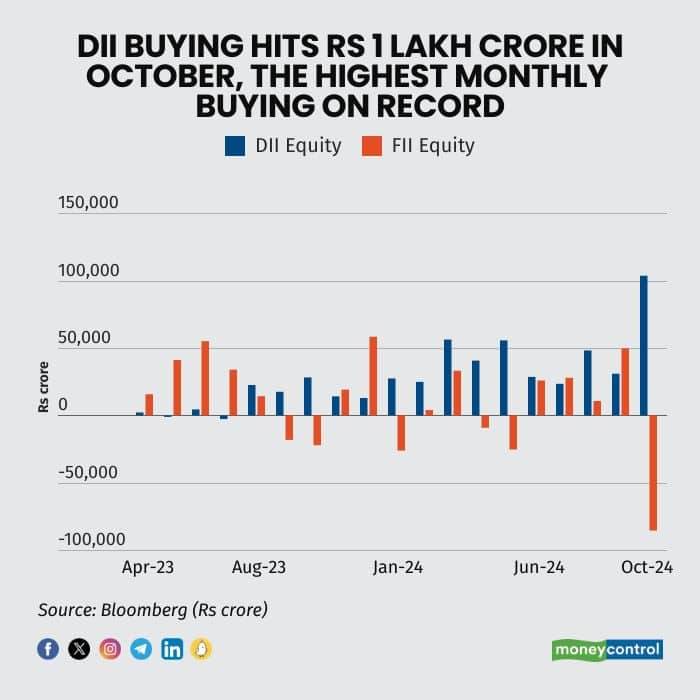

Domestic Institutional Investors (DIIs) invested over Rs 1 lakh crore in Indian equities in October, marking their highest monthly purchasing on record. This sustained DII activity comes even as foreign institutional investors (FIIs) continue to sell with their outflows totalling Rs 85,000 crore ($11 billion) during the month.

DII investments in 2024 have been around Rs 4.41 lakh crore with two more months to go.

The recent DII data indicates a structural shift toward equities, driven by growing retail participation through mutual funds. This trend is expected to support high valuations and provide market stability despite fluctuations amid FII activity, say market experts.

“DII inflows are a result of SIP contributions alongside insurance and retirement fund flows. While net SIP inflows might slow, retirement flows are likely to remain strong and continue to grow. This could be seen as India's 401(k) moment, where domestic flows will keep rising and counter FII outflows,” said Ritesh Jain, Co-founder of Pinetree Macro.

Previously, the highest recorded monthly DII inflows were registered in March 2024, at approximately Rs 56,356 crore. Other notable months for DII investments include May 2024, with over Rs 55,740 crore; March 2020, with around Rs 54,857 crore; and May 2022, with inflows exceeding Rs 49,400 crore.

Amit Kumar Gupta, founder Fintrekk Capital, a SEBI-Registered Research Analyst said DII inflows have been there for the last four years. This year, apart from SIP book, which has been 3x since last four years, we had multiple sectoral NFOs as well leading to flows, he said.

Going ahead, analysts said Nifty may remain flat to mild positive (0-5%) till next Samvat. Corporate earnings, after four consecutive years of healthy double-digit growth, are moderating due to pressures from commodities and fading tailwinds from BFSI asset quality improvements.

Despite the challenges, the ongoing festive season, better-than-expected monsoon, and consequent pick-up in rural consumption provide near-term catalysts. Major global central banks, including the US Fed, have pivoted towards a monetary easing cycle. This shift implies a favourable environment for risk assets. Consequently, markets appear to be experiencing a genuine tug-of-war between the headwinds and tailwinds, analysts added.

Meanwhile, FIIs continued their heavy sell-off, divesting over Rs 85,390 crore, according to NSDL data, amid geopolitical tensions and elevated valuations in Indian equities. Sentiment was further dampened by weaker-than-expected September quarter earnings and a pivot towards Chinese markets following government stimulus measures there.

This marked a record-breaking month for FII outflows. Previous significant sell-offs include March 2020, with FIIs offloading Rs 62,433 crore, followed by June 2022 and February 2022 with sales of Rs 49,468 crore and Rs 37,689 crore, respectively.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.