CARE Ratings

Traditionally, gold is viewed as a safe-haven by stakeholders who seek to preserve their purchasing power during rising inflation or as a hedge against market volatility. Gold prices are typically influenced by monetary policy announcements, economic data, strength of the US dollar, supply & demand, inflation, currency movements, activity of ETFs, and jewellery demand.

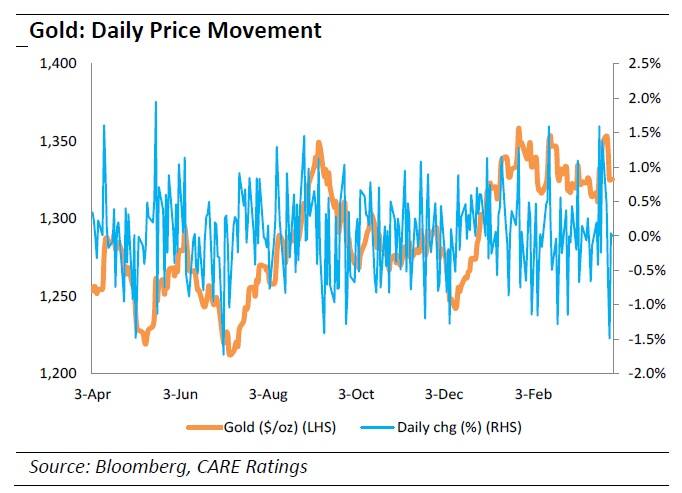

Gold prices have remained volatile for the last year (FY18) and have moved in a narrow band (up 2.5% and down 1.5%), with a high of $1,358.46 and a low of $1,212.46. Gold prices increased from $1,253.5 at the beginning of April 2017 to close at $1,325.48 at the close of March 2018, an increase of 5.7%.

However, despite these changes, volatility in FY18 actually reduced to 10% from 14% in FY17. With the recent words being exchanged between US and China on tariffs, import sanctions and unrest in the Middle East, there has been an increased volatility bringing renewed interest in the yellow metal.

Buying by central banks and elevated jewellery demand has also supported prices. On the other hand, US Fed’s indications of a stronger US economy and Chinese President Xi Jinping's statements on import tariffs have subdued prices

Gold and the US dollar

Historically, gold and the US dollar have had a negative correlation i.e. a strengthening in the US dollar has generally led to a decline in the price of gold. As depicted in the chart below, the correlation between gold and the US dollar index (dollar index measures the value of the US dollar against a basket of six foreign currencies) has generally been a strong negative. The dollar rose aided by expectations of improvements in the US economy, inflation expectations and economic weakness in other currencies

such as the Euro.

Global Demand

Global Demand

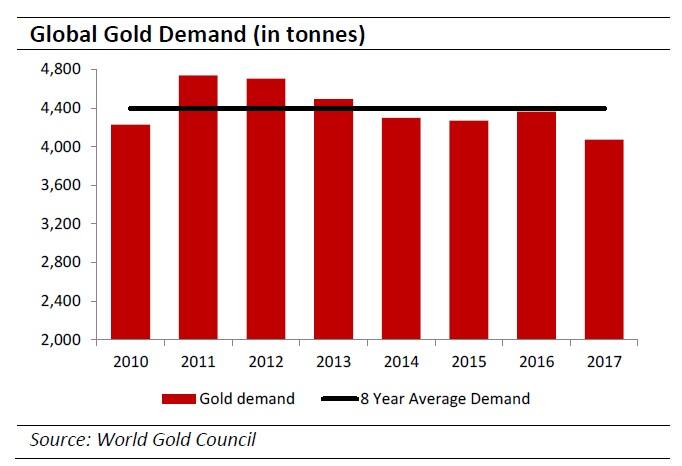

Global gold demand dipped in 2017 by 7%, reversing the strong growth demonstrated in 2016. The global demand for demand had been trending lower since 2012. The global demand continues to trend below the eight year average demand.

