July 15, 2021 / 15:52 IST

Vinod Nair, Head of Research, Geojit Financial Services

Indian indices extended their gains to all-time high supported by positive Asian market and rally in realty, IT, financial and metal stocks, in anticipation of robust Q1 earnings and recovery in demand. Asian markets were positive as China reported better than forecasted economic data and the global market was boosted by the accommodative stance in the Fed official’s statement, reducing the risk of change in rates.

July 15, 2021 / 15:43 IST

S Ranganathan, Head of Research, LKP securities

As global investors digest inflation data and the Fed commentary, Dalal Street bulls were seen betting on economic recovery as IT stocks continue to power the Indices to new highs.

The market seemed in no mood to oblige investors waiting on the sidelines for a correction as sector rotation played its part today as capital goods made a smart comeback across market capitalisation. The broader market was buzzing with action across cement, real estate and pharma names.

July 15, 2021 / 15:38 IST

Closing update:

The Indian market benchmarks the Sensex and the Nifty logged healthy gains to settle at record closing highs.

The Sensex closed 255 points, or 0.48 percent, higher at 53,158.85 while the Nifty settled with a gain of 70 points, or 0.44 percent, at 15,924.20.

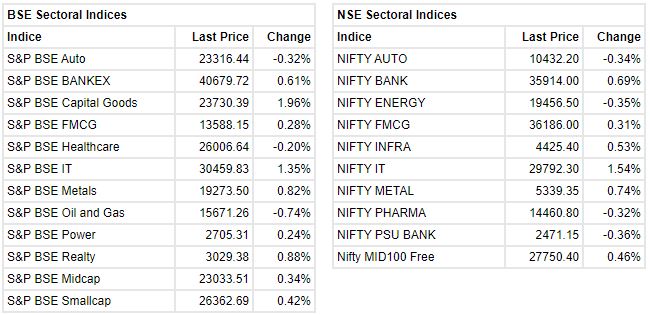

The BSE Midcap and Smallcap indices closed 0.31 percent and 0.43 percent higher, respectively.

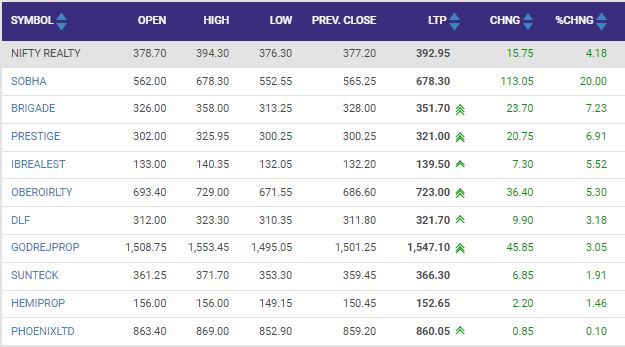

Nifty Realty emerged as the top sectoral gainer, closing 4.20 percent higher, followed by Nifty IT which rose 1.29 percent. Nifty Auto (down 0.40 percent), media (down 0.35 percent), PSU bank (down 0.33 percent) and pharma (down 0.27 percent) closed in the red.

July 15, 2021 / 15:23 IST

Neeraj Chadawar, Head - Quantitative Research, Axis Securities

The Indian market surged to record high levels, led by positive global cues and robust Q1FY22 earnings from the IT sector.

Yesterday, the US market closed in the green after a dovish commentary from the FED chairman, suggesting the central bank is not likely to begin the tightening of monetary policy anytime soon. This led to optimism in the equity market, which was further supported by the positive revision in the revenue guidance by the major Indian IT companies.

We believe this will augur well for IT companies and valuations will be likely to sustain in the near future. However, the execution will be monitored for the upcoming quarters of FY22.

Midcap, smallcap, and largecap values remain key allocation themes as these themes will continue to deliver strong returns.

We remain constructive on the market and believe the dips should be utilised to build positions in the recommended themes. Rising inflation, the dollar index, rising concern over delta variant and the management commentaries post Q1 will be the near-term monitorable indicators for the market.

July 15, 2021 / 15:17 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers

The markets started on a positive note despite mixed Asian market cues with China reporting its economy grew 7.9 percent year-on-year in the second quarter which was marginally lower than the expectations of 8.1 percent.

