Akansha Singh

When you wake up in the morning, what’s the first thing that you do? Most of us check messages and emails on our phones, which are probably made by Apple, Oppo or Samsung.

Our mornings are kickstarted by coffee, probably provided by Nescafe. During the day, we conduct meetings on Zoom or Microsoft Teams. Our interaction with friends and family is through WhatsApp or Facebook.

These companies have become an indispensable part of our daily lives and are changing the way we live. They have gained a significant foothold in most parts of the world and are some of the fastest-growing companies.

Indian investors can only be a part of this growth through international investing. We look at why international investing is likely to benefit Indian investors.

Larger and profitable opportunity set

Indian investor interest in domestic equity has been rising over the past few years. The number of individual Indian investors in the market increased by 14.2 million in FY21, with 12.25 million new accounts at the Central Depository Services (India) Ltd. and 1.97 million at the National Securities Depository Ltd., according to a report by the State Bank of India.

This will enable these investors to participate and benefit from the growth of Indian companies.

However, India accounts for a small percentage of the overall global market capitalisation. As per Bloomberg data for May 2021, India accounted for a little less than 3 percent of the global market capitalisation. The US leads the pack with a 42 percent share, followed by China at 10 percent and Hong Kong at 6.2 percent.

These numbers emphasise the size of the opportunity set available for equity investing outside India.

As per Fortune magazine’s Global 500 for 2020, which ranks companies by their revenue-generating capability, only eight Indian companies make the cut. Reliance Industries, which tops the list of Indian companies in the Global 500, is in the 96th spot.

The largest companies of the world, which invariably are market leaders in their sectors, can be accessed only through international investing.

Chance to invest in new-age businesses

The representation of new-age businesses such as technology, healthcare (including pharmaceuticals and healthcare services), media and communication services is low in the representative Indian benchmarks.

Globally, these sectors constitute a much larger piece of the investable market. For example, the combined share of these new-age sectors in the NSE 500 (a broad-based index representative of the investment opportunities available in India) is 21.62 percent, whereas they constitute more than 41 percent of the MSCI All Country World Index, which is a benchmark representative of the global equity investable universe.

With the pandemic further highlighting the importance of these sectors, they are now an essential part of an investor’s portfolio. Yet, most cutting-edge opportunities for investing in these sectors lie in markets outside India.

Participate in earnings of trendsetter companies

Companies such as Facebook, Netflix, Amazon, Google and many more are rapidly changing the world as we know it.

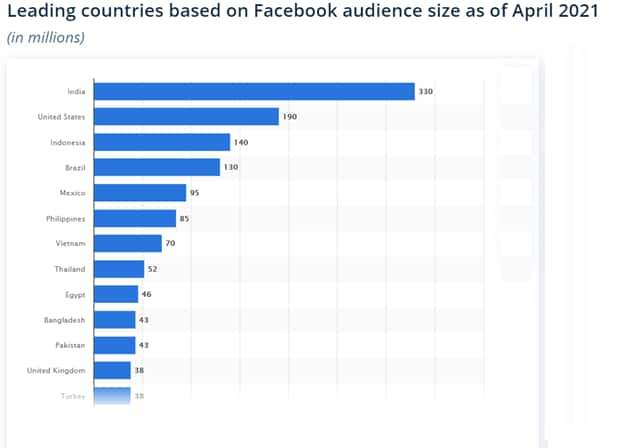

Although they have a global footprint, Indians are a large – sometimes the largest – group contributing to their growth. For example, as of April 2021, Indians were the largest audience for Facebook at 330 million users, which is much larger than the US audience, which was 190 million.

As another example, consider that Indians as a group have 95.45 percent of their desktop search traffic originating from Google (October 2020).

While Indians make a significant contribution to the revenue growth of these companies, it is not possible for them to participate in their earnings without international investing.

Benefit from innovation

There is a growing school of thought that links innovation – both product and financial – as a driver of investor wealth creation. Innovative products and services are often responsible for the disruption of established business models and creation of new markets where disproportionate revenue-generating capability lies with the disruptors.

As a result, such disruptors often emerge as global market leaders. Consider Netflix, which in the late 2000s switched its business model from renting out DVDs by mail to a video-streaming service, which changed the way millions of people spend their free time.

Although many service providers followed in this sector, Netflix remains the leader by a wide margin. The rise in its subscriptions, especially outside the US, has led to significant wealth creation for Netflix investors over the years.

As per the 2020 ranking of the Global Innovation Index, India ranks 48th, whereas the top spots go to several European countries and the US and has remained so for the past few years. To benefit from the innovation culture in these countries, it is important for Indian investors to diversify globally.

To sum up, the world represents a much wider spectrum of wealth-creating assets, which are pushed on by different factors.

While there were few opportunities for Indian investors to participate in this growth until a few years ago, with the help of the Reserve Bank of India’s initiatives such as the Liberalised Remittance Scheme and the increasing availability of overseas fund-of-funds offered by mutual fund houses, participation in global growth can now be done easily.

With a plethora of opportunities that international investing opens up, there is a compelling case for Indian investors to start allocating a certain portion of their portfolio – say 10 to 15 percent – to the global markets.

(The author is Associate Director – Managed Portfolios, Morningstar Investment Adviser India)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.