There is some technical issue. Please try again later.

That’s the message you see when you click the bright orange ‘Open Demat Account' button on the IIFL Securities website. Oddly enough, this message stands true for the IIFL Securities-5Paisa merger too. The two entities of IIFL Group were in the middle of a business reorganisation process when the Securities and Exchange Board of India (SEBI) imposed a ban on the former from onboarding new clients for two years.

The merger has not been called off yet, but speculation is rife. Clients are questioning if they should continue trading with 5Paisa considering it is a sister company. That said, 5Paisa’s ‘Open Demat Account’ is still functioning, and the customer care representative is quick to badger you the moment you feed in your contact number.

On June 20, a day after SEBI’s order for misusing clients’ funds, the share price of IIFL Securities tumbled 16 percent. 5Paisa Capital fell over 2 percent.

What is the merger all about?

In December 2022, IIFL Securities announced it would divest its retail clients with an asset base of up to Rs 10 lakh and merge them with discount broker 5Paisa. Post-merger, as many as 15 lakh customers of IIFL Securities would have been transferred to 5Paisa Capital, increasing the latter’s customer base to over 47 lakh.

The plan was for 5Paisa to focus on retail clients while IIFL Securities would take care of the affluent segment. IIFL Securities has online retail trading, private client groups (PCG), institutional equities, and franchisee businesses.

Also Read: The good, the bad and the ugly of IIFL saga

"The transfer will help us mitigate the overlap with 5Paisa and help us focus more on the PCG and the franchise businesses. This will create a conducive business culture as the same RM (relationship manager) might find it difficult to handle a Rs 1,000 customer and a Rs 1 crore customer," said R Venkatraman, Chairman and Managing Director (CMD) of IIFL Securities, in the recent earnings call.

The company was still awaiting SEBI approval on the same, and then it had to knock on NCLT’s doors. "So, I think we are about eight to nine months away," Venkatraman had added. But clearly, SEBI had other plans.

Many believe the hive-off was planned as the SEBI investigation was dragging on. "The part of the business that came into question for misuse was the retail business. It is likely that they were separating the problematic area to save the brand image," said an industry insider.

A slow train

With the COVID-19 exuberance gone, client additions had already slowed down for both companies. In Q4 FY23, IIFL Securities added only 49,000 customers compared to 209,000 in Q4 FY22. 5Paisa Capital, on the other hand, acquired 1.36 lakh customers, 66 percent down from Q4 FY22. The additions were lower sequentially, too.

"IIFL Sec was anyway not too active in the 20-35-year age group. At the group level, they were spending aggressively on 5Paisa to be the face of the retail trading segment," said an executive from a rival brokerage firm on condition of anonymity. As the SEBI order has raised doubts, it will be important to monitor if clients abandon their demat accounts with the sister entities and switch to a different broker, the executive added.

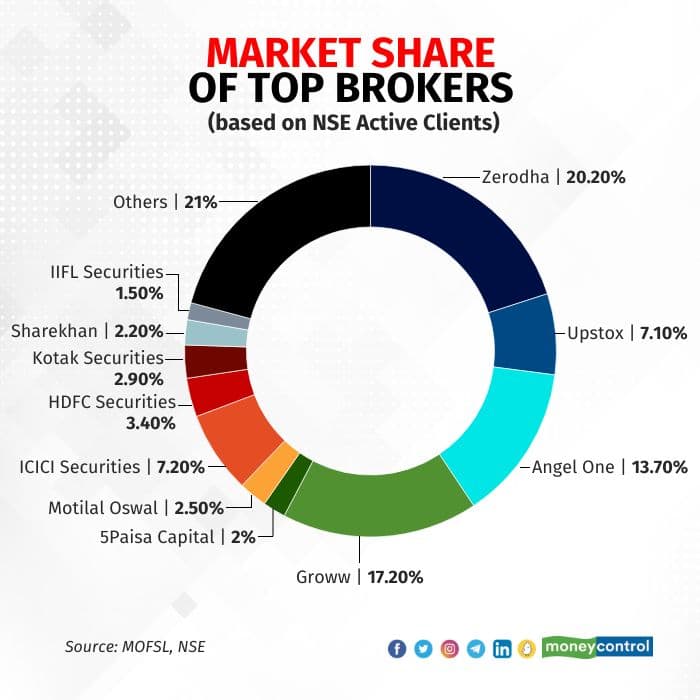

Based on data from the exchange, 5Paisa Capital had a 2 percent market share of the NSE’s active clients in April, while IIFL Securities had a 1.5 percent share. Back in September, IIFL Securities had a 3 percent market share, while 5Paisa had a 3.9 percent. Both brokers are clearly missing out on the additional brokerage income coming from rising trading volumes, with the markets touching new highs.

