The Nifty continued its upward journey for the second session in a row on the back of strength in auto, banks and consumer durable stocks, on August 8.

From the recent bottom of 15,183 (low made on June 17, 2022), Nifty has registered a steep rise of 2,300 points in short span of time towards 17,550. On Monday, the Nifty broke out from the last four days trading range and closed above the resistance level of 17,500. Nifty is placed above its 20, 50, 100 and 200 days EMA (exponential moving average, which indicates bullish trend on all time frames).

Weekly RSI (relative strength index - 11) for the Nifty has reached near 60 which is still far from overbought zone, which indicates room for more upside. Daily ADX (average directional index - 10) has been rising and placed at 44, below the extreme momentum levels. With rising ADX and +DI placed above –DI on the daily chart, we can expect Nifty to extend the gains from the current levels.

In the Index Futures segment, FIIs created fresh longs in the Index Futures segment, where their net long to short ratio has moved up to 1.23 level from 1.07 levels. In the Option segment, Nifty open interest Put Call ratio has risen sharply on the back of aggressive Put writing at 17,300-17,400 levels. This level also coincides with the 5 days EMA which is placed 17,380 levels. Therefore, our advice is to continue to remain bullish with the trailing stop-loss.

On the higher side, Nifty could move towards 17,800-17,900 levels. Long should be protected with the stop-loss of 17,300 in Nifty.

Here are three buy calls for next 3-4 weeks:

Century Textiles & Industries: Buy | LTP: Rs 851 | Stop-Loss: Rs 800 | Target: Rs 910-950 | Return: 12 percent

The stock price has broken out from the symmetrical triangle on the daily chart. Primary and intermediate trend of the stock is positive as it is trading above its all important moving averages.

The stock price is forming higher top higher bottom formation on the daily chart. Plus DI is trading above Minus DI while ADX line is placed above 25, indicating stock is likely to gather momentum in the coming days. One can buy the stock in the range of Rs 820-850.

Triveni Turbine: Buy | LTP: Rs 192.6 | Stop-Loss: Rs 180 | Target: Rs 206-220 | Return: 14 percent

The stock price has broken out from the downward sloping trendline on the daily chart. Primary trend of the stock is positive as it is trading above its 100 and 200 days EMA.

Momentum Oscillators – RSI (11) and MFI (money flow index 10) have placed above 60 and sloping upwards, indicating strength in the current uptrend of the stock.

On the monthly chart, the stock price has reached near the strong support zone. One can buy the stock in the range of Rs 192.5-185.

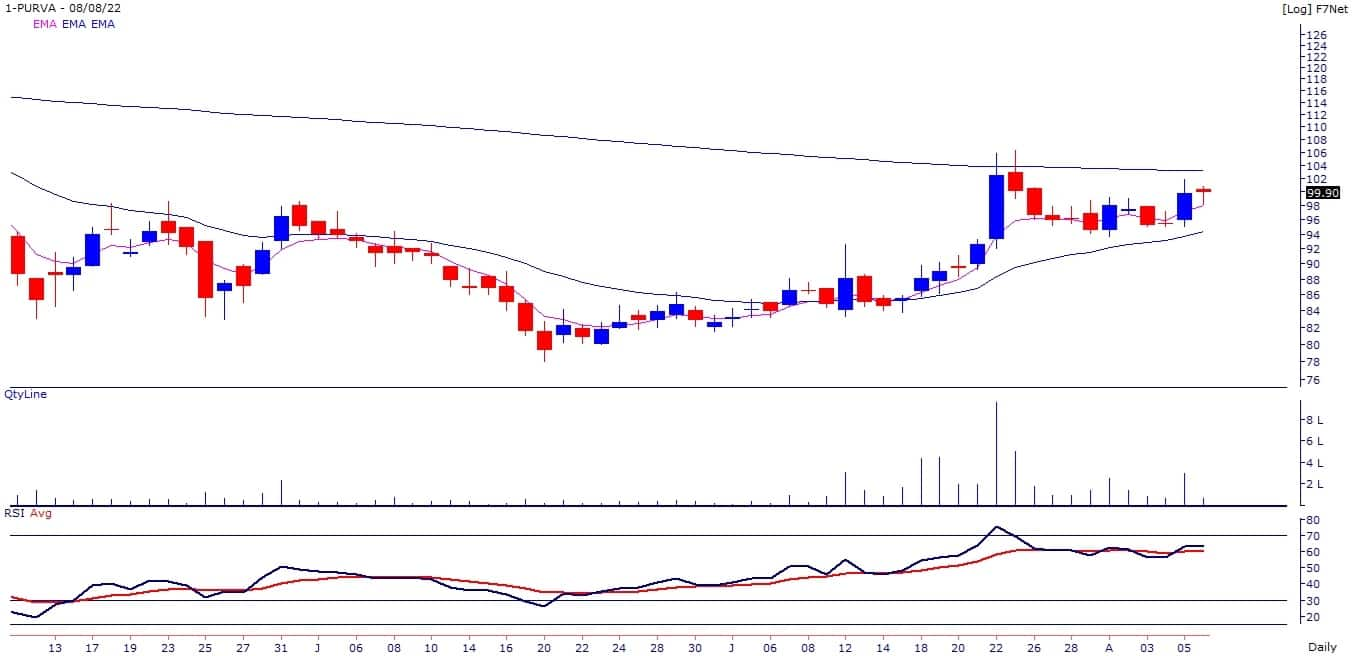

Puravankara: Buy | LTP: Rs 99.65 | Stop-Loss: Rs 94 | Target: Rs 107-112 | Return: 12 percent

The stock price has broken out on the daily chart on August 5, where it closed at highest level since July 25, 2022. Short term trend of the stock is positive as it is trading above its short term important moving averages.

RSI oscillator is placed above 60 and rising upwards, indicating strength in the current uptrend. One can buy the stock in the range of 99.65-97.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.