With retail inflation softening to 69-month lows, economists and market experts are projecting inflation for FY2026 to come in below the Reserve Bank of India's forecast of four percent.

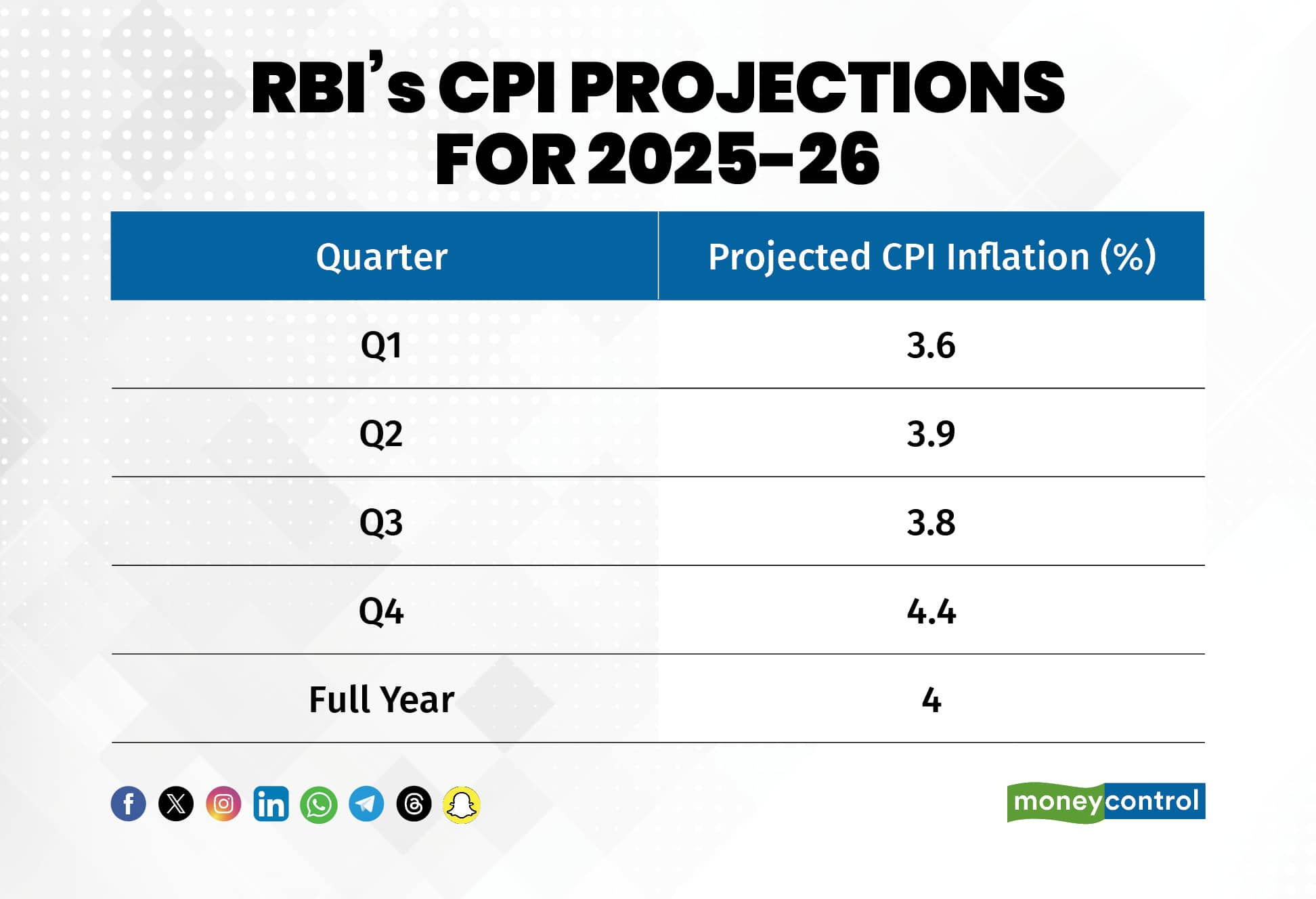

For the ongoing fiscal year, the central bank expects consumer price inflation (CPI) to clock in at four percent, with the print projected to be at 3.6 percent for the three months ended June 30, 2025.

