August 05, 2022 / 16:25 IST

Vinod Nair, Head of Research at Geojit Financial Services

:

Despite the rate hike being on the higher side of the expectations, the market welcomed the RBI's move of 50 basis hike with rising bond yields. Even though metals prices are softening, RBI decided to keep FY23 inflation targets unchanged at 6.7 percent, which is above the tolerance level. However, given that Q3 and Q4 inflation is anticipated to be between 4.0 percent and 4.1 percent, the market is hopeful for the future.

August 05, 2022 / 16:14 IST

Amol Athawale, Deputy Vice President - Technical Research, Kotak Securities

:

Though the market was volatile, it moved in a small band as investors traded with caution after the recent upsurge. However, the positive thing was benchmarks managed to rebound in late trades to end in the green. With the overhang of monetary policy now behind us, the geo-political tension between China & Taiwan will be in focus, as any flare up in the region may lead to panic situations across the globe.

Technically, on weekly charts, the index has formed a bullish candle. Further, daily and intraday charts are indicating the continuation of a non-directional activity in the near future. The short texture of the market is still on the bullish side but a fresh uptrend rally is possible only after the 17500 breakout level. Above the same, the index could rally up to 17600-17750. On the flip side, below 17500, the index would retest the level of 17250-17200 and if the downside continues, it may correct up to 17050-17000.

August 05, 2022 / 16:08 IST

Ajit Mishra, VP - Research, Religare Broking

:

Markets remained range bound for yet another session and ended almost unchanged amid mixed cues. After the flattish start, the benchmark tried to regain some strength however profit taking at the higher levels capped the upside as the session progressed. It remained volatile till the end, after the outcome of MPC’s meet which was in line with market expectations. Finally, the Nifty ended the choppy day on a flat note. On the sector front, a mixed trend continued wherein IT, FMCG and financials were the gainers while auto, energy and media settled in the red.

With no major event lined up ahead, the focus would be on earnings and global cues for direction. On the index front, we’re currently seeing time-wise correction as it’s somehow holding around the upper band of the consolidation range. A decisive break above 17,400 would help resume the trend ahead else consolidation may continue. Since we’re seeing rotational buying across sectors, focus more on stock selection and overnight risk management.

August 05, 2022 / 15:52 IST

Y. Viswanatha Gowd, MD & CEO of LIC Housing Finance on RBI policy

:

The repo rate hike by 50 basis points to 5.4 percent is closely in line with the expectations. RBI’s decision is well measured and abreast with the global economic trend. The repo rate hike will cause some minimum fluctuation in the EMIs or the tenure on the home loans but demand for housing will remain robust.

August 05, 2022 / 15:43 IST

Dhiraj Relli, MD &CEO, HDFC Securities on RBI policy

:

The MPC unanimously voted to raise the repo rate by 50 bps to 5.4% while remaining focused on withdrawal of accommodation. The RBI has chosen to again front-load the rate hikes to tackle the elevated inflation levels which would remain above upper tolerance level of 6 percent till at least Q3FY23. Move of a hike of 50bps highlights the urgency to move closer to the neutral policy rate especially when the external environment remains uncertain. Recent depreciation in rupee coupled with elevated crude oil prices (though now on falling trend); might have weighed on members’ decision in favour of larger rate hike, addressing external sector imbalance and reducing the interest rate differential.

Even though inflation seems to have reached its peak, it still warrants caution given the uncertain global environment. Inflation projection of 5 percent for Q1FY24 by RBI provides some comfort indicating modest pace of rate hikes going forward. Bond yields and equity markets may not get much impacted by the announcement and will get driven by changes in global risk appetite and direction of global flows.

