There is some more steam left in the current move on the upside. For the Nifty a plausible minor degree dip towards 12,000 can be considered as a fresh buying opportunity. The short term target for the Nifty is placed at 12,350.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,926.51 | 25.80 | +0.03% |

| Nifty 50 | 25,974.90 | 15.40 | +0.06% |

| Nifty Bank | 58,906.10 | 70.75 | +0.12% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bharat Elec | 409.85 | 6.05 | +1.50% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Nestle | 1,261.60 | -7.60 | -0.60% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10093.00 | 75.10 | +0.75% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36812.10 | -225.80 | -0.61% |

There is some more steam left in the current move on the upside. For the Nifty a plausible minor degree dip towards 12,000 can be considered as a fresh buying opportunity. The short term target for the Nifty is placed at 12,350.

Markets will react to the GDP numbers in early trade on Monday. The recent feud between the US and China over Hong Kong could induce volatility in the global markets. Amid all, we reiterate our bullish view and suggest continuing with stock-specific trading approach.

Major global markets were mostly positive for the week, the Chinese markets being an exception. Chinese equities remained under pressure on the back of ongoing turmoil in Hong Kong. Tensions rose between US and China after the US passed a law supporting the Hong Kong protests. The BSE-30 Index gained (1.1%) in the week to reach a new life-time high. Markets were buoyed by progress on phase-1 of the US-China trade deal, resolution of stress in financial sectors and multiple government initiatives to arrest the ongoing economic slowdown.

After a two days of run the benchmark indices cooled off and ended lower but recovered from the day's low on the back of buying seen in the last hour of trade.

At close, the Sensex was down 336.36 points or 0.82% at 40793.81, while Nifty was down 95.20 points or 0.78% at 12056. About 1210 shares have advanced, 1318 shares declined, and 182 shares are unchanged.

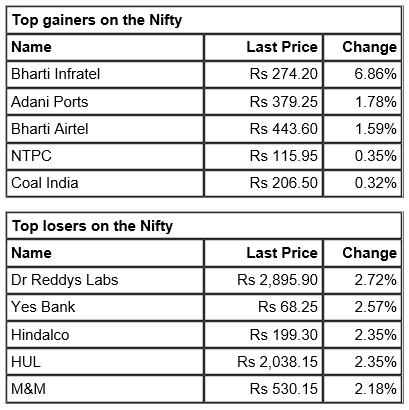

Zee Entertainment, Yes Bank, HUL, SBI and Dr Reddys Laboratories were among major losers on the Nifty, while gainers include Bharti Infratel, Adani Ports, Bharti Airtel, HDFC Bank and NTPC.

All the sectoral indices ended in the red led by the metal, auto, pharma, PSU bank, FMCG, IT and infra.

The Indian rupee has recovered marginally from the day's lowbuttrading lower at71.79per dollar.

Ujjivan Small Finance Bank had a steady ride in terms of advances growth along with maintaining asset quality. There was continued focus on garnering retail liability along with building CASA base. We have a subscribe recommendation on the stock. Further, at the IPO price band of Rs 36-37, the stock is available at a P/BV of ~2.2x (post issue) at the upper band on H1FY20 basis.

Shares of Lemon Tree Hotels rose nearly 3 percent on November 29 after the company launched hotel under Red Fox brand in Andhra Pradesh.

The euro hovered around its lowest levels for this month on Friday as the dollar held its poise on hopes that the United States and China would be able defuse their damaging tariff war with a preliminary trade deal.

Mortgage lender Home First Finance Company (HFFC) on November 29 has filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for its proposed initial public offering (IPO). The housing finance company is expected to raise Rs 1,500 crore through the public issue