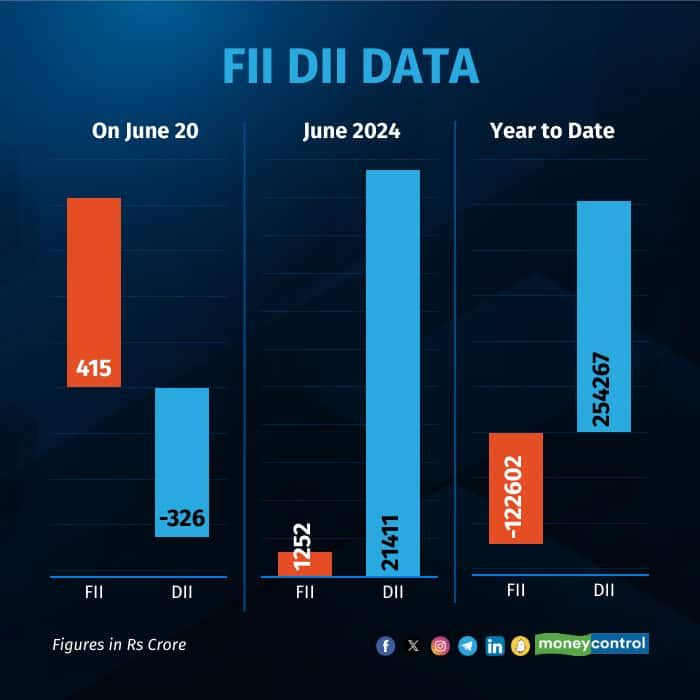

On June 20, FIIs/FPIs net bought equities worth Rs 415 crore while Domestic Institutional Investors (DIIs) net sold equities worth Rs 326 crore.

According to provisional data from the exchanges, FIIs bought Rs 16,277 crore and sold Rs 15,862 crore. Meanwhile, DIIs picked up Rs 12,564 crore in shares and offloaded equities worth Rs 12,890 crore in the session.

In the year so far, FIIs have net sold shares worth Rs 123,439 crore, while DIIs have bought shares worth Rs 232,530 crore at the same time.

In the year so far, FIIs have net sold shares worth Rs 123,439 crore, while DIIs have bought shares worth Rs 232,530 crore at the same time.

Also read: Taking Stock: Sensex, Nifty close higher amid volatility; metal, realty sectors top performers

At close, the Sensex was up 141.34 points or 0.18 percent at 77,478.93, and the Nifty was up 51 points or 0.22 percent at 23,567.

Top Nifty gainers included Grasim Industries, Hindalco Industries, JSW Steel, Adani Ports and BPCL, while losers were Hero MotoCorp, Sun Pharma, M&M, NTPC and Wipro.

While selling was seen in the auto, pharma and PSU Banks stocks, while buying was seen in the metal, capital goods, realty and oil & gas sectors.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services notes that on the domestic front, the market is consolidating with a positive bias amid strong FII flows and healthy macros. "An expectation of a growth-focused budget is aiding sentiments and is likely to lead to sector-specific action. On the global front, all eyes will be on the BOE rate decision," he added.

In the year so far, FIIs have net sold shares worth Rs 123,439 crore, while DIIs have bought shares worth Rs 232,530 crore at the same time.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.