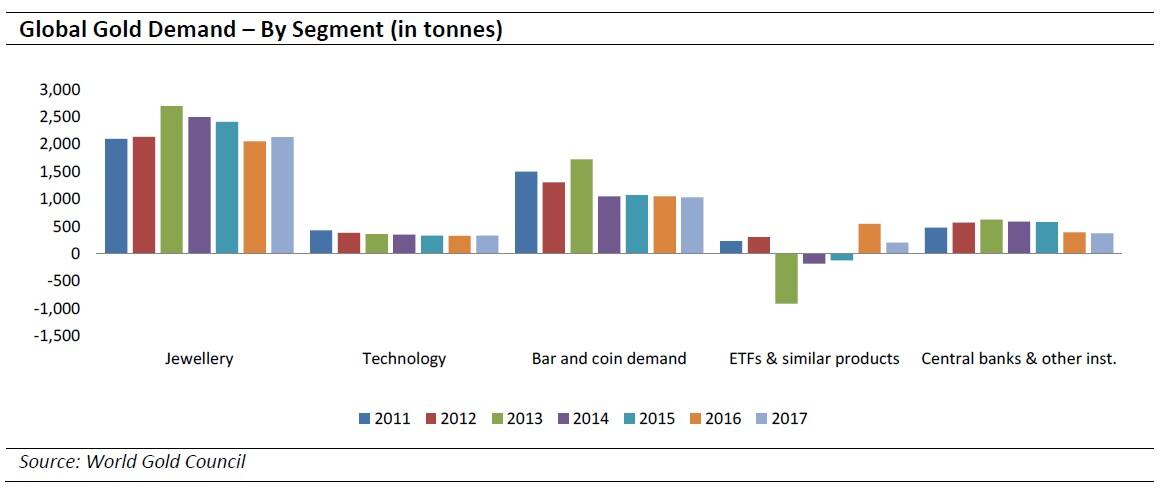

In 2017, jewellery demand grew by 4% to 2,135 tonnes supported by robust demand in India and China. In 2017, overall investment demand fell by 23% to 1,231 tonnes. Bar and coin demand fell 2% due to a significant drop in US retail investment.

ETF inflows also lagged significantly the inflows witnessed in 2016. Central banks continued to increase gold purchase however, 2017 net purchase were down by 5% as compared with 2016. Gold usage in technology increased after several years driven primarily due to rising presence of features in smartphones and vehicles.

India Demand

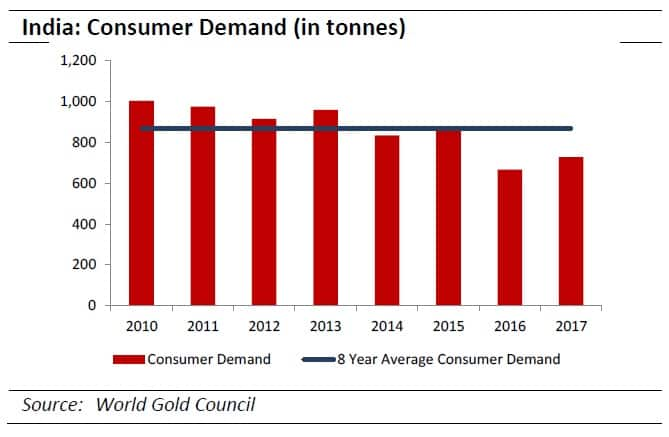

Being the second largest consumer of the metal and given the country’s near total reliance on imports for meeting its demand, the changes in domestic demand scenario have an outsize impact on the global demand for gold and it price.

According to the World Gold Council, in CY17, demand for gold in India stood at 727 tonnes against 666 tonnes in CY16. The demand rose due to positive consumer sentiment in the October-December quarter and appreciation in the rupee. However, despite the 9% increase, the demand was below the eight-year average of 865 tonnes. India’s annual bar and coin demand increased by 1.6% over 2016 to 164.2 tonnes, however, it too was below the three-year average demand.

