Risks in the global financial market remain elevated amid high interest rates, staggering debt levels and fragility in the US banking system, but the impact on India is expected to be limited due to its strong banking sector and low dependence on external loans, analysts said.

Investors should also remember that crises are good times to buy Indian banks, which are cushioned by a strong deposit-base, stable asset quality and strong regulations, they added.

In a recent report on India titled ‘Safe zone vibes’, Crisil said the primary factor driving financial risks this year are the high interest rates in developed economies.

Over the past 15 months, the Fed has jacked up its policy rate by 500 basis points (bps) -- the fastest pace of hikes since 1980s -- to 5 - 5.25 percent. The Bank of England too on May 11 hiked the policy rate for the 12th consecutive meeting, taking it to 4.25 - 4.5 percent to quell stubborn inflation. The European Central Bank has jacked up borrowing costs by 375 bps since July last year.

Also Read: Debt default, banking crisis key concerns for US economy, says economist David Rosenberg

This unprecedented pace of monetary policy tightening is proving to be a stress test for a host of segments, from the tech sector to US regional banks.

“Risks of more malfunctions and further tightening in global financial conditions remain high,” analysts at Crisil warned.

Fanning the Flames

According to S&P Global’s Financial Fragility Indicator for the US, financial fragilities of the private sector are at the worst since the 2008 financial crisis.

Apart from the high interest rates, one key factor is the rapid growth of non-bank financial intermediaries (NBFIs) such as pension funds, insurers and hedge funds, which account for around half of global financial assets at present.

As per the IMF’s Financial Stability Report for April, vulnerabilities have increased in certain NBFI segments on account of leverage and liquidity mismatches. Moreover, their high interconnectedness with the core financial sector such as banks can amplify their stress through the global financial system.

But an even bigger worry is record global debt.

Global debt is currently at a mind-numbing $300 trillion, or 349 percent of global gross domestic product (GDP), according to S&P Global.

With interest rates expected to stay higher for longer, debt servicing risks becoming the next global challenge.

Impact on India

Both FPI and FDI flows into India have been hit in periods of rising US interest rates, such as 2018-19 and 2022-23. FPIs, being more volatile in nature, were hit more than FDIs.

Despite the US banking turmoil, FPI flows into equities have been on an upswing since March this year.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, says there is a distinct change in the FPI strategy with respect to India.

“In the first three months of 2023, FPIs were continuous sellers in India due to India’s premium valuations and the opportunities provided by the Chinese reopening and the relatively lower valuations in South Korea, Hong Kong and Taiwan. That phase is now over and India has once again become a favoured emerging market destination for FPIs,” he said.

Analysts, however, say it would be premature to assume that the US banking crisis is over.

“Credit conditions are likely to tighten in the US financial system on account of rising interest rates, and troubles in small banks. This can constrain global lending, especially for those entities and economies linked to the US banking system,” Crisil said.

Also Read: If the banking crisis offers one lesson, let it be this

However, India’s dependence on the global banking sector remains small. A study by Bank of International Settlements also points out that India and China remain less financially integrated with the world relative to other large emerging markets.

Another point in India’s favour is that its current account deficit (CAD) is expected to reduce this fiscal on the back of falling crude oil prices, boost from services exports, and rising remittances.

CAD is India’s major short-term external liability, which affects the exchange rate and investor sentiment.

“We expect India’s CAD to moderate to 2 percent of GDP this fiscal from an estimated 2.5% of GDP in the previous one,” Crisil added.

Lending Support

Analysts maintain that India’s banking system is largely insulated from the current global banking turmoil.

This is because firstly, interest rates in India did not fall to the same extent as in developed markets during the pandemic, and consequently, the quantum of rate hikes so far has also been lesser (250 bps by RBI vs 500 bps by Fed).

Secondly, the asset books of Indian banks are dominated more by loans (around 70 percent of deposits) than investments (30 percent). As seen by the recent collapse of a number of US lenders, banks’ investment portfolios are more vulnerable to interest rate risks.

Besides, regulations allow banks to hold investments up to 23 percent of net demand and time liabilities under the held-to-maturity (HTM) category, which significantly shields them from interest rate movements.

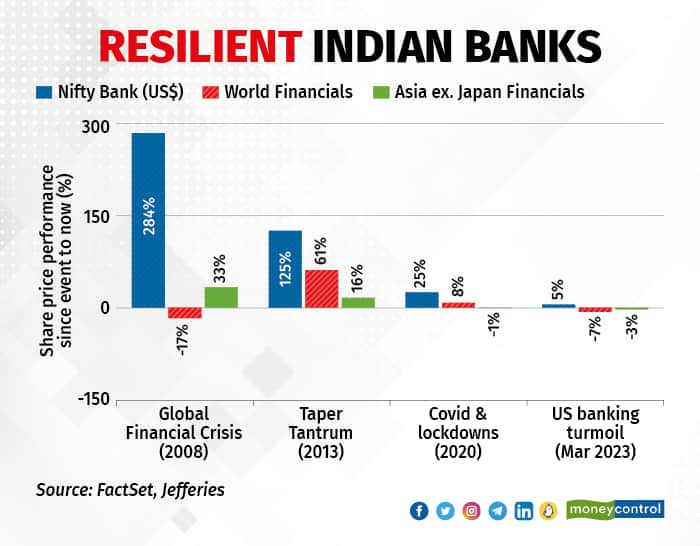

In a recent note, global brokerage Jefferies said Indian banks have matured through 8 crises over the past 15 years. These include the Global Financial crisis of 2008, taper tantrum, demonetisation, Covid, Yes Bank bailout, and the current US banking turmoil.

Not only that, the Nifty Bank index has outperformed global peers by 10 percentage points (annualised) since 2007 and always within a year of the event.

Strong deposit-base, balanced asset-liability management, stable asset quality, adequate capital levels, low foreign ownership, and strong regulations are some of the factors highlighted by analysts.

“Key learnings are that banks that held-up through crises widen lead and crises are good times to buy Indian banks,” Jefferies added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.