The outperformance of small-cap stocks has dazzled the Street. There are investors who have made loads of money investing in them in this ongoing bull run, those who believe they have likely missed the bus, and then those who are the naysayers of the rally.

Though it is impossible to determine which camp is right given the fickleness of the market, the debate is ongoing. There are fund managers and investors on both sides of the debate – one believing it is a ticking time bomb, the other saying that it is just the beginning.

No matter what, it is the truth that money is pouring into the smallcap space like water.

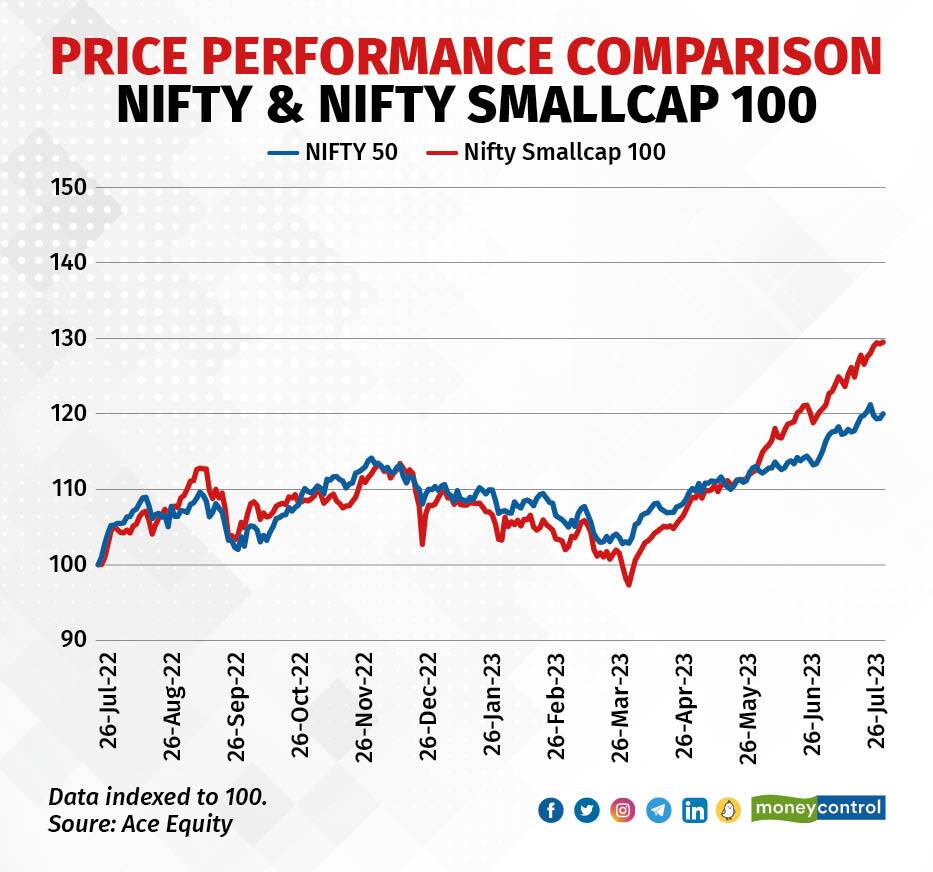

There are several reasons behind this, the most prominent being money following the momentum in the market. Take a gander at the data: Nifty Smallcap 100 rose about 7 percent from December 2022 to June 2022 – during the period when Nifty delivered zero returns to investors. If one looks at individual small-cap stocks, the returns are stunning.

The Virtuous Cycle

As most investors chase recent performance, money chased funds with a higher allocation to small-caps or dedicated small-cap funds as they were topping the performance tables. And the outperformance of small-cap stocks and small-cap funds created its own virtuous cycle of performance because as more money came into these funds, they got deployed in the same set of stocks perpetuating the cycle of outperformance.

Vikas Khemani, Founder, Carnelian Asset Advisors, believes it was excessive liquidity that fueled the rally, and there may not be substance in this rally.

AMFI data shows the smallcap category received 17,900 crore in net inflow during the first six months of 2023 while the midcap scheme received Rs 10,300 crore. In essence, mutual fund schemes, especially those from small and midcap categories, have been so flushed with cash that they have no avenues left to invest. Thus, some fund houses stopped lumpsum investment in small-cap schemes.

Deploying significant amounts of money in smallcap stocks is not easy as there is usually not much liquidity. So the moment a fund manager places an order, the stock prices run up significantly resulting in a higher cost of acquisition. Moreover, there is always a fear that fund managers may not be able to exit when the market takes a turn for the worse as there won’t be any buyers left.

The Real Story

While curtailing inflows into small-cap funds will slow down the liquidity cycle to a certain degree, the moot point is if these stocks hold potential for outperformance from hereon. Mukesh Kochar, National Head-Wealth, AUM Capital Market, believes their outperformance thus far was justified as there was a valuation gap between large-caps and small-caps waiting to be bridged. As of July 26, Nifty traded 24 times its earnings while Nifty Smallcap 100 was at about 21 times. This is despite the rise thus far.

In the past, Nifty Smallcap has mostly traded at a premium to Nifty Smallcap 100, however, lately, this trend seems to have reversed. According to Ace Equity database, Nifty 10-year average PE is 24.36 and Nifty SmallCap 100 10-year average PE is 33.71. That means the smallcap index still has some catching up to do.

"People are in denial mode," says Amit Jeswani, Founder at Stallion Asset, alluding to naysayers.

He highlights that just because smallcap indices have run up 15-20 percent from their last all-time highs, it cannot be termed euphoria. According to him, euphoria will be when these indices have run up 50-60 percent without slowing down. Jeswani brings to attention the fact that the biggest gainers of the current bull run are companies that are riding the capex upcycle, led by government orders. "At the top of the list of small-cap outperformers are companies that have been fulfilling the government orders from sectors such as rail, government infra, defense, etc."

Jeswani, who manages a Rs 700-crore midcap-focused portfolio, says companies active in B2G (business to government) space have made a lot of money for investors and may continue to do so.

It boils down to the same thing then – being selective about stocks. While some stocks have legitimate reasons to rise, many more have risen just driven by sentiment and false narratives. "As a whole, investors should be cautious about investing in this segment now," says Khemani. "Since some of them have run up sharply, over a three to six-month period, they could underperform, but many should outperform in the long term," says Khemani."

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.