Dear Reader,

An eventful week leading to the annual budget presentation saw profit booking in the broader market while the benchmark indices closed flat. The week started with a failed assassination attempt on former U.S. President Donald Trump, followed by a global outage of Microsoft services, causing widespread disruptions.

These disturbances significantly impacted global markets more than the Indian market. The MSCI World Index fell by 2.03 percent, the S&P 500 recorded its worst weekly drop since April, losing 1.97 percent, and the Nasdaq declined by 3.65 percent. European markets also experienced selling pressure, with the Stoxx 600 falling by 2.46 percent and the German DAX leading the decline with a 3.07 percent loss.

In comparison, Indian benchmark indices held their ground, closing flat for the week after reaching new highs, although broader indices faced selling pressure. As we move into budget week, traders are generally expected to keep their positions light. The volatility index has also crept up, closing at its highest level in a month.

Short-term Pressure Likely

Nifty closed up for the seventh consecutive week, though we saw some selling in the broad market at the end of the week. A correction ahead of the budget does open us up to negative surprises. But if markets fall ahead of the event, it can also result in a post-event rally. Sentiment data can help us navigate the near-term move into the event, as we have an interesting set up in the short term.

The short-term sentiment, as measured by the swing, is showing an oversold condition (see chart Daily Swing) that is developing. The swing fell to the oversold zone at 14. If it falls further to single digits, it would be extremely oversold. All we need to do is wait for the downward momentum of the last two days to reverse. Then, it should be back to the highs.

Daily Swing

Source: web.strike.money

The FII positioning is the only concern. The long futures position by FIIs in the number of contract terms is at a new seven-year high (see chart FII Futures Position), and that does put you on tenterhooks. However, this data can remain elevated until the stock market confirms a trend reversal. At this stage, it's only a warning.

FII Futures Position

Source: web.strike.money

The 20-day Advance/Decline (A/D) ratio (see chart Advance Decline ratio) has fallen significantly, relieving us of the overbought reading because of the correction in midcaps and small caps. So, even as the Nifty is down a bit from the recent highs, stocks have already seen a correction. The Nifty Midcap 100 is close to the 40dema and might find support there on Monday.

Advance Decline ratio

Source: web.strike.money

Sector Rotation

Last week was largely negative for the markets, with only a few sectoral indices, such as IT, FMCG, and PSU Banks, managing to close positive for the week.

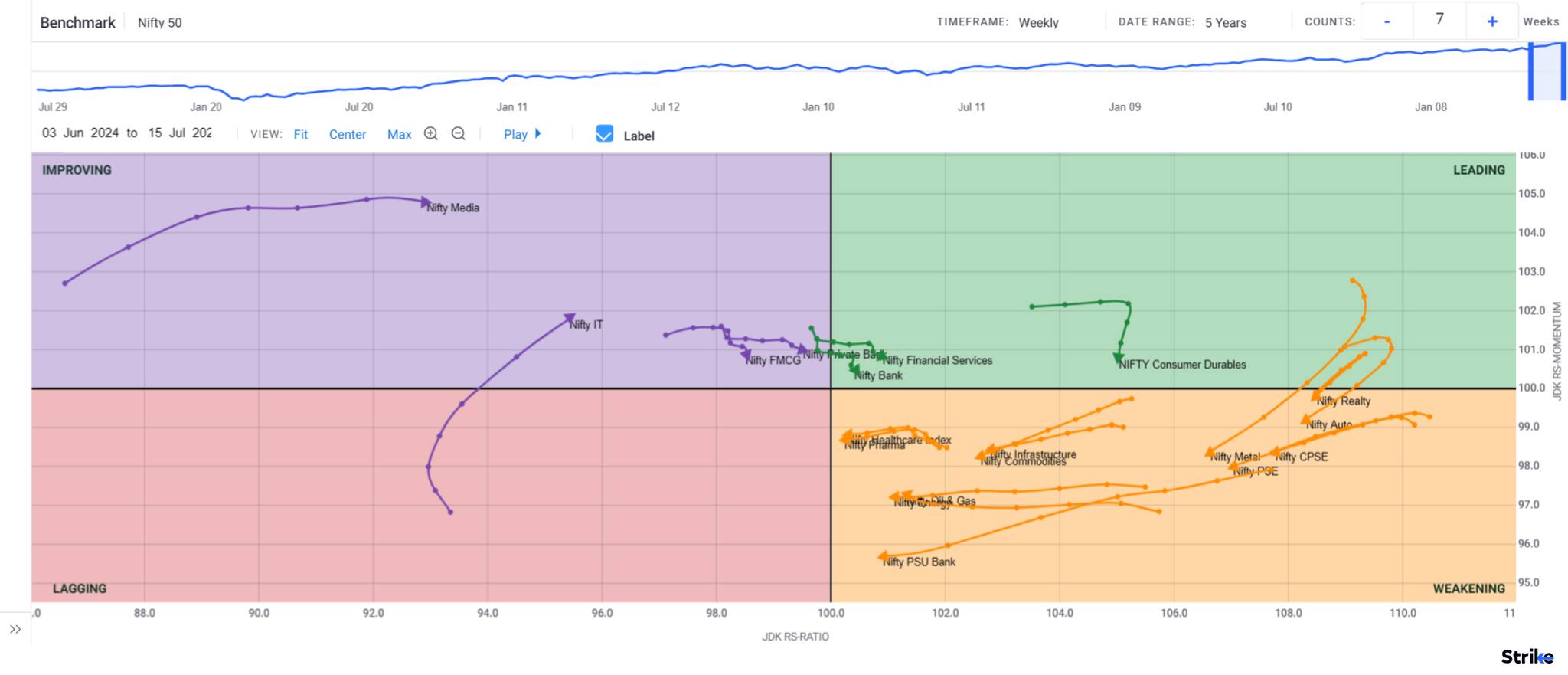

On the weekly timeframe RRG (see chart Weekly RRG), almost all the sectors are losing either relative strength or relative momentum, if not both. Only the Nifty IT Index has shown a positive tick in both parameters and maintains its position in the improving quadrant.

