The underperformance of PSU stocks has made them attractive from a valuation point of view and brokerages believe select players from the sector offer good risk-reward.

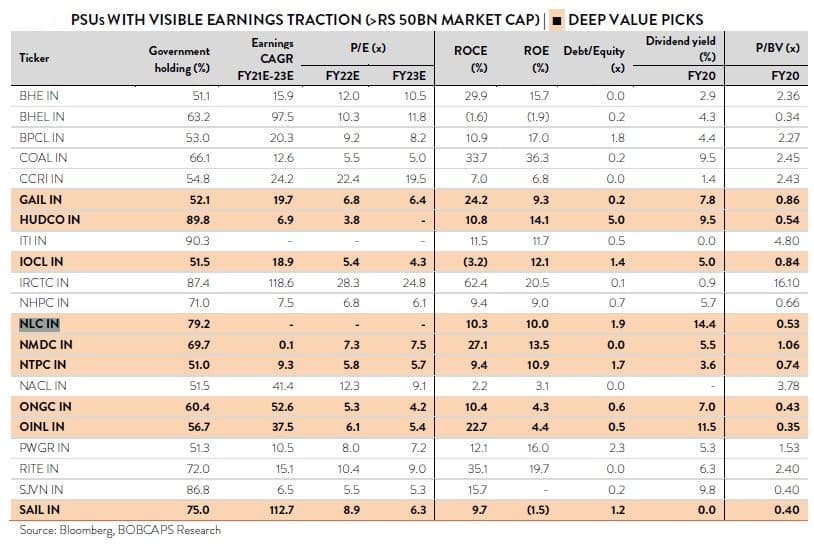

"From a valuation perspective, many of over 70 listed central government-owned enterprises look attractively priced on both P/E and P/BV parameters, while also offering attractive dividend yields. PSUs in the cyclical business, especially oil, offer attractive risk-reward," said brokerage firm BOBCAPS in a note on November 20.

BOBCAPS said it excluded the financial sector from its analysis considering the limited scope for any corporate action (especially buybacks) in the current environment.

The brokerage firm underscored that PSU stocks have had a most forgettable year in 2020, with the Nifty PSE index declining about 30 percent since January 2020.

"Average P/E for some Navratna PSUs has shrunk to less than seven times on FY22E despite a robust earnings outlook. The rationale for buybacks emerges from the deep discount on valuations. While the HPCL

buyback sets the right tone for reviving PSUs valuations, BPCL’s divestment could lend an impetus to the rerating momentum," BOBCAPS said.

The brokerage firm is of the view that the government’s divestment target of Rs 2 lakh crore for FY21 would need most PSUs to trend much higher than the current value, whether it explores strategic divestment (BPCL, Concor, Air India) or fundraising through secondary markets (ETFs, IPOs).

BOBCAPS sees PSU cyclicals such as GAIL, HUDCO, NLC, Indian Oil, NMDC, NTPC, SAIL, Oil India, and ONGC as ideal picks for the near term.

PSU stocks have been under pressure and have witnessed significant price erosion since the coronavirus outbreak.

Jyoti Roy- DVP- Equity Strategist, Angel Broking, said one of the reasons for underperformance could be that the market expecting an additional supply of stocks.

"One of the biggest problems with PSUs is that there has been a continuous supply of shares by the government in the past as it looks to raise additional resources through the sale of shares in order to make up for any shortfall in tax collections," Roy said.

The trend would continue and may keep a lid on valuations in the near future, Roy said.

However, given the positive sentiments in the market, Roy said there was a possibility of a rally in PSU stocks given beaten down valuations in pockets.

"We believe that any such rally in the PSU space would be tactical in nature and investors could use the rally for tactical purposes," he said.

Vinit Bolinjkar, Head of Research, Ventura Securities, said the government had ordered all the PSUs to pay higher dividends (pushing for quarterly payouts) to bridge the fiscal deficit.

Most PSUs were at their multi-year lowest valuation and could offer a very high dividend yield of 9-12 percent, he said.

As per Bolinjkar, HPCL and Indian Oil were trading at their 10 years lowest valuation (HCPL and BPCL at FY22 EV/EBITDA of 4.7 times and 5 times, respectively), while BPCL was at a premium valuation of 8.7 times (FY22 EV/EBITDA) over HPCL and Indian Oil due to its divestment process, but was still lower than the valuation of private refiners. Other PSUs such as BHEL, GAIL, BEL and Rites were trading at a discount of 20-30 percent to the valuations of their private counterparts.

"Few of these companies are leading names in their respective sectors and with the revival of the Indian economy, they are expected to perform better. Lucrative dividend yields could also attract investments in these PSU stocks, which could also provide a better chance for capital appreciation," Bolinjkar said.

Analysts emphasise that depressed valuations cannot be the trigger to go for a hectic buying.

Gaurav Garg, Head of Research, CapitalVia Global Research, said even though the majority of the shareholding was with the government, one cannot follow the strategy of buy and forget in PSU stocks.

"Budget plans, financial deficit, government policies and government disinvestment plans are key events to watch out for if one holds PSU stocks. Any such policy announcement by the government can impact the stock performance," Garg said.

The government gets huge dividends from these companies and hence the opportunity for growth is limited because of the lack of reinvestment of profits. These companies pay a significant proportion of their PAT as dividends.

"One should consider all these factors before investing in a PSU. Before choosing the company for investment, choose the right sectors and company, as history says not many PSUs multiplied the wealth of investors," Garg said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.