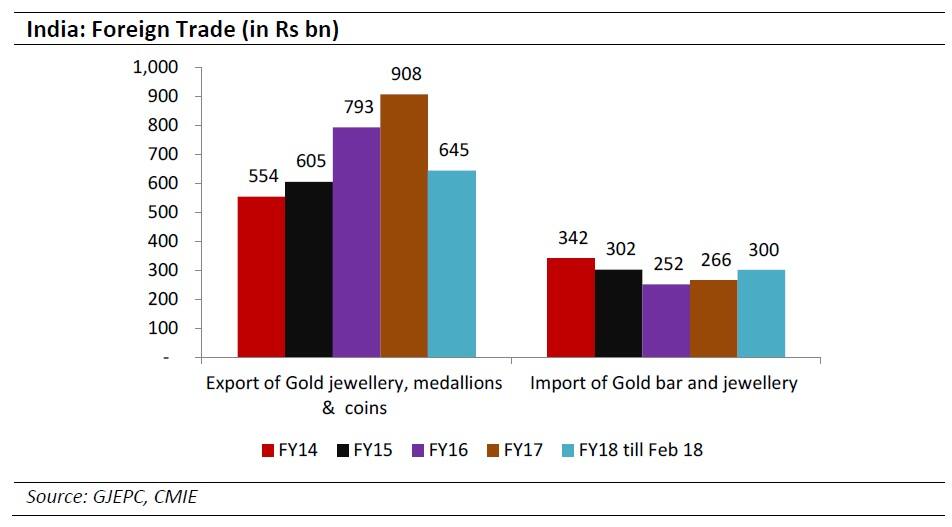

The export of gold jewellery, medallions and coins has increased steadily from Rs 554 bn in FY14 to Rs 908 bn in FY17, however, it is anticipated that there would be a reduction in exports in FY18 based on the data till February 2018 due to a fall in the US demand. Import of Gold bar and jewellery had fallen from Rs 342 bn in FY14 to Rs 252 bn in FY16, but rose marginally to Rs 266 bn in FY17. The imports in FY18 till February 2018 are already more than the FY16 and FY17 levels and are expected to reach close to FY14 level due to consumer demand after shrugging off the effects of demonetisation.

Gold ETFs in India

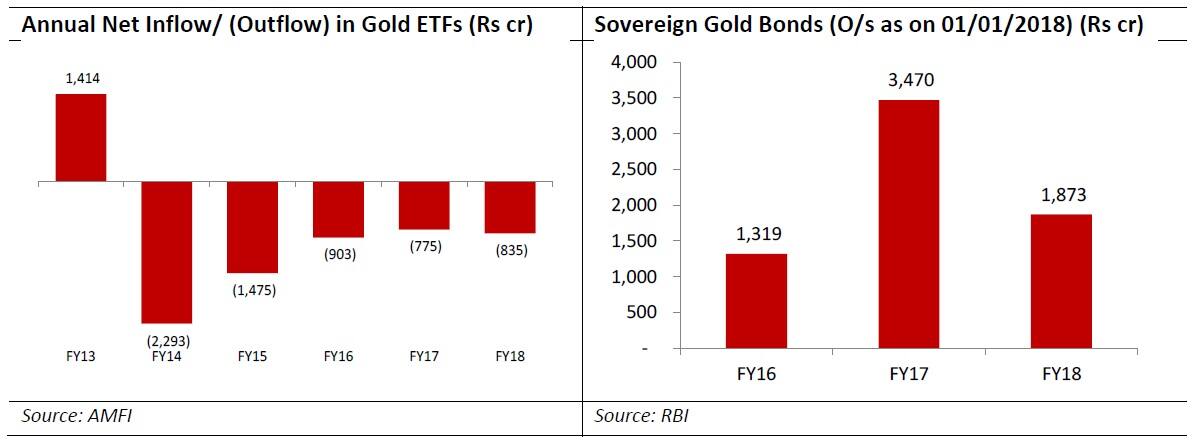

As equity funds have generally outperformed gold ETFs in FY18, investors redeemed Rs 835 cr. from gold ETFs, making it the fifth consecutive financial year of outflow, while investments have continued to flow into equity funds. The outflow has reduced the asset sunder management (AUM) of gold funds by over 12%.

Another reason for the decreasing attraction of gold ETFs in India is the introduction of sovereign gold bonds (SGBs) by the government which encourages people to buy more of electronic or paper gold instead of buying gold in the physical form. SGBs are more attractive as compared to Gold ETFs as these bonds pay interest as well as protect the quantity of gold invested (e.g. while the investor faces price risk, the investor would receive proceeds equivalent to the gold quantity invested), further gold ETFs suffer from tracking error which reduces returns and do not pay any interest.

Outlook

US developments continue to remain the key influence on prices. Gold prices are expected to remain volatile in the near term. Gold prices are expected to be negatively impacted with the US dollar expected to strengthen further on the back of better performance of the US economy and expected US interest rate hikes. In the medium term, geo-political tensions in the Middle East, increasing US government debt and rising inflation pressures, volatility and lower equity markets could support gold prices. Gold is likely to remain range-bound in the short-term around the $1,350/oz range.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.