After consolidating for a couple of months, the Nifty had a strong run in August, hitting a record high of 16,712 in the last week of the August series. The index gained 5.44 percent during the August series, largely driven by IT, FMCG, banking & financial services, and energy stocks.

Experts expect the momentum to continue in September and say the Nifty50 can surpass the 17,000 mark, although there may be intermittent consolidation and correction, which would offer buying opportunities.

"Going ahead, we expect largecaps to outperform, which would gradually drive the Nifty towards a revised target of 17,000-17,200 in coming months," said ICICI Direct.

"Over the past 15 months, the buying-on-decline strategy has worked well. We advocate sticking to the same strategy. Therefore temporary breather after around 8 percent rally over the past four weeks would present an incremental buying opportunity to build a quality portfolio from a medium-term perspective," it said.

The brokerage is not expecting the index to breach the key support threshold of 15,900.

But, the broader markets underperformed benchmark indices on account of profit booking after the sharp rally in previous months. The Nifty Midcap 100 index declined 0.35 percent and Smallcap 100 index fell 4.89 percent in August series.

"Key point to highlight in the broader market is that the Nifty Midcap and Smallcap indices have breached previous month's low for the first time after 16 months as they witnessed stupendous rally since April 2020, indicating pause in upward momentum," said ICICI Direct.

The brokerage believes healthy consolidation should make larger trends more healthy and offer incremental buying opportunities.

Bank Nifty also underperformed Nifty50 in the August series, rising 2.67 percent to 35,617.55. The Bank Nifty witnessed an extended consolidation in the 34,500-36,300 range in the previous month, thus forming a base for the next leg of the up move, ICICI Direct feels.

It expects the index, after the recent healthy base formation, to break out above the upper band of the range (36,300) and head towards 37,700 levels in the coming month as it is the confluence of the measuring implication of the recent range (36,300-34,800) and the previous all-time high of February 2021. "We do not foresee the index breaching strong support of 34,500."

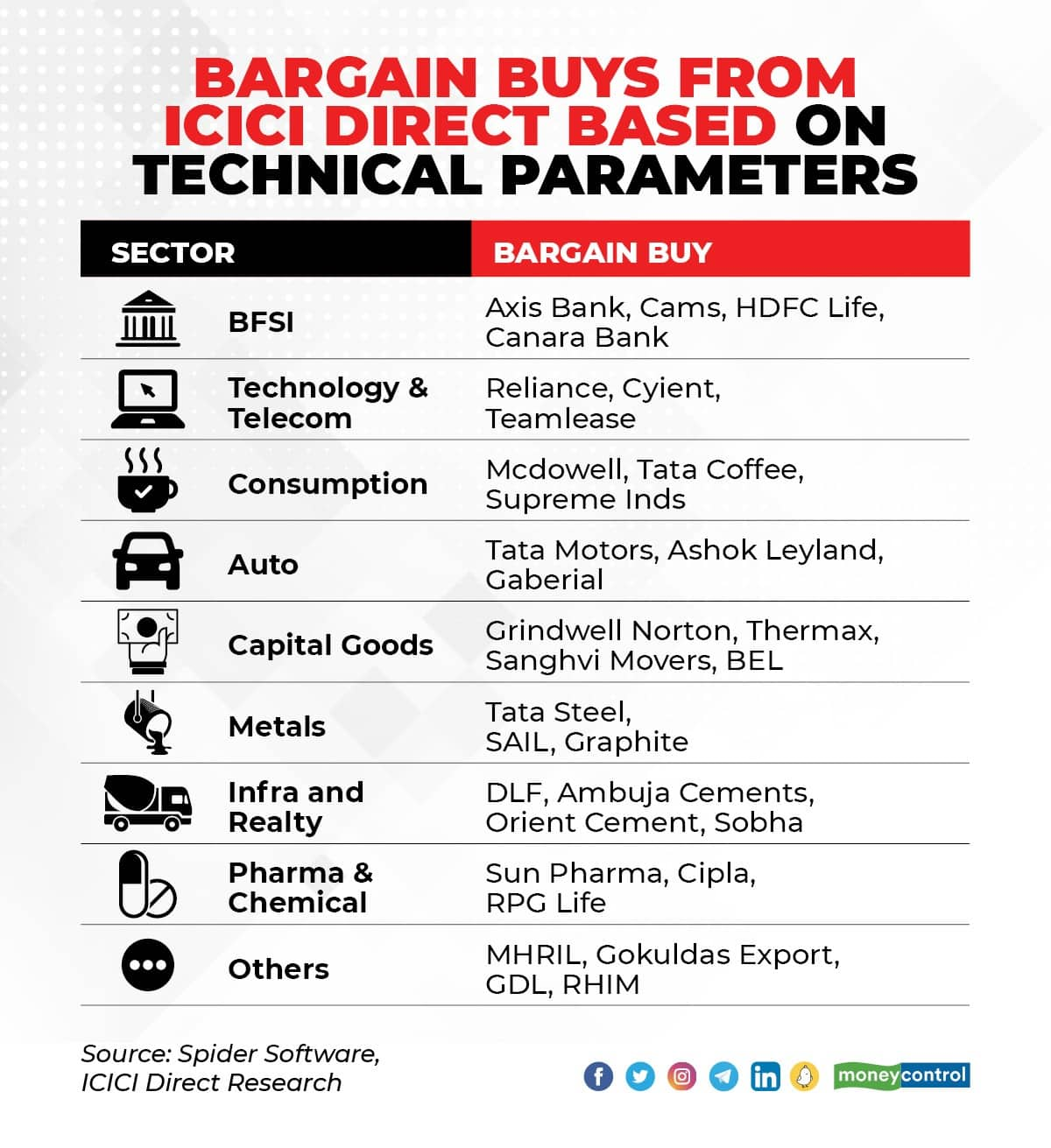

Bargain buys

ICICI Direct selected 31 stocks as bargain buys including Axis Bank, HDFC Life, Reliance Industries, Tata Coffee, Tata Motors, Ashok Leyland, Thermax, Bharat Electronics, Sun Pharma, Cipla, Gokuldas Exports, Orient Cement, TeamLease, Cyient, Sobha, Graphite India, and Mahindra Holidays.

The above bargain buys are from sectors like BFSI, technology & telecom, consumption, auto, capital goods, metals, infra & realty, and pharma & chemicals.

The brokerage feels that cyclicals like IT, Telecom and Consumption are expected to be the outperformers in coming months.

"We expect the IT sector to continue its relative outperformance albeit a mild profit booking in the short term cannot be ruled out after a strong rally," said ICICI Direct. The Nifty IT index was the biggest gainer in August series, gaining 12 percent.

On the consumption front, it expects the sector to outperform on a relative basis. "While staples have broken out of their consolidation patterns, many discretionary stocks are at good support levels."

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.