December 26, 2022 / 16:32 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets started the week on a strong note and gained over a percent, taking a breather after the recent slide. After the initial uptick, the Nifty index gradually inched higher as the day progressed however some profit taking in the last half an hour trimmed some gains. Eventually, it settled at 18,014 levels; up by 1.17%.

Most of the sectoral indices participated in the recovery wherein realty, banking, metal and energy packs posted decent gains. The broader indices too rebounded swiftly and gained in the range of 2.8%-4%.

Participants shouldn’t read much into a single day rebound and wait for the sustainability of the move. We have the next hurdle around the 18,150-18,200 zone in Nifty, so we recommend utilising further recovery to reduce positions. In absence of any major event, the upcoming expiry of December month derivatives contracts will keep the traders busy.

December 26, 2022 / 16:16 IST

Rupak De, Senior Technical Analyst at LKP Securities

Nifty remained volatile throughout the session before closing below the crucial resistance level of 18,070. Besides, the index failed to reclaim the 50 EMA on the daily timeframe.

The momentum indicator remains with a bearish crossover, implying weakness. The trend is likely to remain weak over the near term.

The supports are pegged at 17,950/17,800, whereas on the higher end, resistance is placed at 18,100.

December 26, 2022 / 16:11 IST

Vinod Nair, Head of Research at Geojit Financial

After a four-day selloff, the domestic market was refuelled by bottom fishing and optimistic sentiment from global counterparts.

PSBs led the rally, while mid- and small-cap stocks outpaced the benchmark.

Contrary to the trend, global concerns over the recession and COVID spread continue to remain high, which will sustain volatility in the market.

December 26, 2022 / 16:02 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty had seen a sharp decline in the last week that had pushed the intraday momentum indicators into the oversold zone. In terms of the Fibonacci retracement, the index had reached 50% retracement of the rally from Sept 2022 to Dec 2022. Consequently, the index had a swift bounce on December 26.

It has moved up to retest a trendline, which was broken on the downside on Friday. Thus 18,100-18,200 will be the near term hurdle zone, which will decide further course of action for the index.

Overall structure shows that the Nifty is likely to witness short term consolidation with key support at 17,800.

December 26, 2022 / 16:00 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Indian equites witnessed a strong recovery after the sharp sell-off last week. Nifty opened positive and gained strength throughout the session to close with gains of 208 points (+1.2%) at 18015 levels.

Action was seen in broader market post its 3 consecutive weeks of decline. Both Nifty Midcap 100 and Smallcap 100 outperformed Nifty with gains of 2.7%/3.8% respectively.

Except Pharma, all sectors ended in green. After sharp fall of 3% in Nifty over the last three trading sessions, value based buying emerged at lower levels.

In the absence of any major global events due to year-end holidays, we expect market to remain sideways to positive based on news flows. We expect focus on banks, auto, capital goods and defense sectors to do well in the near term.

December 26, 2022 / 15:45 IST

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index witnessed a sharp up move after a massive sell-off in the previous week.

The index downside support now stands at 42,000 where aggressive put writing has been observed.

The next hurdle on the upside is seen at 43,000 where the highest open interest is built up on the call side.

The index remains in buy mode as long as the mentioned support is held on a closing basis.

December 26, 2022 / 15:32 IST

Rupee Close:

Indian rupee closed 21 paise higher at 82.65 per dollar on Monday against Friday's close of 82.86.

December 26, 2022 / 15:30 IST

Market

Close: Benchmark indices ended higher with Nifty closing around 18,000 amid buying seen across the sectors, barring pharma.

At close, the Sensex was up 721.13 points or 1.20% at 60,566.42, and the Nifty was up 207.80 points or 1.17% at 18,014.60. About 2787 shares have advanced, 733 shares declined, and 129 shares are unchanged.

SBI, IndusInd Bank, Hindalco Industries, Tata Steel and Coal India were among the biggest Nifty gainers, while losers were Divis Labs, Cipla, Dr Reddy's Laboratories, Nestle India and Tata Consumer Products.

