India's merchandise exports seem to have weathered global headwinds and uncertainty well, falling much less than the decline seen by developing Asia as a whole, said CRISIL in its Quickonomics report titled "Steady in choppy waters".

In FY24, while India’s merchandise exports dropped by 3.1 percent year-on-year (YoY), developing Asia's merchandise exports fell 6.8 percent YoY.

India clocked $437.1 billion from the exports in FY24, versus its $451.1 billion in fiscal 2023.

Also read: India's services exports decline marginally in March to $30 bn

The analysts wrote that the country's performance was largely in sync with global trade.

"According to latest data from the United Nations Conference on Trade and Development, global merchandise exports declined 4.6% in 2023, similar to India’s 4.7% decline during the period, thereby keeping India’s share in world exports stable at 1.8%," they noted.

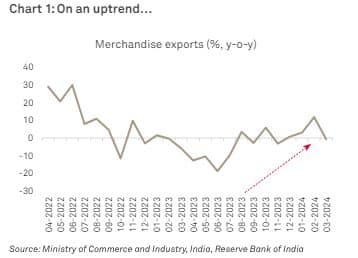

Also, though the yearly data shows a decline in merchandise exports, monthly data suggests that export growth started improving for India post June 2023.

Year-on-year export growth entered the positive zone in August 2023 for the first time in many months and has since displayed healthy momentum, stated the report.

After an average 13.1 percent YoY contraction during April-July 2023, exports logged 2.2 percent growth over August 2023-March 2024. Also, export growth in the last quarter of fiscal 2024 was faster at 4.5 percent, they added.

Lower international commodity prices had a significant role to play in the pulling down of India's export earnings, according to the analysts.

Most international commodity prices have been on a downward trend since shooting up due to geopolitical uncertainties in February 2022, they wrote.

"The sharp decline in energy prices, especially crude oil prices, was one of the biggest contributors to the fall in India’s overall merchandise export bill. With over 20% share, oil is India’s top export item, and hence, its movement has a large bearing on India’s total export earnings," the report stated.

Leaving out the petroleum and gems and jewellery exports, core exports grew at 1.4 percent YoY to $320.2 billion from $315.6 billion a year ago.

That said, this growth in core exports was driven by exports of telecom instruments and mobile handsets, which surged year-on-year.

Barring these, core exports growth declined YoY.

Labour-intensive exports have been struggling, according to the analysts.

"Other than gems and jewellery, exports of a few of India’s large, labour-intensive sector remained under stress – textile products (mostly ready-made garments, even though some categories such as cotton yarn, fabrics, madeups and handloom products managed to increase their exports during the fiscal), leather and leather products and marine products," the report stated.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.