Indian markets opened mildly lower on expectation of softer US markets and on lower-than-expected earnings from Tesla and Netflix. Among sectors, information technology down 0.6 percent, while buying is seen in the metal, oil & gas, power, realty and healthcare. BSE Midcap and smallcap indices are trading in the green.

As of 11.35 am, the Nifty index was up 0.023 percent or 4.65 points at 19,837.80. The Nifty Bank was up 0.14 percent or 64.80 points at 45,734.10.

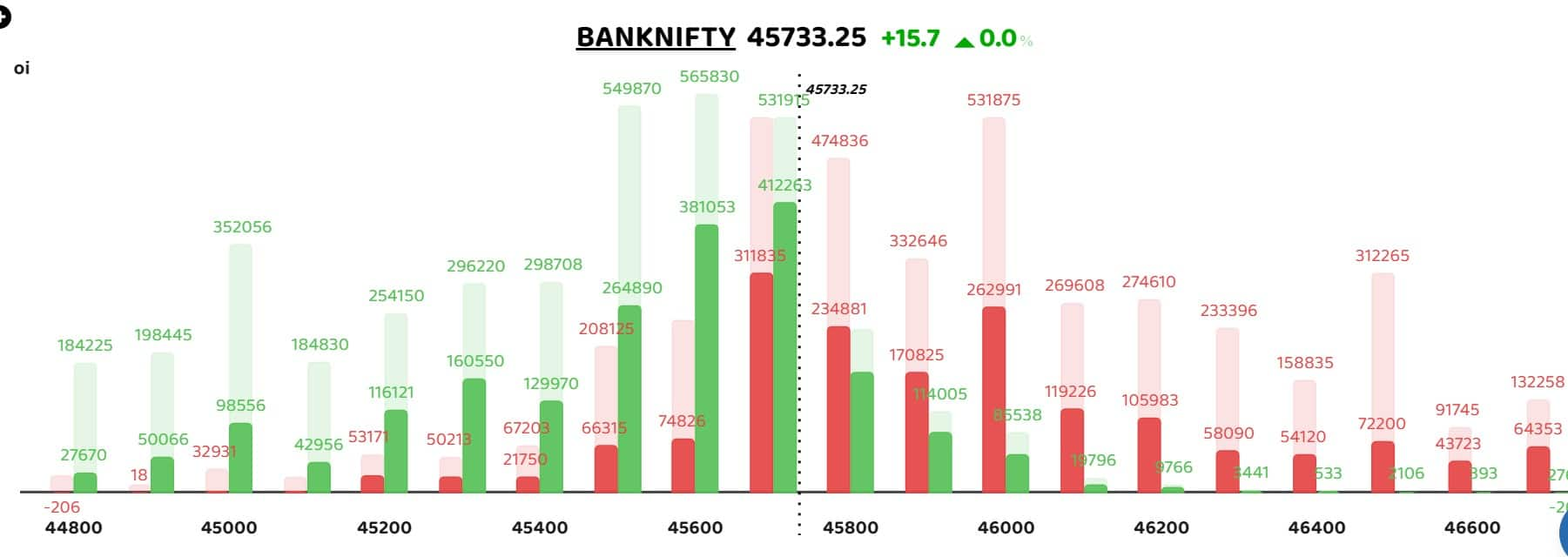

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

The market breaks the winning streak of five consecutive sessions amid volatility. The support for Nifty stands at 19700. The max pain, which is the strike with most open option contracts, is placed at 19,800 in Nifty. Resistance can be seen at 19900 followed by 20000 levels. Sameet Chavan, Head Research, Technical and Derivatives, Angel One Ltd said, “Nifty is now at a knocking distance of magical figure 20,000, and if this condition persists then we may see it tested very soon.”

He also stated that traders should avoid complacency, given the overbought conditions and rapid upward movement, and recommends traders to secure some profits around this psychological level. In case of downside, 18,700 – 18,650 is considered immediate support for the weekly expiry, and a dip toward it continues to be a buying opportunity.

Bars reflect the OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the OI during the day. Red bars show call option OI, and green bars show put option OI.

Both call and put writers played out aggressively at 45,700 Strike. The overall undertone of the Bank Nifty index remains bullish, suggesting that the prevailing trend is in favour of the bulls. “A strong close above 45,700 can take Bank Nifty to 46,000 zones while the downside support is placed at 45,500” stated Ashwin Ramani, Derivatives & Technical Analyst, SAMCO Securities.

"The immediate resistance on the upside is situated at 45,800. If the index manages to sustain above this level, it is likely to open up further upside potential towards 46,000 and 46,300 levels," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Among individual stocks ABB India and Reliance were those that saw short buildup while Alkem, HindPetro and MPhasis saw long buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.