August 05, 2022 / 15:39 IST

Rupee at close

Rupee ends at 79.24 per US dollar against August 4 close of 79.47 per US dollar

August 05, 2022 / 15:36 IST

Market at close

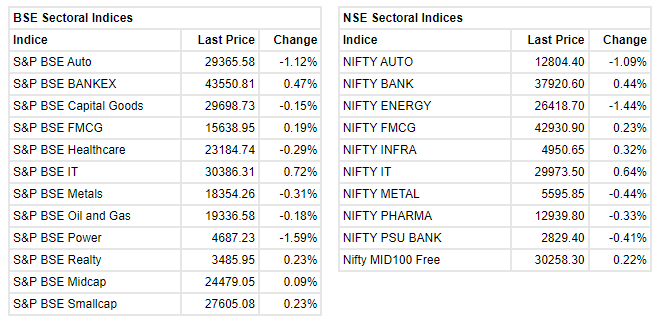

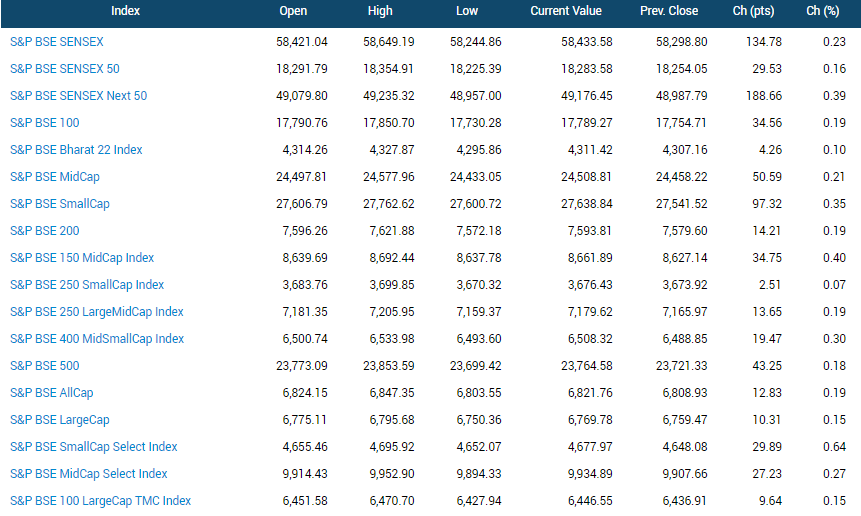

: Benchmark indices ended the session on August 5 on a flat note amid volatility. Sensex was up 89.13 points or 0.15% at 58387.93, and the Nifty added 15.50 points or 0.09% at 17397.50. UltraTech Cement, ICICI Bank and Bharti Airtel were the top gainers while Mahindra & Mahindra, Reliance Industries and Maruti Suzuki were the top losers. About 1807 shares have advanced, 1466 shares declined, and 144 shares are unchanged.

Among the sectors, power and auto indices shed over a percent each while buying was seen in financial and IT names.

August 05, 2022 / 15:28 IST

Talbros Engineering Q1

Profit at Rs 8.28 crore against Rs 3.24 crore (YoY). Revenue was up 66.6% at Rs 112.3 crore against Rs 67.4 crore (YoY). EBIDTA jumped 80.4% at Rs 14.56 crore against Rs 8.1 crore (YoY). Margin at 12.97% against 11.98% (YoY). The stock was trading at Rs 445.55, up Rs 74.25, or 20.00 percent. There were pending buy orders of 9,620 shares, with no sellers available. It was trading with volumes of 32,432 shares, compared to its five day average of 3,457 shares, an increase of 838.21 percent.