Except pharma, all other sectoral indices ended in the green with PSU bank index added 7 percent.

The BSE midcap index added 2.3 percent and smallcap index rose 3 percent.

December 26, 2022 / 15:26 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee appreciated by 0.16% on Monday on surge in domestic equities and a soft US Dollar. Domestic indices gained by ~1.5%. US Dollar softened amid improved global risk sentiments and softer inflation in US.

We expect Rupee to trade with a positive bias on weakness in Dollar and positive domestic markets. Decline in safe haven appeal on rise in risk appetite in global markets may also put pressure on Dollar. However, surge in crude oil prices cap sharp upside in Rupee. USDINR spot price is expected to trade in a range of Rs 82 to Rs 83.30.

December 26, 2022 / 15:23 IST

SJVN wins 100 MW wind power project

SJVN has expanded its footprint in wind energy as it has won the full quoted capacity of 100 MW wind power project at Rs 2.90 per unit on build-own-and-operate basis through e-reverse auction.

SJVN was quoting at Rs 33.60, up Rs 1.55, or 4.84 percent on the BSE.

December 26, 2022 / 15:17 IST

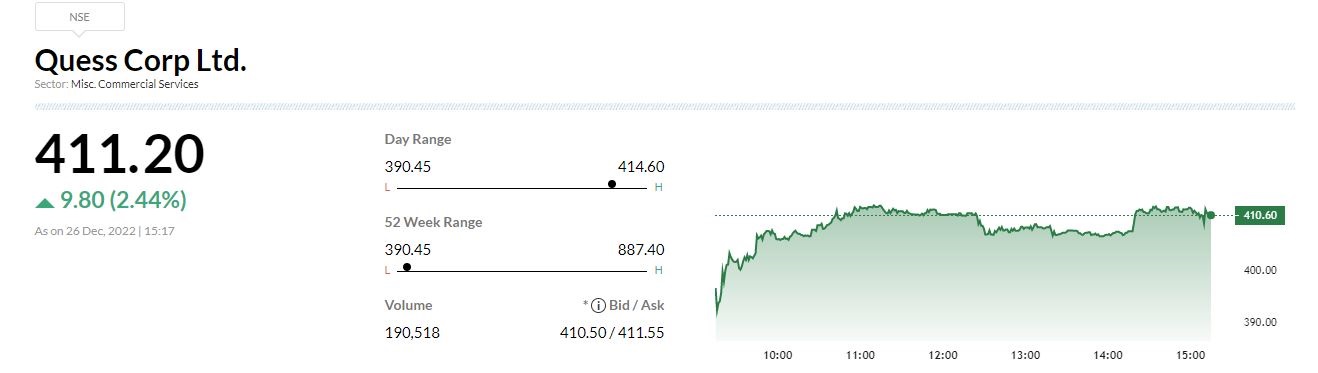

Quess Corp withdraws scheme of amalgamation of Allsec Technologies

Quess Corp said due to changed market scenario, the board has decided to withdraw the proposal of the scheme of amalgamation of Allsec Technologies with the company. The board has appointed Kamal Pal Hoda as the Group Chief Financial Officer of the company with effect from January 10, 2023 in place of N Ravi Vishwanath.

December 26, 2022 / 15:09 IST

Karnataka Bank gets RBI approval for appointment of Sekhar Rao as ED

Karnataka Bank has received approval from Reserve Bank of India for appointment of Sekhar Rao as its Executive Director. Rao is appointed as Executive Director of the bank for a period of three years.

December 26, 2022 / 15:06 IST

Infibeam Avenues gets perpetual license from RBI for bill payments business

Infibeam Avenues has received perpetual license from the Reserve Bank of India for its bill payments business, BillAvenue. With this, BillAvenue will operate as a Bharat Bill Payment Operating Unit (BBPOU) under Bharat Bill Payment System (BBPS). As a BBPOU, BillAvenue operates as both biller and customer operating unit onboarding Billers and Agent Institutions to service the customers.

Infibeam Avenues was quoting at Rs 16.05, up Rs 1.35, or 9.18 percent.