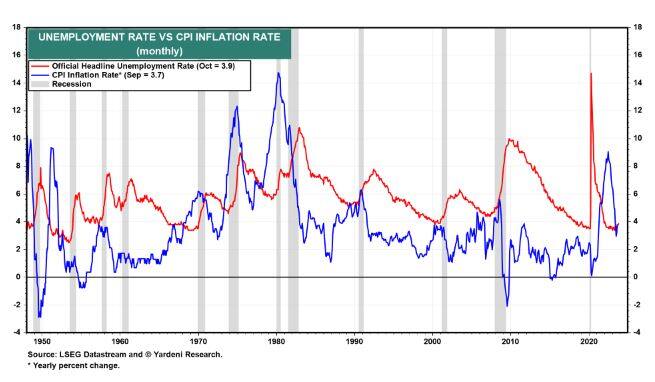

Inflation and unemployment seem to have lost their inverse correlation, with one showing a dip even as the other stays on a downward trend, according to Yardeni Research’s recent Quick Takes note. Yardeni Research is a sell-side consultancy headed by the noted economist and investment strategist Ed Yardeni.

Historically, the two economic indicators have moved in opposite directions and this relationship is captured in the Phillips Curve, described as the foundation of the US Federal Reserve’s monetary policy.

“Perhaps, the Fed’s Phillips Curve model is flawed,” the consultancy said in the note.

Is it time to question the economic models, the consultancy asked in an Xm formerly Twitter, thread that into the note.

Also read: Ed Yardeni expects Fed to cut rates next year; early signs of Santa Claus rally visible

So, what is the usual trajectory of inflation and unemployment?

When people have plenty of money in their hands, they buy more. To meet this demand, companies produce more. To produce more, companies hire more hands and pay higher wages. This leads to lower unemployment, fuel an inflationary trend and economic growth.

But this time, economic growth seems more productivity based, according to Yardeni Research. That is, companies can produce more with fewer hands.

Then more goods would be landing in a market that has a lower purchasing power. This growth, which is riding on better productivity, would be disinflationary.

“The Fed may not be as almighty as Fed officials believe. The FOMC has raised the federal funds rate aggressively by 525bps since March 2022. Their goal was to slow economic growth to subdue inflation. Yet the economy grew rapidly during Q3 and the unemployment rate has remained below 4.0% since February 2022. Nevertheless, inflation has moderated significantly since last summer,” Yarden Research wrote in the note.

According to the consultancy, inflation may have been a transitory problem caused by the coronavirus pandemic and that labour shortages may have stimulated “a productivity growth boom”. The report added, “Maybe retiring Baby Boomers are saving less and spending more”.

Those born between 1946 and 1964 during the mid-20th century baby boom are often referred to as baby boomers.

It said, “Perhaps, the Fed's Phillips Curve model is flawed. Solid economic growth is disinflationary rather than inflationary if it is productivity-based”.

Also read: Money will flow to India, things will keep improving, present investment opportunities: Ed Yardeni

The analysts said that even the credit markets aren't following the Fed's game plan.“Today's Senior Loan Officer Survey (SLOOS) showed that credit conditions actually eased a bit in October's quarterly survey… Last week's plunge in bond yields also eased credit conditions raising some concerns that the Fed may have to raise the federal funds rate if the Bond Vigilantes stop doing their heavy lifting in the bond market,” they wrote.

Coined by Yardeni in 1983, bond vigilante is a term used for investors who sell bonds to reduce their price and raise the yields.

Given all this, the consultancy expects the Federal Open Market Committee (FOMC) “to remain on pause” and to conclude that “growth isn't inflationary after all, but rather disinflationary because productivity is making a comeback”.

“That's our story, and we are sticking to it,” they wrote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.