The bigger pain

About 50 percent of IIFL Securities’ revenue comes from institutional clients, and the other 50 percent is from non-institutional clients. Of the non-institutional segment, retail clients, although larger in number, form a smaller chunk of the topline, according to people in the know.

"If IIFL Securities is unable to hive off its retail clients to 5Paisa, then it won’t be able to focus on growing the affluent segment. Along with the restriction on new client additions, serving these existing retail clients will add pressure to the balance sheet as the strategic focus has changed," said market participants.

Also Read: IIFL Securities cannot accept new clients for two years: Sebi

The SEBI order might also impact IIFL Securities’ institutional business, especially from foreign funds, which are more sensitive to regulatory action. But a section of the industry also believes that IIFL Securities will be able to protect that segment, especially as it has sticky long-standing clients, by convincing clients that ‘the SEBI order pertains to a 10-year-old issue’.

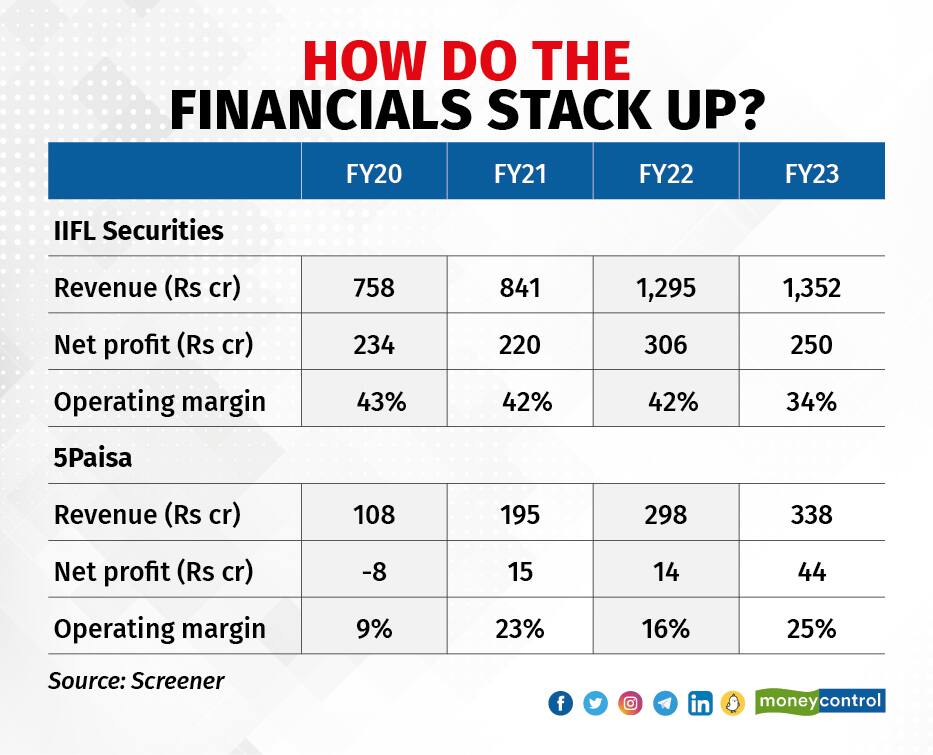

In its earnings presentation, the company justified the decline in new customer additions as a shift in its focus. Its margin has improved from 32 percent to 38 percent over the past few quarters but is yet to reach the pre-COVID-19 levels of 45 percent.

Moneycontrol has reached out to the management for clarification on the merger. Meanwhile, the ‘Open Demat Account on IIFL Sec’s website simply remains a door to nowhere.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.