Financial freedom is not about getting rich quickly. It is about taking control of your finances and reducing financial stress from your life.

There is no “one-size-fits-all” formula to achieve financial freedom. For ease of understanding, let’s divide our lives into “Earning Age” and “Retirement Age”.

In absence of an adequate social security umbrella, retirement is a more serious problem than most people think. Most of retirees finish off their retirement savings quite early and depend on their children or close relatives for financial needs.

During the Earning Age you go through various life events like buying a house, children’s education, family lifestyle maintenance, children’s marriage funds, holidays, pursuing your passion, etc.

Financial decisions across your life cycle can cause tremendous anxiety and stress either due to insufficient savings or erosion in the value of saved money due to inflation.

Inflation is like a termite, it eats into your savings and reduces your purchasing power. The solution to all these problems lies in the seeds you sow during your Earning Age.

Hence, it is important to understand the basics of financial planning - understanding your risk profile, defining needs & financial goals, and creating an asset allocation strategy suitable to your age and risk-taking capacity.

This may sound boring but, financial discipline will go a long way to help in your wealth creation journey.

Here are a few finance-related psychological & behavioural mistakes people often make:

1. Don’t Save. Excuse – I don’t earn enough, my expenses are high, I am not left with enough to save.

2. Don’t have a Budget. Excuse – I know my income and expenses, preparing and reviewing the budget every month is a futile exercise.

3. Postponing Investment. Excuse – My income is limited and investment requires lot of money. I will start investing after settling in life or paying off my loans etc.

4. Trying to time the market. Excuse – Markets are crashing and will go down further. I will invest when markets bottom out.

5. Seeking Safety. Investing all your money in bank FD’s gives low post-tax returns unable to beat inflation.

6. Seeking instant gratification. Looking for fast returns in short term through excessive speculation – a surefire way to lose money. Avoiding long-term planning and investing, as its boring, tiring and less exciting.

You can have excuses or you can have wealth, you can’t have both!! What’s your excuse?

Money is unlimited but time is limited, so becoming financially independent as quickly as possible should be your top priority. Let’s look at some simple yet powerful idea’s to help you reach your financial Mt. Everest faster:

1. Have adequate investments in Equity (either directly through equity shares or in-directly through equity mutual funds, PMS based on your preference) to harness the power of compounding. Equity has the potential of giving 12% compounded returns in long term (NIFTY has given 13.66% CAGR in 5 years as of 30th June’21).

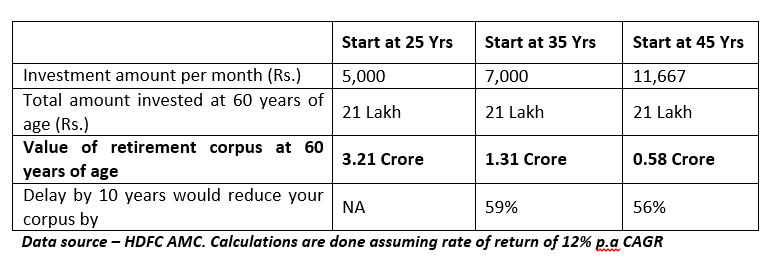

2. Start investing in Equity early, from a young age. The magic of compounding can help you build exponential wealth at a much lesser capital. Delaying investments has an opportunity cost (see illustration).

3. Use SIP (Systematic Investment Plan) to benefit from rupee cost-averaging through staggered investing. SIP’s can help you get started with small investment amounts, build financial discipline and a mindset of long-term investing, manage market volatility and overcome the emotional and psychological biases mentioned above.

4. Diversify your portfolio based on your asset allocation strategy. For example - 60% Equity: 30% Debt: 10% Gold ratio. Within Equity, diversify between Indian equities and international equities. Further diversify between large-cap, mid-cap & small-cap equity based on your return expectations and risk-taking capacity.

Key points while investing in any asset class is risk, returns, liquidity, and taxation. There are so many products in the market that choosing the right product suitable to your needs and goals could be overwhelming. Having a good financial advisor can always help.

Insurance is your safety belt harness while climbing the financial Mt. Everest. Adequate health and life insurance are a must to help you absorb unexpected shocks.

A family floater health policy using base policy + super top-up can save you from expensive hospitalization cost in critical times. A term life cover equal to 10 to 15 times of your annual income along with suitable riders will help you in securing your family’s financial needs in your absence.

We are seeing the emergence of alternative assets like VC, PE, Angel Investing and Crypto’s. Family Trust-based tax-efficient frameworks for Succession Planning and many other sophisticated vehicles for managing wealth in HNI / Ultra-HNI space are in vogue. These could also be explored and considered in your wealth planning & creation journey.

(The author is Head – Investment Products at Prabhudas Lilladher)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.