selling before any significant short-covering occurs. Consequently, the downtrend may continue as more short positions are established.

Source: web.strike.money

In the short term, after five consecutive days of selling, the daily swing indicator for combined momentum in the futures and options (F&O) segment has dropped to 5. This indicates that 95 percent of stocks are exhibiting negative momentum. Such low readings are often associated with short-term market bottoms, suggesting that a small bounce can be expected following this week’s decline. However, it is important to note that this does not necessarily indicate a medium-term trend reversal.

Source: web.strike.money

The market-wide put/call ratio based on open interest reflects a similar trend. The 9-day average of this indicator is currently around 0.68, and readings below 0.70 typically indicate oversold conditions. However, this indicator did not prove effective during the bearish phase observed in October 2024. A low reading suggests that there are significantly more outstanding call options in the market than put options.

Source: web.strike.money

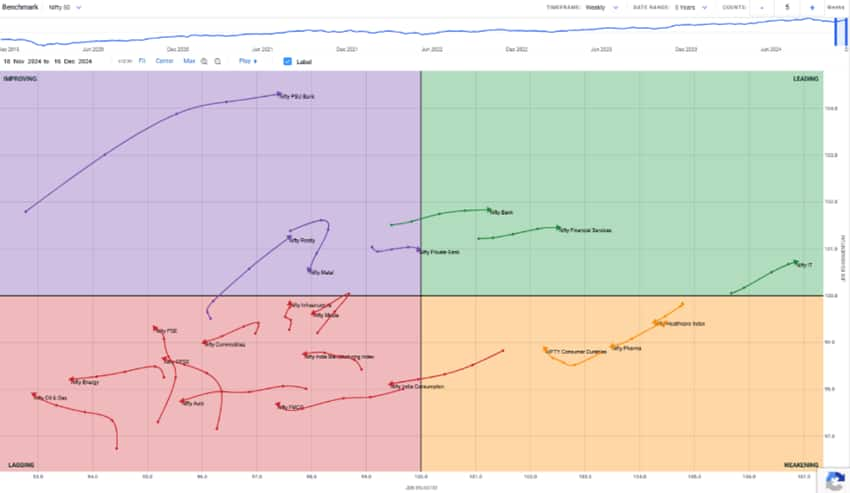

Sector RotationThe Weekly Relative Rotation Graph (RRG) from India Charts shows Nifty PSU Bank, Bank Nifty, Nifty Financial Services, and Nifty IT remained outperformers while Nifty India Consumption got into the Lagging quadrant from the Weakening indicating Loss of Momentum and Underperformance compared with Benchmark Nifty 50.

Nifty Realty continued to head towards the northeast in the improving quadrant, indicating an increase in sector momentum and outperforming the benchmark.

Sectors like Nifty FMCG, Auto, and Energy are heading west, indicating they are significantly underperforming and are the weakest indices.

Source: web.strike.money

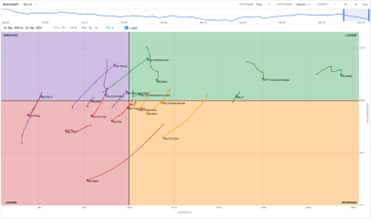

On the Daily RRG chart, most of the Indices have lost momentum, especially on the last 2 days of the week. Still, the ones that outperformed were Nifty Pharma & Nifty Healthcare, where the Pharma index is headed towards the Leading quadrant. The Healthcare Index has entered the Leading quadrant, hinting at least towards Outperformance for the next few trading sessions.

Also, Nifty FMCG has shown an increase in momentum and has entered into the Improving quadrant from the Lagging. Nifty India Consumption, as well, has entered into Improving from the Lagging quadrant but is nearer to the zero-point, and a bit more Outperformance can bring this Index quickly into the Leading Quadrant.

Nifty Media, Nifty Energy, Nifty CPSE, Nifty PSE & Nifty Oil & Gas are the major indices whose momentum has dropped & they are underperforming the Benchmark indicating they are weakest sectors currently.

Source: web.strike.money

Stocks to watchAmong the stocks expected to perform better during the week are Page Industries, Coromandel, Max Health, Policy Bazaar, and Apollo Hospital.

Among the stocks that can witness further weakness are Tata Consumer, Berger Paints, IRCTC, Dabur, Britannia, and Concor.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.