Julius Baer Group is expecting Indian stocks to hit a new high in the second half of the fiscal year, as domestic consumption recovers.

“The biggest theme going forward will be a revival in consumption in India,” Nitin Raheja, head of discretionary equities at Julius Baer India, said in an interview. One third of his portfolio is in consumption-linked themes and he’s increasing bets on retailers focused on tier-two cities and apparel firms.

Lower- and middle-income segments will lead the pickup in India’s consumer spending, aided by slowing inflation, abundant monsoon rains and income-tax cuts, said Raheja, who oversees portfolio management services and alternative investment funds for the Zurich-based wealth manager in India.

There was a K-shaped recovery in India after the Covid-19 pandemic, and the bottom part which suffered the most will likely now see a revival, he added.

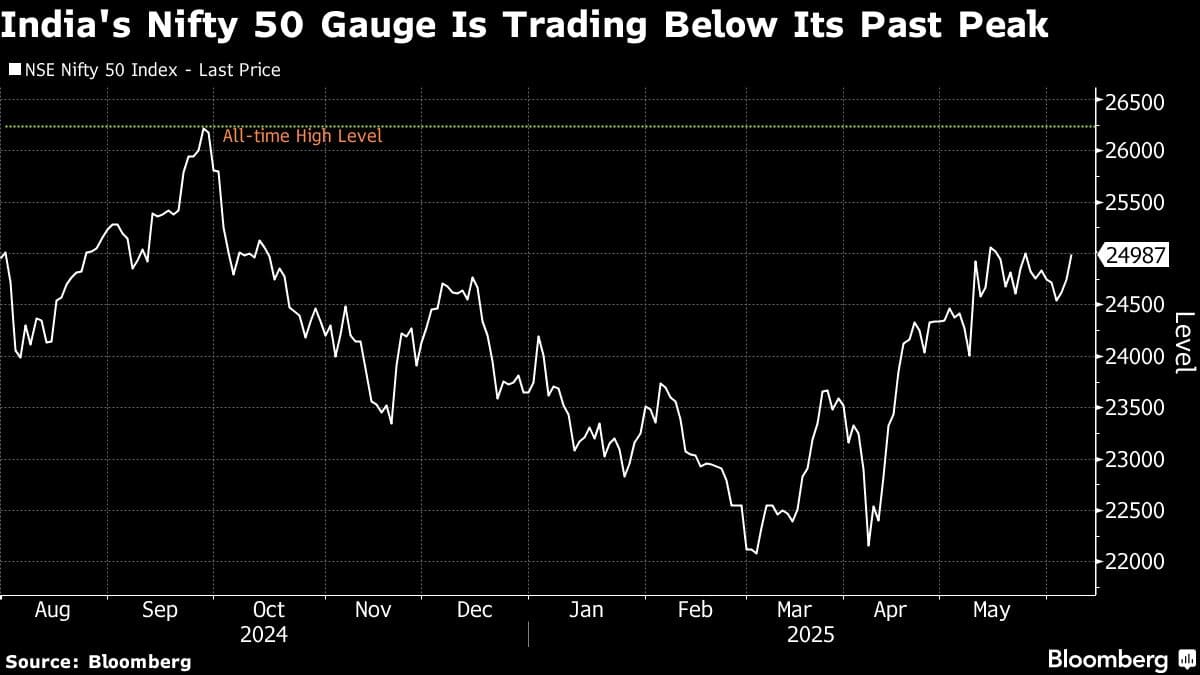

While elevated valuations could keep the market “range-bound” in the next few months, Raheja expects the benchmark NSE Nifty 50 Index to scale fresh highs after October, as consumer demand flows into corporate profits.

The gauge is 4.6% away from its peak set in September and the central bank’s jumbo rate cut Friday is further raising expectations of a record-breaking surge.

“Private consumption, the mainstay of aggregate demand, remains healthy, with a gradual rise in discretionary spending,” Reserve Bank of India Governor Sanjay Malhotra said Friday. “Rural demand remains steady, while urban demand is improving.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.