India’s defence sector rally is being driven more by long-term structural tailwinds than short-term war sentiment, say analysts, even as geopolitical tensions such as the Israel-Iran conflict coincide with market momentum. While defence stocks have surged recently, experts caution that this is not a broad-based move, and that investors should focus on fundamentals amid continued concerns on higher valuations.

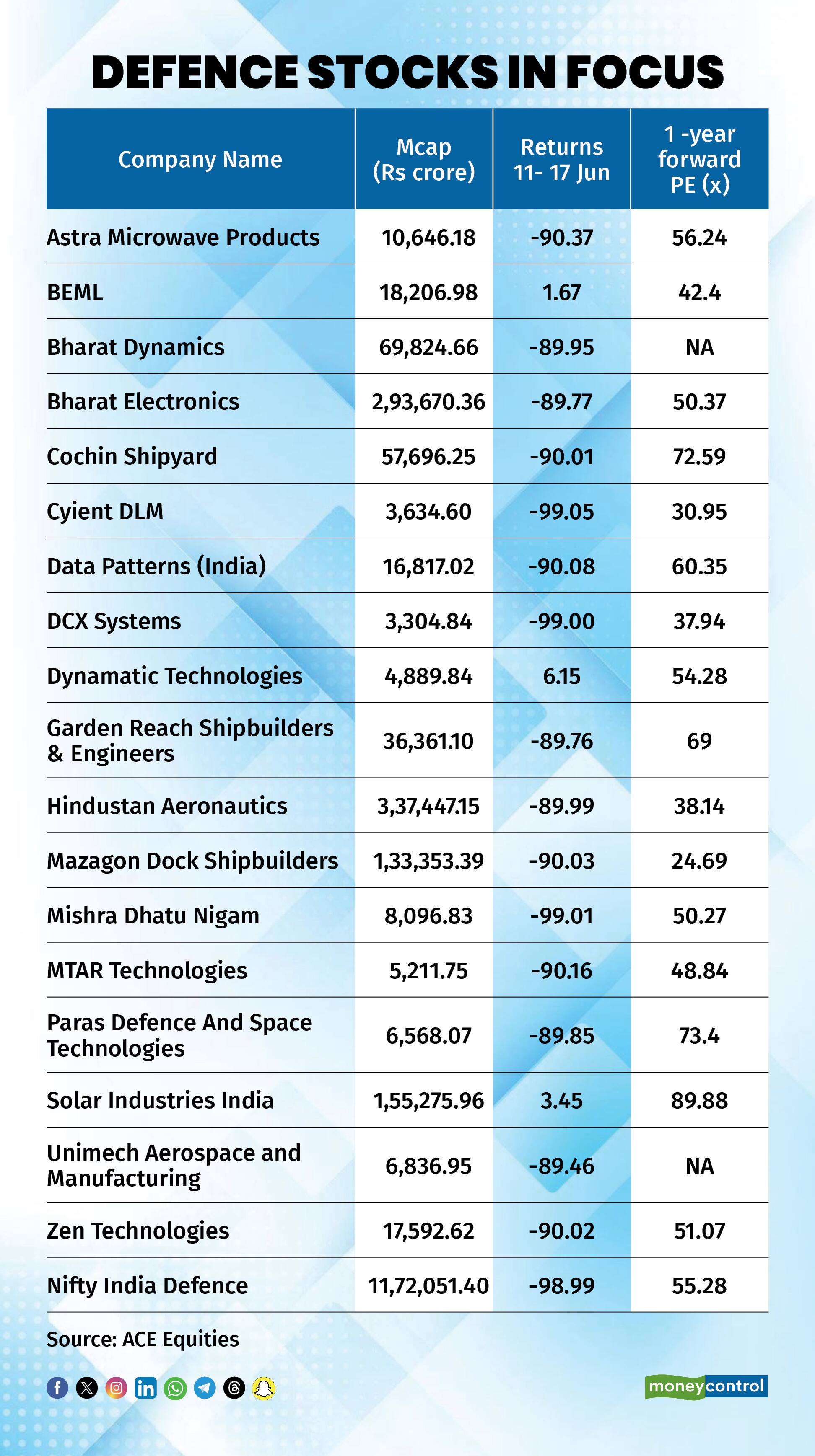

On June 17, defence stocks rallied around 5 percent, with the Nifty Defence Index rising approximately 0.38 percent. Over the last four sessions, several key defence players posted strong gains. Since June 13, the biggest gainers have been Unimech Aerospace and Manufacturing (5.39 percent), Dynamatic Technologies (6.15 percent), Bharat Electronics (2.25 percent) and Garden Reach Shipbuilders and Engineers (2.44 percent).

