Gold funds may well have witnessed outflows in the month of April but fund managers are unanimous in their views that the yellow metal will continue to shine and offer a safe hedge, especially during periods of market volatility.

In April, gold exchange traded funds (ETFs) experienced outflows totaling Rs 395.69 crore, as per latest data from the Association of Mutual Funds in India (AMFI). Incidentally, this is the first time in the last one year that the category has seen outflows in a month.

Fund managers, however, believe that for investors, both Indian and global, gold will never lose its relevance.

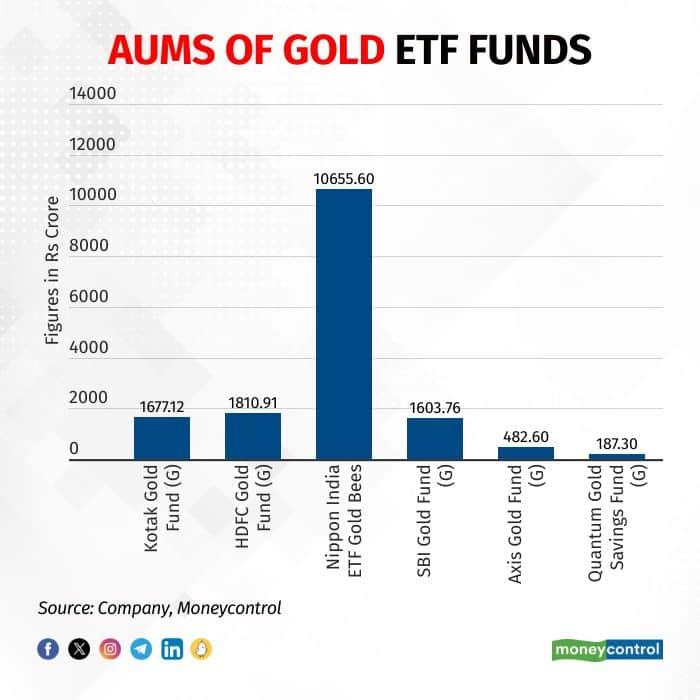

Vishal Jain, CEO, Zerodha Mutual Fund, in a note issued on May 9, highlighted how gold ETFs have historically grown during challenging times. According to Jain, gold ETFs' assets under management increased significantly by around 150 percent from Rs 5,527.76 crore in December 2019 to Rs 13,819.39 crore in December 2020 during the pandemic period.

As per AMFI data, the AUM of gold ETFs was pegged at Rs 32,855.41 crore in April 2024, much higher than Rs 22,909.38 crore in April 2023 – a jump of nearly 43 percent in just one year.

All that glitters is gold

Deveya Gaglani, Senior Research Analyst at Axis Securities, attributes the popularity of gold as an investment strategy to its exceptional performance - a compounded annual growth rate (CAGR) of over 50 percent in the domestic market over the last two and a half years.

“We expect gold prices to touch Rs 77,000 by the next Akshaya Tritiya as well, as investors may flock towards gold due to uncertainty in the global market,” Gaglani said.

Today is Akshaya Trithya and the day is considered an auspicious time to buy gold.

Gaglani advises investors to look at investment in gold ETFs, gold sovereign bonds, and gold Bees over physical gold.

Interestingly, the last few years have seen the emergence of investment options in the form of digital gold wherein investors do not have to worry about storage and safekeeping of the precious metal.

Suraj H S, co-founder of Aurm, an asset protection firm that offers automated safe-deposit vaults in residential communities in partnership with banks, believes that both digital gold and traditional gold jewellery are equally attractive options to invest in though digital gold offers better liquidity in case there is an immediate requirement for cash.

“Gold jewellery has a dual purpose - as an investment, as well as ornaments that can be used for special occasions. In addition, traditional jewellery can also be passed on as inheritance to the next generation,” he said

In a similar context, Kresha Gupta, Director, StepTrade Share Services, said that while investing in gold has long been a staple in India, retail investors are now increasingly turning to online gold investments.

“With its stability against market fluctuations and ability to provide consistent returns against inflation, gold mutual funds offer a hedge against economic shocks. The primary goal of such investments should be to generate wealth over the investment period and safeguard against market downturns," said Gupta.

Meanwhile, Ghazal Jain, Fund Manager at Quantum Mutual Fund, is of the view that given the geopolitical situation in the Middle East and also around Russia-Ukraine, a 10-15 percent gold allocation could limit portfolio downside during risk-asset corrections.

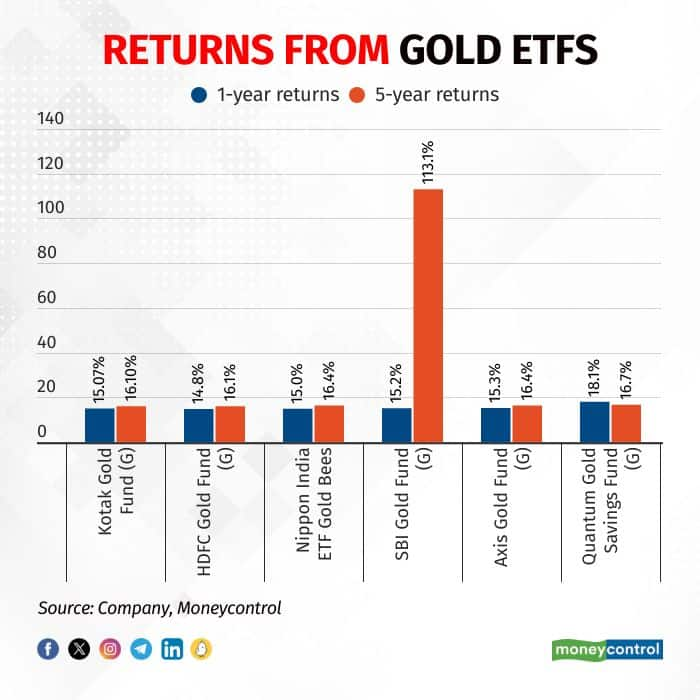

As gold prices have seen steady rise, gold ETFs have also continued to provide healthy returns, on a one-year basis. For example, Axis Gold ETF, with an AUM of Rs 483 crores, has given returns of around 15 percent in the last one year. Similarly, Nippon India Gold Savings Fund, with an AUM of Rs 1,842 crore has also delivered around 15. 58 percent.

“The demand for gold funds in India has commenced this year robustly, primarily propelled by portfolio diversification and multi-asset investing themes. As capital market participation increases, gold funds should witness enhanced coverage and subscriptions, attributed to their convenience, safety, and efficiency,” said Vikram Dhawan, Head Commodities and Fund Manager at Nippon India Mutual Fund.

While gold prices are currently at historic highs, he adds that investors “yearning to hedge against two the Indian & US elections occurring this year might also consider allocations in gold ETFs”.

Most fund managers believe that the recent outflows in gold ETFs could be attributed to investors choosing to book gains or rebalance their portfolios.

Jain of Quantum Mutual Fund anticipates a return in investor interest in gold ETFs in the coming months, with price pullbacks being opportune entry points for those looking to invest.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.