Weekly RRG

Source: web.strike.money

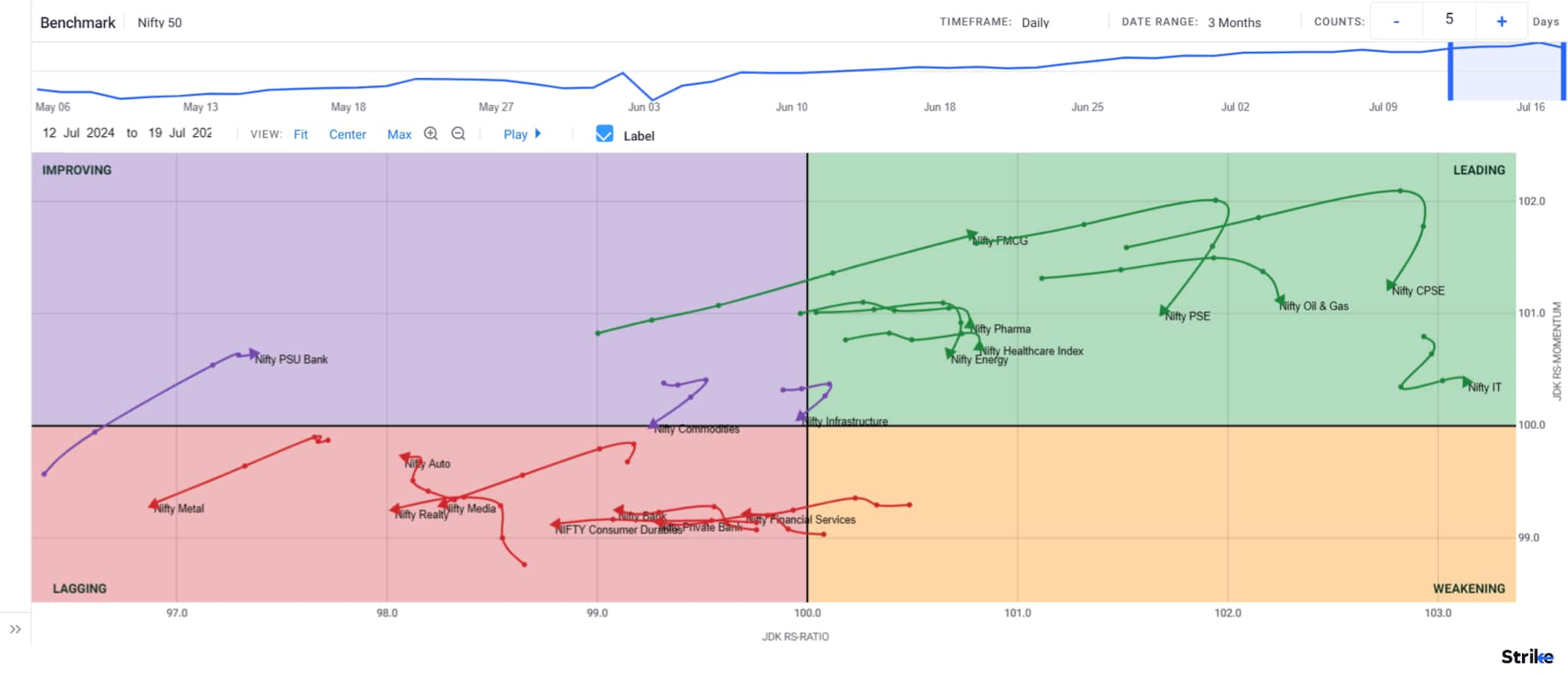

Regarding the Daily timeframe RRG (see chart Daily RRG), the Nifty FMCG Index has been the pick for the week. With a steady rise in both relative strength and relative momentum, it has made its way back to the leading quadrant. The PSU Bank Index has entered the improving quadrant, but it still needs to catch up on relative strength.

PSE, Oil & Gas, IT, Pharma, Healthcare, and Energy remain in the leading quadrant, but their relative momentum was flat to negative. The rest of the sectors, namely Metals, Realty, Media, Consumer Durables, Private Banks, and Financial Services, are all in lagging territory and posted a decline in relative strength.

Daily RRG

Source: web.strike.money

Indices and Market Breadth

A sharp fall on Friday saw the benchmark indices retrace the gains made during the week. Both BSE Sensex and Nifty 50 closed the week flat with a gain of 0.10 percent. The broader indices, however, saw selling pressure, resulting in the Midcap index losing 2.60 percent and the small-cap index stocks shedding 2.36 percent.

As in the derivative market, FIIs continue to add to their positions. During the week, FIIs bought Rs 10,945.98 crore of shares, bringing their total buying for the month to Rs 21,664.63 crore.

The top gainers among stocks in the derivative segment were India Cements, which closed 16.52 percent higher, Mphasis, which was up 6.80 percent, and SBI Life, which ended 5.43 percent higher.

Among the losers during the week were HAL, which closed 12.55 percent lower, Siemens, down 10.03 percent, and Cummins, down 9.98 percent.

Stocks to Watch

Among the stocks expected to perform better during the week are ICICI Bank, Hindustan Unilever, Glenmark, SBI Life, Colgate Palmolive, ICICI GI, Lal Path Lab, India Cements, Muthoot Finance, SBI and Eicher Motors.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.