However, not all defence stocks participated equally. Astra Microwave Products Ltd., Cyient DLM Ltd., DCX Systems Ltd., Mishra Dhatu Nigam Ltd., MTAR Technologies Ltd., Mazagon Dock Shipbuilders Ltd., and Zen Technologies Ltd. witnessed slight declines or only marginal movements.

Harshit Kapadia of Elara Securities suggests the market reaction to the Israel-Iran war is likely misplaced. “I don't think there is a direct relationship through which India can benefit from the Israeli-Iran war. The recent rallies in the market don’t seem warranted by this conflict," he says adding that if the market is looking at it from that perspective, it's likely misreading the situation.

Nirav Karkera, Head of Research at Fisdom concurred. He says, “This is part of a structural tailwind and not an event-specific development. Of course, it coincides in timelines, but there’s no real correlation between the two.” While sentiment appears strong, the rally is not uniform.

“While people talk about the entire defence pack moving, it’s actually selective,” he says, adding that a few index constituents with heavier weights are moving. Market breadth in the defence pack is narrower than in other sectoral indices.

Macro push and strong order bookChethan Shenoy, Executive Director & Head - Product & Research, Anand Rathi Wealth Limited noted that the recent rally has been fuelled by a combination of factors including increased government spending on defence modernisation, favourable policy initiatives such as Make in India and Atmanirbhar Bharat, and heightened geopolitical tensions, which have collectively boosted sentiment in the sector. The sector, he noted, is also extremely sensitive to macro events whether geopolitical tensions, defence deals, or policy announcements. "Sharp rallies like the current one have been seen in the past too, often followed by periods of consolidation or correction when sentiment normalises," he says.

Amit Anwani, Senior Research Analyst, Prabhudas Lilladher adds, "Post Operation Sindhoor, there was a sentimental move in the stocks. From the recent lows, some of these names have gone up 40–50 percent. And after 4–5 months, we also saw lump-sum orders being cleared by the Ministry. For instance, we saw the helicopter order ( a Rs 62,000 crore to buy Made-In-India Attack helicopters from HAL) and other clearances come through. That’s meaningful traction in terms of defence order flows, especially for HAL. Bharat Electronics also mentioned significant pipeline visibility which could mean additional Rs 30,000 crore-plus QRSAM opportunity. ( Quick Reaction Surface-to-Air Missile system)"

Indigenisation and export focusKarkera adds that indigenisation efforts and domestic CAPEX are providing structural support. “Imports not just of equipment, but also defence systems and spares are increasing. Indigenisation is taking centre stage. There’s also a spillover tailwind from the budget’s focus on defence and the PLI scheme for manufacturing,” he says.

Experts add that there has also been talk of the government increasing defence exports to Rs 50,000 crore, from the current Rs 24,000 crore and aiming for Rs 29,000 crore–Rs 30,000 crore.

Anwani noted, “There is rising focus on exports as a key re-rating factor. Companies like BEL are expressing intent to increase their export share, and we’re seeing strong inquiry traction from friendly nations.”

Valuation remains a concernHigh valuations remain a key challenge. Anwani pointed out that there is some concern on the valuations even though the fundamentals remain intact. "For instance, HAL missed some delivery targets, but margins were very strong, and there were some upward revisions for the year. Bharat Electronics also guided for 27 percent margins, which is above my earlier estimate of 25.5 percent or so. That margin guidance was significant," he said.

Karkera, however, is more optimistic. “Valuations seem steep from a long-term perspective, but in the context of the emerging growth outlook, they make more sense. Look beyond conventional PE or PB; PEG and adjusted PEG matter more. Most EPS growth is already being factored in.” He adds that he doesn't expect this shift to play out in the near term. "Monetary transmission and capital formation take time. This is a long-gestation industry. The case for re-rating is strengthening, likely through H1 FY26," he says.

What should investors do?Kapadia advises against blanket buying. He recommends selective exposure, especially in companies with strong IP like BEL, and favours large PSUs for core allocation. “Larger PSUs will continue to take the lion’s share, while smart private players will focus on component supply,” he said.

Karkera agreed that managed strategies could be better in the current situation. “For retail investors, ETFs and MFs are more effective than DIY approaches. It’s easy to get swayed by momentum, but bottom-up stock selection is critical now.”

Shenoy suggests that investors should diversify via broad-based equity funds. “Market-cap and strategy-based funds help reduce concentration risk and ride across cycles. Diversification is crucial when a rally is not broad-based," he says.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.