Sampath Reddy

Year 2018 was slightly unusual for the Indian markets -- in terms of how narrow it was and also with the broader markets (small/midcaps) witnessing a significant correction.

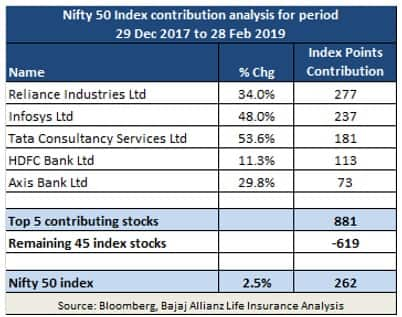

This polarization or narrowness continued for most part of the first two months of CY2019 as well. The headline Nifty50 index was primarily lifted by a handful of stocks.

The chart below highlights the divergence of returns between the Nifty index and Nifty index (Equal Weight) between December 2017-end and February 2019-end, indicating the polarization.

The table also highlights that over this period, the top five contributing stocks of Nifty 50 index contributed a cumulative 881 points to the index, while the net change in the index was 262 points over the same period.

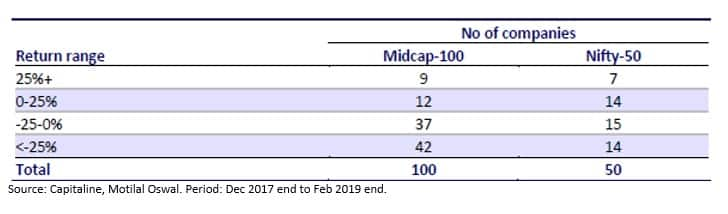

The broader markets saw a deep correction over the above mentioned period (December 2017-end to February 2019-end). While the Nifty50 index returned +2.5 percent, the Nifty Midcap-100 and Nifty Smallcap-100 indices fell sharply by 20.9 percent and 34.7 percent, respectively.

Further analysis of stock level performance shows that out of the Nifty Midcap-100 index companies, 42 companies fell by more than 25 percent, and 37 companies fell between 0-25 percent -- indicating that bulk of the mid-cap index stocks saw a significant correction.

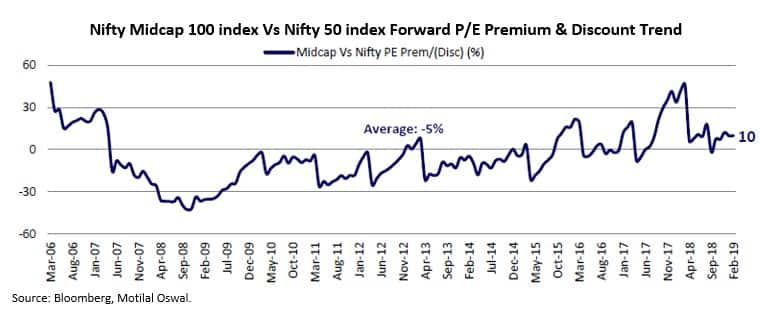

With deep correction seen in small and mid-cap segment, the valuation premium that these stocks commanded (versus their large-cap peers) at the end of 2017, has come down significantly.

Historically, mid-caps have traded at a valuation discount to large-caps. Although we still continue to be more positive on large-caps from a risk-reward perspective, some attractive bottom-up opportunities have emerged in the mid-cap segment as well and we have been advising allocation to this segment over the past few months.

However, over the past month or so, we have witnessed a sharp rally in the Indian markets (particularly in the broader markets). This has been on the back of a strong pick-up in FII inflows.

Globally, major central banks like the US Fed, European Central Bank, and some others, have been quite dovish in their monetary policy statements, and this has benefited in terms of inflows into peer emerging markets, helping their stock markets & currencies to also outperform over the past few months.

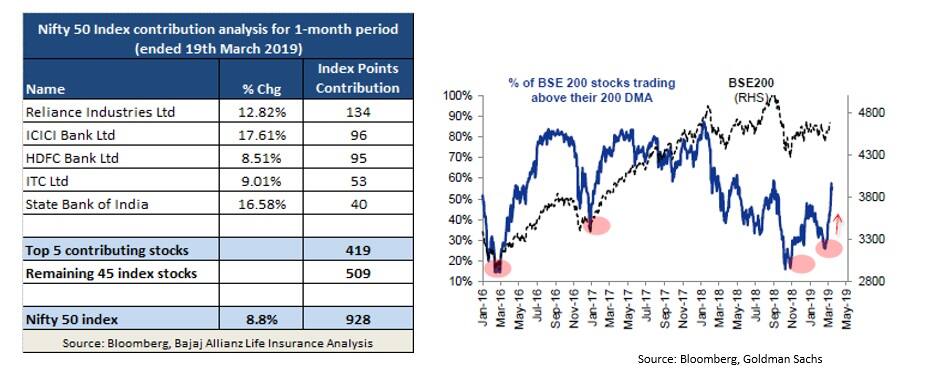

It may be still a bit early to conclude, but at the time of writing, we have seen a much more broad-based rally in the Indian markets over the past month, compared to before.

Corporate earnings growth is also recovering, and we expect it to be relatively more broad-based going forward. Some of the earlier underperforming sectors, which have been a drag on earnings over the past few years, are starting to turn-around, and this will aid the earnings recovery cycle, and hopefully, make the market participation more broad-based (and not as narrow as before).

If we look at the performance data, over one-month period (ended March 19, 2019), the top five contributing stocks of Nifty 50 index contributed a cumulative 419 points to the index, while the net change in the index was 928 points over the same period.

This is much more broad-based than in the previous illustration. Also, the chart highlights that presently close to 60 percent of BSE 200 index stocks are trading above their 200-day moving average (DMA), compared to just 25 percent in mid-February 2019.

Conclusion:

Therefore, we feel that with the expected acceleration of corporate earnings growth in FY20, and with a relatively more broad-based recovery, the narrow market phenomena that we have seen in the Indian markets over the past year or so, may be largely behind us now.

This narrow market phenomena, had caused several active managers (particularly in the large-cap segment) to underperform the headline Nifty 50 index last year.

This could be because mutual fund and ULIP portfolios are more diversified in nature, but last year—only a handful of stocks was keeping the headline Nifty index up (and contributing to most of the index returns).

We believe that India is still a stock-pickers market, with the potential to generate good alpha over the long term by active fund managers.

As the market matures, the alpha potential may start to narrow down, like it has happened in some of the other developed markets—but I do not believe we are there yet.

(The author is Chief Investment Officer, Bajaj Allianz Life Insurance)

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.