As we enter the new year 2024, hopes run high that the market will continue to rally this year too, extending its winning streak to the ninth year in a row. However, the stellar run has also induced some cautiousness among market participants.

In a Moneycontrol Markets Poll, nearly half of the 35 analysts and fund managers surveyed said they see the Nifty in the range of 23,000 to 25,000 by the end of 2024. That means a potential return in the range of 6-15 percent.

The NSE Nifty 50 gave a 19 percent return in 2023, ending at 21,731. It also hit an all-time high of 21,801 during the year.

Also read: Stockology: What the new year holds for Indian markets?

About a quarter of respondents (23 percent) said they believe the Nifty will surpass the 25,000 mark during the year, taking the yearly returns to more than 15 percent. The rest see a relatively muted year for the market, with 14 percent seeing the Nifty end the year in the range of 20,000 to 23,000 and another 14 percent below the 20,000 mark.

“The euphoria is expected to continue during the start of the next year on account of the exuberance of rate cuts and drop in bond yields,” said Vinod Nair, head of research at Geojit Financial Services. “We expect a modest return of 10 to 12 percent on the main market in CY24.”

Similar year for Bank Nifty as 2023?

Bank Nifty, which underperformed during 2023 with a 12 percent return, is expected to have a similar yearly performance in 2024 according to the poll. About 63 percent of respondents, or nearly two-thirds, believe that Nifty Bank will end 2024 between 50,000 and 55,000. That means potential returns of 4 percent to 14 percent.

However, a small number of analysts – about 14 percent of respondents – are bullish on the index and believe the Nifty Bank will end the year above the 55,000 level. On the other hand, 9 percent of respondents believe the index will have a flat year, ending in the range of 48,000 to 50,000. The rest – 14 percent – see the index declining below 48,000.

Bank Nifty ended the year 2023 at 48,292, rising from 43,203 at the beginning of the year.

The comparatively poor performance of private banks limited the performance of Nifty Bank during 2023. The Nifty PSU Bank index rose 32 percent during 2023, leaving their much-touted private peers far behind, thanks largely to now much cleaner books and low valuations. The Nifty Private Bank index gained 13 percent during the year.

However, most analysts continue to be bullish on private banks. “Our top picks from the sector would be HDFC Bank, ICICI Bank, SBI, and Federal Bank,” said Dnyanada Vaidya, research analyst for BFSI at Axis Securities. “We expect banks to continue to deliver a healthy performance on growth driven by buoyant demand and pick-up in the capex cycle. We do not expect any significant challenges to asset quality. Thus, steady credit costs will continue to support earnings.”

Largecaps to the fore

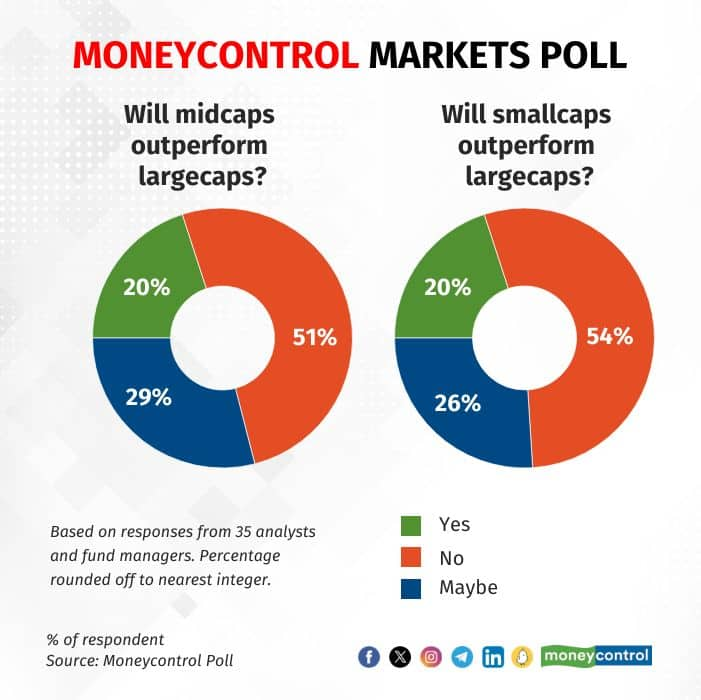

Most analysts participating in the poll believe 2024 will belong to largecap stocks. About 51 percent of the analysts and fund managers polled said they don’t believe the midcap segment will outperform largecaps, while 54 percent said that smallcaps will fail to outperform large caps.

The shift in the outlook to large caps follows a stupendous year for midcaps and smallcaps. In 2023, Nifty Smallcap 100 zoomed 56 percent while Nifty Midcap 100 added 47 percent. In comparison, the Nifty 100 advanced 20 percent.

Also read: Popular theories on why the rally should continue, and counterarguments

However, a minority - one-fifth of the respondents - believe that both the broader market indices will outperform the largecap segment. About 29 percent are not sure about midcaps’ outperformance, while 26 percent are uncertain about smallcaps’ outperformance.

Valuation has become a key concern for smallcaps and midcaps, making analysts cautious on the segments. Nifty Smallcap 100 is valued at 29 times its earnings, while Nifty Midcap 100 trades at 25 times its earnings. This is against 24 times its earnings for Nifty 100.

Risks to the markets in 2024

In the last year, geopolitical crises have had the biggest impact on markets as they usually lead to economic turmoil. Two major crises – the Russian attack on Ukraine and the re-emergence of the Israel-Hamas conflict – have kept investors on their toes. Both conflicts are ongoing.

About 63 percent of respondents in the poll believe geopolitical risk can be the biggest factor derailing the market from its track in 2024. It is followed by high valuation, which 54 percent of respondents believe is another big risk to the market.

Crude oil price fluctuations and any surprise in the 2024 general elections are regarded as risks by 29 percent of respondents each. About 23 percent believe China can become a risk to markets followed by 20 percent for adverse interest action and 14 percent for the rise in inflation.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.