September 16, 2022 / 16:16 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services

Indian Equities wilted under global pressure and gave up all its weekly gains. Nifty plunged by 380 points during the day and closed with loss of 347 points at 17,531 levels. The index failed to sustain above key 17,777 levels, indicating overall weakness in the market. India VIX spiked by 7.8 percent to near 20 levels, indicating increased volatility in the market. Going forward, we expect this trend to continue until the clarity emerges on the quantum of the rate hike being taken by US Fed next week.

September 16, 2022 / 16:12 IST

Kunal Shah, Senior Technical Analyst, LKP Securities

Bank Nifty witnessed some profit booking at higher levels after being an outperforming index. The index will resume its uptrend, once it closes above the level of 42,000 where a significant amount of call writing has been witnessed. The downside support stands at 40,000-39,800 and any dip toward that would be an opportunity to buy.

September 16, 2022 / 16:11 IST

Suvodeep Rakshit, Senior economist, Kotak Institutional Equities

Inflation prints over the coming months are expected to remain elevated albeit moderating gradually to below MPC’s upper threshold of 6 percent in 4QFY23. With the MPC expected to continue with rate hikes, the lagged impact of monetary tightening will help curb inflation expectations. Accordingly, we expect the average CPI inflation trajectory to be lower than the RBI’s estimates by around 60 bps in 1HCY23. We maintain our FY2023E CPI inflation estimate at 6.5 percent.

We retain our view that the MPC will continue with calibrated repo rate hikes towards 6 percent by end-CY2022 with 35 bps hike in the September policy along with the shift in the operating target from SDF to repo rate by end-FY2023.

September 16, 2022 / 16:06 IST

Vinod Nair, Head of Research, Geojit Financial Services

With persistent bearish pressure from global stocks amid rising yields and dollar index, the domestic market surrendered to the global trend despite its strong decoupling scenario and encouraging macroeconomic data. Post the release of US inflation data, which showcased a MoM increase in inflation, the global market has been pricing in the likelihood of a more aggressive policy response from the Fed.

September 16, 2022 / 16:04 IST

Rupak De, Senior Technical Analyst, LKP Securities

Nifty slipped below the falling trend line on the daily chart suggesting a waning bullishness. On the daily timeframe, the index has fallen below the near-term moving average, 20 EMA. The momentum oscillator is in bearish crossover and falling. The trend for the near term looks negative; immediate support is seen at 17,500, below which the Nifty may fall towards 17,350. On the higher end, resistance is visible at 17,700.

September 16, 2022 / 16:01 IST

Ajit

Mishra, VP - Research, Religare Broking Ltd Markets witnessed a sharp sell-off on the final day of the week and lost close to 2 percent. Nifty gradually inched lower after opening with a down gap and settled closer to the lower band of the day’s range to close at 17,530.85 levels. The selling pressure was widespread wherein IT, realty and auto pack were among the top losers.

The last two days of slide in the index have completely engulfed the gains of the previous week and a decline below 17,500 in Nifty may result in a further slide. We thus recommend maintaining a cautious stance and limiting positions. Among the sectoral pack, banking is still looking comparatively stronger so participants can continue with “buy on dips” in private banking names.

September 16, 2022 / 15:57 IST

Sensex ends almost 1100 points lower; only two stocks end in green

September 16, 2022 / 15:48 IST

Rupee At Close | Rupee ends at 79.74/$ versus Thursday’s close of 79.70/$

September 16, 2022 / 15:47 IST

Markets this week

Benchmark indices reversed last week gains and closed 1.7 percent lower each. But, Nifty Bank managed to rise for the fourth consecutive week, gaining nearly 1 percent.

35 of 50 Nifty stocks ended the week with cuts as IT & cement stocks were the top drags. Astral,IndiabullsHousing Finance, Intellect Design and L&T Tech were the topmidcaplosers.

September 16, 2022 / 15:45 IST

Markets at close

Sensexdeclined 1,093.22 points or 1.82 percent to end at 58,840.79. Nifty ended 346.60 points lower at 17,530.80.About 952 shares have advanced, 2455 shares declined, and 100 shares were unchanged.

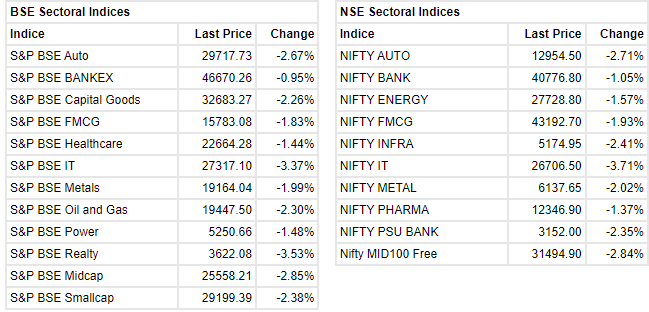

Among sectors, IT and realty shed over 3 percent. Midcap and smallcap indices shed nearly 2.5 percent.IT & auto stocks were major drags with Tech Mahindra, Infosys andM&M among top losers on the exchanges.

September 16, 2022 / 15:11 IST

Anuj

Choudhary, Research Analyst, Sharekhan by BNP Paribas USDINR (CMP Rs 79.78 spot): Indian rupee depreciated 0.03 percent today on weak domestic markets and a strong US Dollar. Domestic markets were down ~1.6 percent. US Dollar is trading 0.3 percent higher at 110.01 on expectations of ahawkish US Federal Reserve.

We expect Rupee to trade with a negative bias on strong dollar and risk aversion in global markets. Concerns over aggressive rate hike expectations by Federal Reserve may also put downside pressure on Rupee.However, easing crude oil prices may support Rupee at lower levels. Markets may also take cues from FII fund flows data. USDINR spot price is expected to trade in a range of Rs 79 to Rs 80.50 in next couple of sessions.

September 16, 2022 / 15:06 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Nifty lost around 1% in the past week. The Indian markets posted small losses on relative basis on hopes of continued growth momentum, even as global and domestic data prints were adverse with elevated inflation reported across major economies.

IT services and oil & gas were the top losers in the week, while metals, banks and autos were the top gainers among major sectors. Going forward, D-street will focus on the macro trends. TheFIIshave been on a buying spree and have bought over Rs 12,764 crore of equity so far in September. The continuousFIIbuying has been a major contributor to the current rally.

In International news, US inflation data for August came at an unexpected 8.3 percent, the Dow Jones Industrial Average index fell sharply by 3.94 per cent on Tuesday, its worst fall since June 2020. Initial jobless claims came in better than expected, but import prices saw a smaller drop than estimates suggested. Manufacturing data also showed a slowing economy.

September 16, 2022 / 15:00 IST

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

On Gold

Prices traded lower with spot gold at COMEX trading 0.45 percent down near $1655 per ounce on Friday. Gold October future contract at MCX were trading 0.67 percent lower near Rs 49,000 per 10 grams by noon session.

We expect gold prices to trade sideways to down for the day with COMEX spot gold support at $1640 and resistance at $1675 per ounce. MCX Gold October support lies at Rs 48,700 and resistance at Rs 49,200 per 10 grams.

On Crude Oil

Crude Oil prices traded lower with benchmark NYMEX WTI crude oil down 0.19 percent near $84.94 per barrel on Friday. We expect crude oil prices to trade sideways to down with resistance at $89 per barrel with support at $82 per barrel. MCX Crude oil September contract has important support at Rs 6650 and resistance at Rs 6890 per barrel.