During the afternoon session, the market went from strength to strength escalating to all-time high points on sustained buying activities by fund houses and retail investors.

Sentiments were upbeat as a private report stated that IT spending in the country is expected to grow at 8 percent to $92.7 billion in 2021. The growth at 8 percent is a shade less than the world average of 8.6 percent and global spending on information technology is estimated to come at $4.2 trillion.

July 15, 2021 / 15:02 IST

Nifty Realty index jumps more than 4%

July 15, 2021 / 14:51 IST

Over 475 stocks hit their upper circuits:

More than 475 stocks, including Suzlon Energy, Datamatics Global Services, Trigyn Technologies, Kanpur Plastipack, Aditya Vision, Dhani Services, IVP, White Organic Retail and Inspirisys Solutions, hit their upper circuits in intraday trade on BSE.

July 15, 2021 / 14:45 IST

More than 480 stocks hit 52-week highs:

More than 480 stocks, including Infosys, Larsen & Toubro, Larsen & Toubro Infotech, L&T Technology Services, Tata Elxsi, Tata Steel, Tech Mahindra, Wipro, Birlasoft, Coforge, Cyient, Mindtree, Mphasis, OFSS, Bajaj Finserv, ACC, Ambuja Cements, Apollo Hospitals, InterGlobe Aviation (IndiGo), IRCTC, Manappuram Finance, Marico and Sobha, hit their 52-week highs in intraday trade on BSE.

July 15, 2021 / 14:27 IST

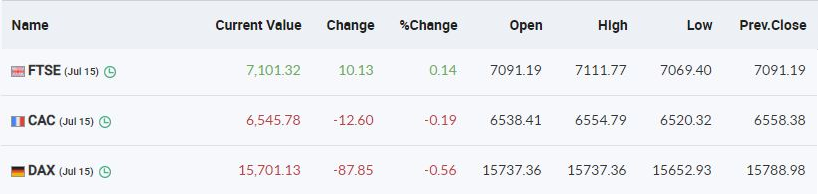

European markets are trading mixed with DAX down half a percent while FTSE is trading in the green

July 15, 2021 / 14:12 IST

Market update: Sensex is up 331.39 points or 0.63% at 53235.44, and the Nifty jumped 89.10 points or 0.56% at 15943.10. HCL Tech, L&T and Tech Mahindra are the top gainers while L&T Technology, Wipro and Infosys are the most active stocks.

Among the sectors, Bank Nifty and IT added over half a percent each while the midcap and smallcap indices are also trading in the green.

July 15, 2021 / 13:49 IST

US FDA puts Jubilant Pharmova Roorkee facility under import alert

: Jubilant Pharmova said that the US FDA has put its Roorkee facility under import alert. Products to be impacted due to import alert Forms <3 percent of FY21 revenue. The stock was trading at Rs 722.95, down Rs 28.70, or 3.82 percent. It has touched an intraday high of Rs 751.90 and an intraday low of Rs 713.15.

July 15, 2021 / 13:31 IST

Gaurav Garg, Head of Research, CapitalVia Global Research

: Indian equity benchmarks remained in the green, despite strong indications from other Asian markets. Sentiments were supported by claims from a private report that IT investment in the country is predicted to expand at an annual rate of 8 percent to $92.7 billion in 2021. Another positive in the market for investors came after an ICRA Ratings poll in which, roughly 42% of non-banking financial companies (NBFCs) predict a 15% increase in their asset under management (AUM) in fiscal 2021-22.

We witnessed some positive movement in the market and an attempt to hold the support level around the Nifty 50 Index level of 15900. Sustaining above 15900, we expect the market to gain momentum, leading to an upside projection till 16150-16200 level. On the sectoral front a few sectors have shown some weakness, despite the positive momentum in the market.

July 15, 2021 / 13:22 IST

Market update

: Sensex is up 307.31 points or 0.58% at 53211.36, and the Nifty added 82.60 points or 0.52% at 15936.60. HCL Tech, L&T and Tech Mahindra are the top gainers while L&T Technology, Wipro and Infosys are the most active stocks.

Among the sectors, Capital Goods index added 2 percent while IT, metals, banks and FMCG indices are also trading in the green.