Election results showing a narrower than expected win for BJP without a single party majority sent markets into a tailspin on June 4, with benchmark indices Sensex and Nifty diving about 6 percent each.

At 2 pm, BSE Sensex was down 3,565 points or 4.66 percent at 72,904, and NSE Nifty was down 1,105 points or 4.75 percent at 22,159. Both the indices had recovered from the day’s lows, as election results firmed up, with the markets presumably digesting the undesirable outcome. The market breadth was overwhelmingly weak, with only 317 shares gaining, and 3,092 falling.

Investors unloaded their long positions at 22,000-22,500 levels on the Nifty, as the index fell through various technical support levels, with the next supports appearing to be weak to withstand strong movements.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Nifty’s fall brings index closer to next level supports

“The index has fallen by about 5 percent due to a weaker trend for the NDA in the poll counting. The market, which had begun to price in a landslide victory for the NDA, is witnessing a significant correction due to margin calls, as retail investors were carrying heavily leveraged positions,” said Rupak De, Senior technical analyst at LKP Securities.

Follow our live blog for all market action

“Support seems to be very fragile. Short term support is visible at the level of 20700-21000. Recovery looks possible once the trend moves in favour of the BJP winning the election comfortably,” added De.

Investors unwind long positions in Nifty, Bank Nifty

Open interest data shows significant long unwinding at 22,500, 22,400 and 22,000 strikes prices in Nifty options. While heavy call writing and short build up is seen across strikes from 22,000 to 22,500 levels.

On Bank Nifty, the options data suggests heavy long unwinding at 48,000, 47,500 and 47000 strikes. Heavy call writing seen at 46,500, 47000 and 47,500 strikes showcasing short build up.

According to Riyank Arora, Technical analyst at Mehta Equities, "Nifty 21,700 should be the most important support yet again now. It is advisable to wait and watch. One might see 22,300 and 22,400 coming in if 21,700 holds this time now."

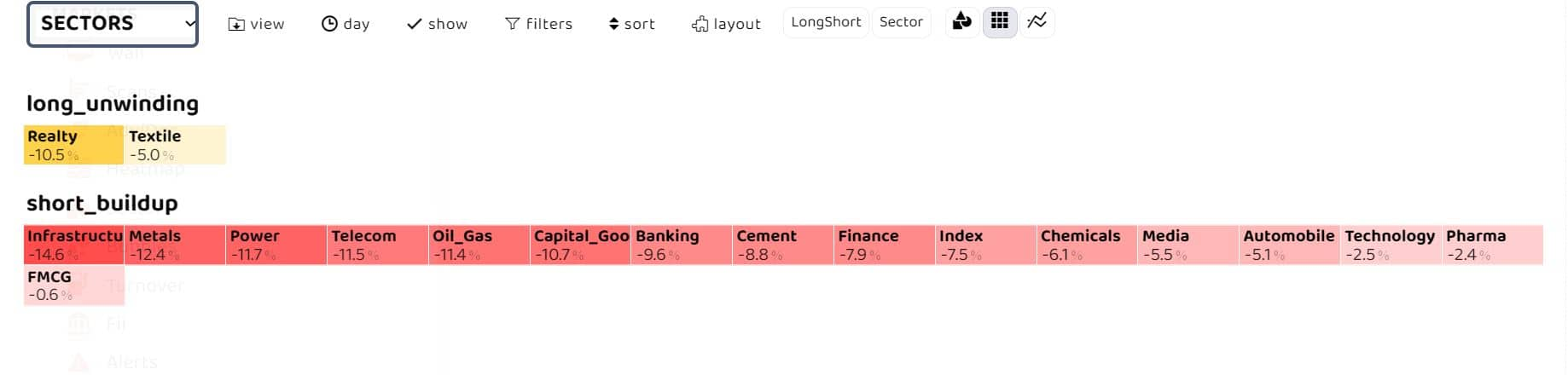

Sector, stock-specific long-short action

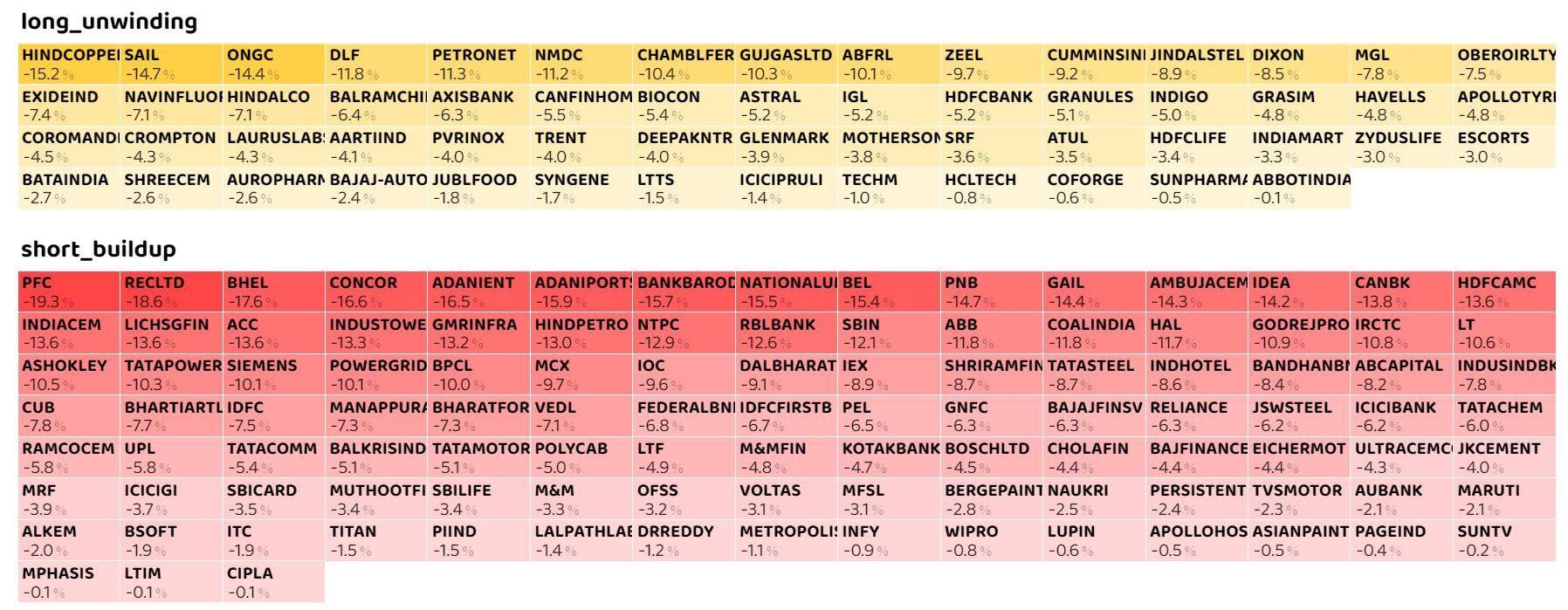

Among sectors, realty and textile are observing long unwinding, while rest all sectors see significant short build up. Among individual stocks, Only FMCG majors HUL, Dabur, Marico, Godrejcp and Britannia show long build up along with Pidilite Ind and Heromotoco

Long unwinding and short build up is seen across stocks, with highest short build up in PFC, REC Ltd, BHEL, Adanient and Concor. Major short covering is seen in Colpal, UBL, Mcdowell, Nestle India, Divislab and Tataconsumers.

Major short covering is seen in Colpal, UBL, Mcdowell, Nestle India, Divislab and Tataconsumers.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.