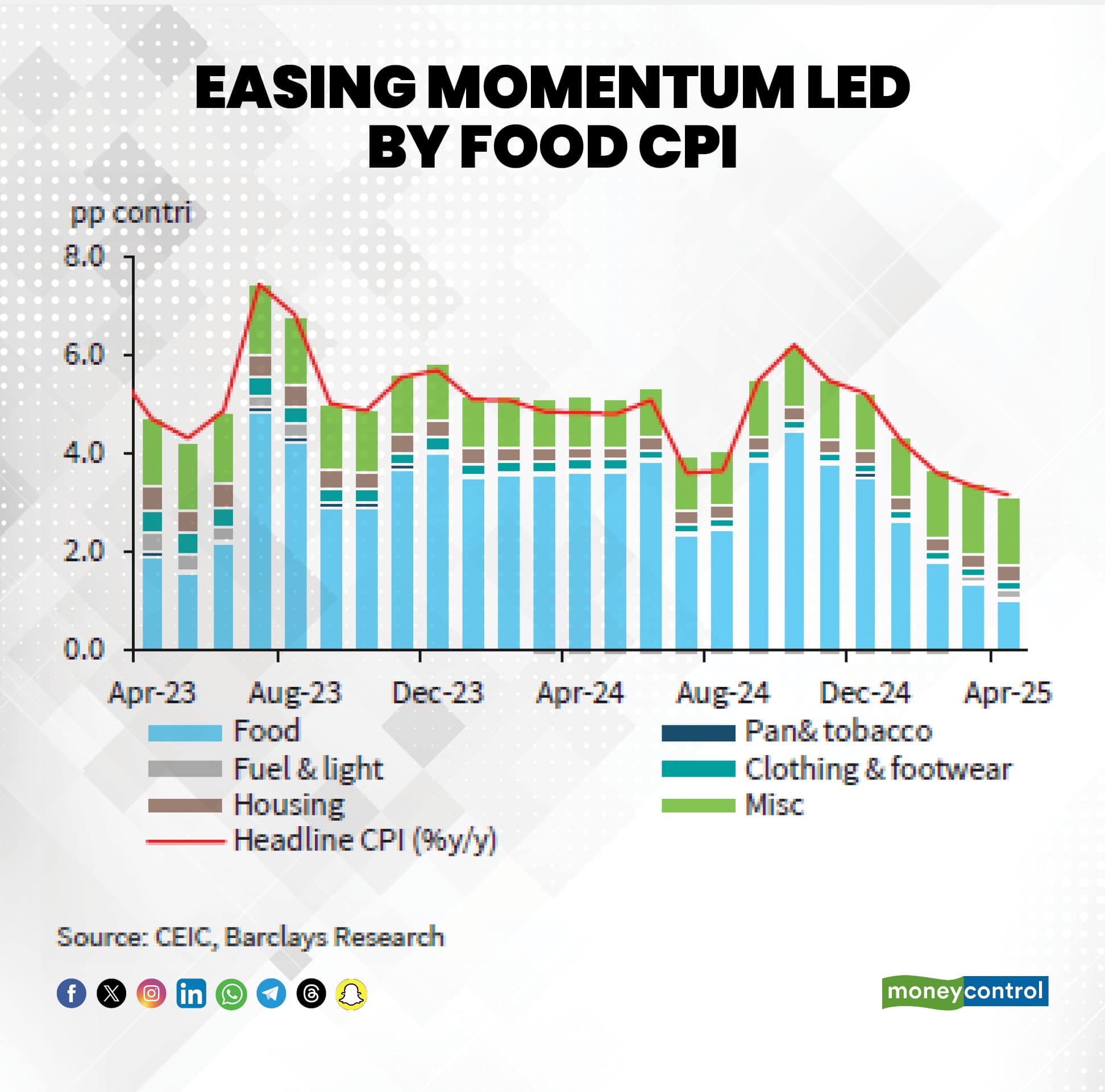

In April, the cooling inflation was led by moderating food inflation, especially degrowth in vegetable prices, which contracted for a fourth consecutive month. Vegetable inflation deepened to -11 percent YoY in April from -7 percent in March, contributing significantly to the easing of overall food inflation, which softened to 2.1 percent from 2.9 percent in the previous month, noted Nuvama Institutional Equities' analysts.

Going ahead, favourable weather conditions in the form of La Nina and above-normal monsoon expectation should aid food prices in the near term, which in turn will lead to easing inflation.

"Lower food prices should pass-through to core inflation as well. With domestic demand still subdued and given the possible tariff-led domestic deflationary impulse, core inflation also has downside risk," said economists at Emkay Global.

"We are currently tracking May headline inflation at 3.2-3.3 percent, with prices of cereals, pulses, and vegetables easing further. RBI’s headline CPI forecast for Q1FY26 (3.6 percent) has downside risk of 30-40 bps if the current price trends continue," said Emkay Global.

With inflation for April coming in at 3.16 percent, with May tracking at around three percent so far, analysts from Barclays Research expect the CPI inflation for June to average around 3 percent on-year, lower than the MPC's forecast for the quarter, with food prices expected to cool further.

Domestic brokerage JM Financial concurred. With deflationary forces evident in the latest retail prices until May 11, and the IMD's above-normal monsoon forecast supporting food price, the brokerage said there is a downside risk to RBI’s 3.6 percent projection for 1QFY26 by around 20bps.

Emkay projected a similar downside to RBI's estimates for the full year. "We estimate FY26 headline inflation at 3.7-3.8 percent, with possible downside comfort if current food price trends continue."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.