August 05, 2022 / 15:18 IST

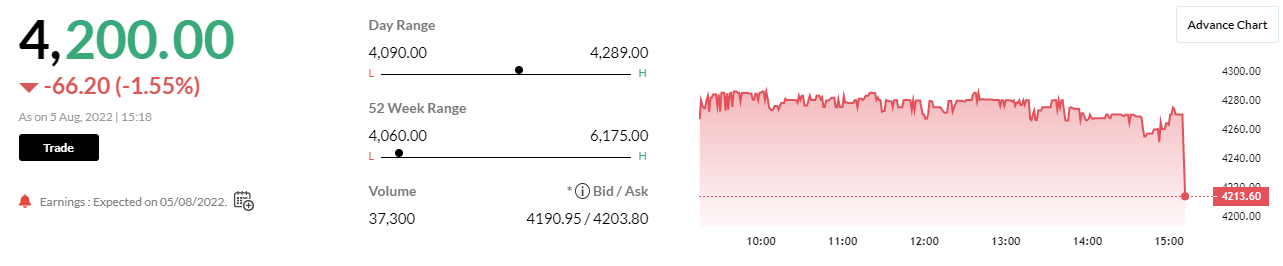

Pfizer Q1

Net profit went down 83.7% at Rs 32.5 crore against Rs 200 crore (YoY). Revenue was down 20.9% at Rs 593 crore against Rs 749.2 crore (YoY). EBITDA fell 33% at Rs 191.8 crore against Rs 285.7 crore (YoY). Margin at 32.4% against 38.1% (YoY).

August 05, 2022 / 15:14 IST

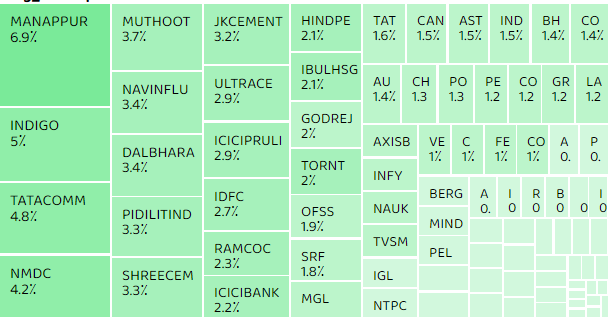

Long build-ups

Long build-up is seen in Mannapuram, Interglobe Aviation and Tata Communication.

August 05, 2022 / 15:04 IST

Market update at 3.00 PM

Benchmark indices pare gains and trading marginally higher with Sensex up 74.45 points or 0.13% at 58373.25, and the Nifty was up 25.2 points or 0.15% at 17407.5. Of the 3,479 stocks traded on BSE, there were 1817 advances, 1493 stocks declined and 169 stocks remained unchanged.

Source : BSE

August 05, 2022 / 14:54 IST

Shanti Lal Jain, MD & CEO, Indian Bank on RBI Policy

To rein-in the runaway inflation, the RBI raised the Policy rates by 50 bps.The CPI inflation continued to breach the RBI’s upper target range for the sixth straight month and remained above 7% for the third month in a row. Through this policy, RBI has brought in several measures including raising of policy rates by 50 bps so as to maintain price stability while keeping in mind the objective of growth.The central bank has already started tightening the liquidity in the system along with withdrawal of accommodative stance in a calibrated manner. However, the domestic inflation, which has been mainly driven by supply side constraints, appears to have peaked off.To allow Standalone Primary Dealers (SPD) to offer Forex services as AD category bank will strengthen the Forex market. Further, by permitting SPDs for Offshore Rupee OIS will remove the segmentation of domestic/offshore prices.By enabling cross border inward bill payment system, ease and convenience of the NRIs will improve along with the forex inflow. Setting up a committee for removing the hurdles related to MIBOR will help in transition of MIBOR as an international alternate benchmark.

August 05, 2022 / 14:43 IST

Aditya Birla Fashion Retail consolidated revenue surges 3.5 times, declares a PAT of Rs 94 crore

Aditya Birla Fashion Retail consolidated revenue surges 3.5 times on year, declares a PAT of Rs 94 crore against a loss of Rs 352 crore during the same period last year. On a sequential basis, the profit for the company jumped 3 folds from Rs 32 crore during the previous quarter. The EBITDA for the quarter stood at Rs 500 crore against a loss of Rs 145 crore during last year. EBITDA margin for the quarter expanded by 130 bps over pre-COVID levels to 17.4 percent during the quarter.