The Indian economy is characterised by scarcity of capital, which also reflects in the growing budget deficits of the government every progressive year. To fund this deficit, the government borrows from the market through sovereign securities. These government bonds are simultaneously the benchmark for interest rates and a harbinger of future returns. During years of crisis such as the present spell, the Reserve Bank of India (RBI), which is the government’s banker, has managed to deftly keep the cost of borrowing within reasonable limits, sometimes even admirably low. But other times, it has failed. Then there are the state governments that have their own borrowings. What will FY23 entail for the Centre and states? To know the future, let us look into the past:

Don't look up

The pandemic has been a key reason behind the sharp widening of the fiscal deficit. But as the chart shows, the central government’s deficit widened even before the pandemic. State finances were stretched too as they suffered a disproportionate blow to revenues. Tax revenues post the introduction of goods and services tax (GST) had plateaued with the GST giving rise to the Centre-state tussle. Hence, the combined fiscal deficit is in double digits for India.

Peaky climbers

The government bridges its fiscal gap mostly through borrowing from the bond market. With the fiscal gap wide, the government’s market borrowing more than doubled in a single fiscal year to reach a record amount in FY21. Meanwhile, already weakened state budgets were further shredded due to the pandemic. The combined market borrowing was in excess of Rs 21 trillion, unseen in the past. Economists believe the borrowing will stay elevated for at least two more years but the government can work towards chipping away the debt pile slowly.

Honey, I shrunk the yield

In FY21 the bond supply from the government ballooned but it didn’t shake the market. Logically, an increase in supply brings down prices and drives up bond yields. But the opposite has happened since FY21. Bond yields fell sharply even as the government borrowed a record amount from the market. One big reason was the Reserve Bank of India’s liquidity infusion through various instruments which has expanded the long-term durable liquidity surplus to more than Rs 10 trillion now.

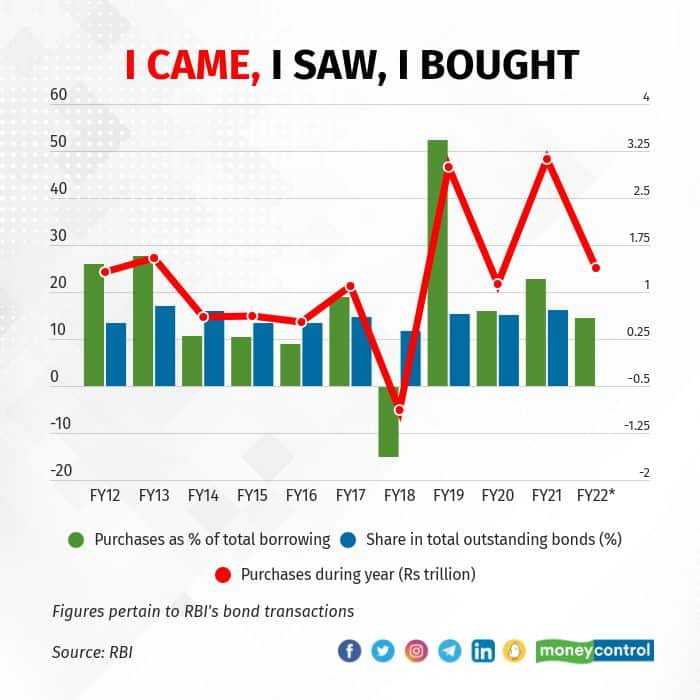

Defenders

Yet another reason for the bond market to swallow a record supply without flinching was the entry of a big buyer—the RBI. The central bank stood as a big buyer in the market through auctions and also covert secondary market purchases. The RBI now holds a little over 16 percent of the outstanding government bond stock on its books. The central bank was a big buyer even before the pandemic hit. The RBI has been a reluctant buyer, though. Its bond purchases as a proportion of the borrowing have come down post the pandemic.

Bringing down the market borrowing has been easier said than done in the past. With the pandemic's effects still visible on the economy, the government won't be able to significantly cut its fiscal deficit or market borrowing in FY23. Bond yields are in for a rough ride with a colossal supply of paper and little support from the RBI.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.