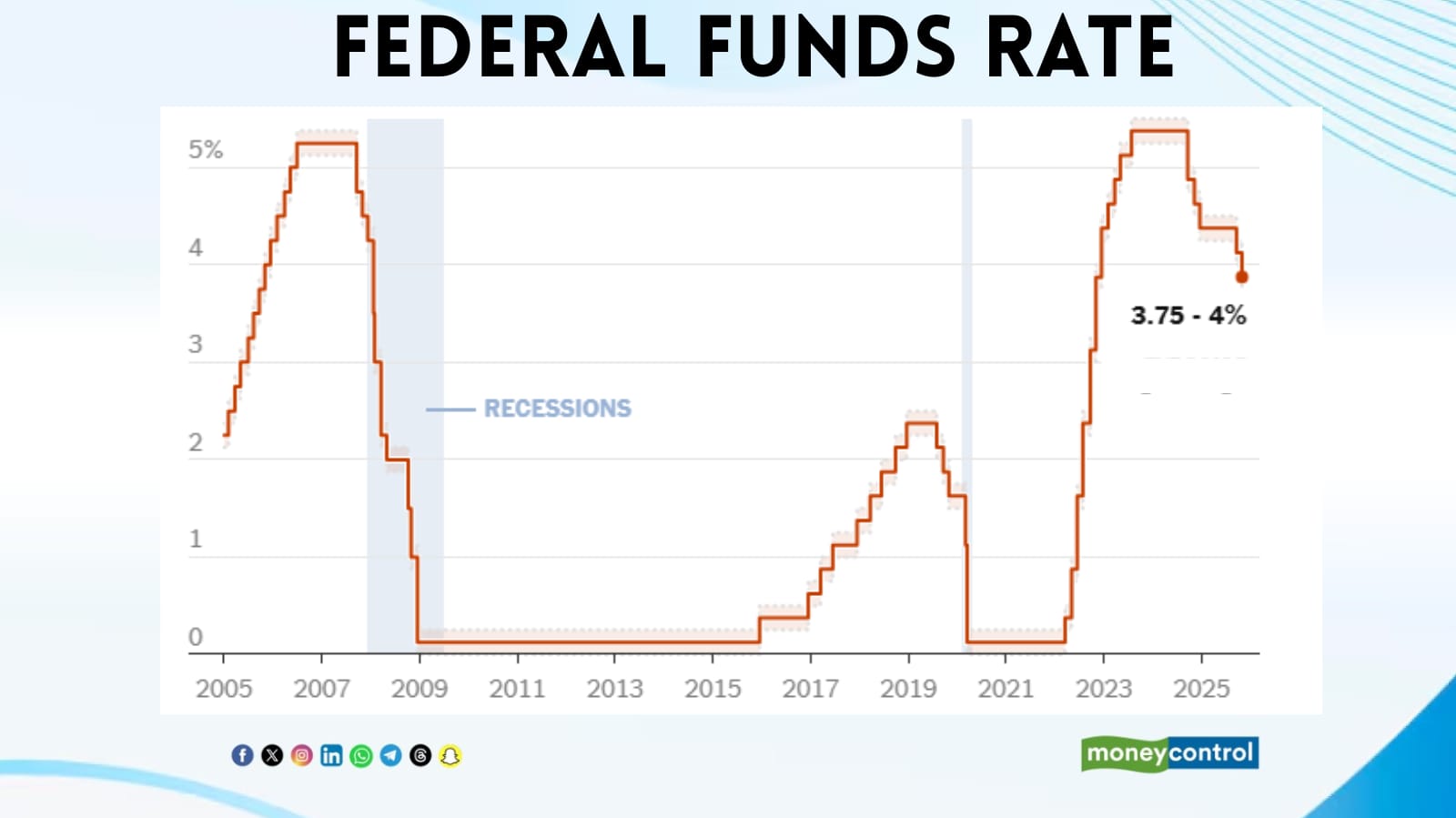

The U.S. Federal Reserve trimmed the benchmark lending rate by 25 basis points on October 29, in a widely expected move. The overnight lending rate is now in a range between 3.75 percent to 4 percent.

Available indicators suggest that economic activity has been expanding at a moderate pace. "Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated," said the central bank.

Further, the Federal Reserve signalled an end to quantitative tightening, which could help improve liquidity in the financial system and support easier credit conditions. "Uncertainty about the economic outlook remains elevated," it added.

Voting for the monetary policy action were 10 members, including the Chair and Vice Chair.

Voting against were 2 members, as one favored a deeper 50 basis points cut, while the other preferred no change to the current rate range.

The central bank trimmed its lending rate for the first time since December 2024 in its previous meeting. Going ahead, the market is pricing in another cut of 25 basis points in the next meeting, which would lower the key rate to the range between 3.5 percent to 3.75 percent.

Core inflation in the U.S. has held steady at 3 percent for three consecutive months, roughly 100 basis points above the Federal Reserve’s 2 percent target, leaving limited room for dovish policymakers to push for further easing. However, a rise in unemployment claims and signs of labour market weakness have bolstered arguments for additional rate cuts to support the slowing economy.

The ongoing government shutdown since October 1 has further complicated the Fed’s assessment, delaying key economic data releases, including official unemployment figures. The most recent data, from August, showed an unemployment rate of 4.3 percent.

However, the American labor market remained mired in its low-hiring, low-firing doldrums through September, though the economy "may be on a somewhat firmer trajectory than expected," Federal Reserve Chair Jerome Powell had said earlier this month. He noted that policymakers will take a "meeting-by-meeting" approach to interest rate cuts as they balance job market weakness with above-target inflation.

Accordingly, the CME Group’s FedWatch tool noted that 98 percent expected a 25 basis points cut in the October meeting, while 3 percent saw no cuts in the meeting. By the December meeting, 85 percent of the participants expect a 50 basis points cut, while 14 percent see a cut of only 25 percent. A small fraction expect the Federal Reserve to maintain status quo.

Follow our live blog on the U.S. Federal Reserve for all the updates

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.