In the December quarter, big churn was witnessed in investments in banks (both private and PSU banks), OMCs, metals, NBFCs, consumer and FMCG space by major institutions, Edelweiss Securities said in a report.

Foreign institutional investors (FIIs), which were net sellers during the December quarter, pared holdings across banks, IT, telecom, cement as well as construction whereas they added NBFCs, consumer and gas distribution companies.

In Q3FY19 (Sep-Dec), FIIs were net sellers of about $2.97 billion equities in the secondary market while Domestic Institutional Investors (DIIs) were net buyers to the tune of $4.42 billion for the quarter, and for the CY18, the net buy by DIIs stood at a whopping $17.6 billion, said the report.

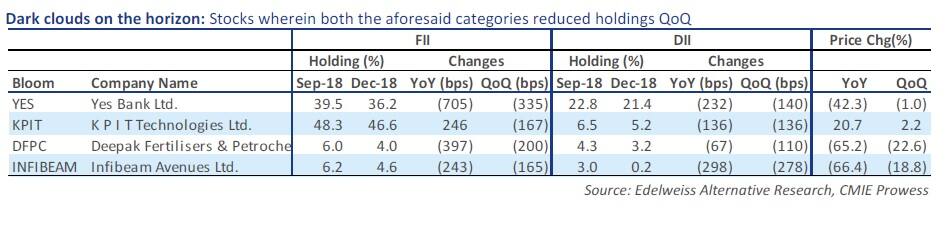

In its report ‘Dark cloud on the horizon’, the brokerage has named 4 stocks in which both FIIs and DIIs pared their holding on a quarter-on-quarter basis include names like Yes Bank, KPIT Technologies, Deepak Fertilisers, and Infibeam Avenue.

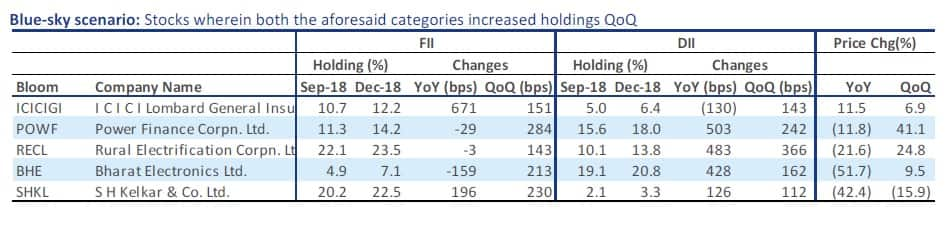

Edelweiss Securities also highlighted five stocks in which both FII as well as DIIs raised their stake sequentially. The stocks are — ICICI Lombard General Insurance, Power Finance Corporation, REC, Bharat Electronics, and SH Kelkar and Company.

In terms of individual stocks, FIIs reduced exposure in large-cap private banks such as Yes Bank, Axis Bank, ICICI Bank, and HDFC Bank. They raised exposure in stocks like IDFC Bank, IndusInd Bank while selective additions were made in Bharat Financials, LT Finance Holding, and Edelweiss Financial Services.

Domestic Institutions increased exposure to PSU & private banks, OMCs and metal names whereas reduced exposure to consumer, auto and pharma names. In the large-cap space, they added Axis Bank, and ICICI Bank. In the mid-cap IT, DIIs added NIIT Technologies, Hexaware, Persistent Systems, MindTree and InfoEdge.

Top Contra Trends according to Edelweiss Securities:

FII: increased allocation in NBFCs such as Bharat Financials (651bps), Equitas Holdings (529bps), Power Finance (284bps), L&T Finance (178bps) and Edelweiss (174bps).

Akin to Q2FY19, allocation in gas distribution continued towards Mahanagar Gas (258bps), GAIL India (213bps) and Gujarat Gas (51bps). FIIs reduced midcap IT bets in stocks like NIIT Technologies, MindTree, Persistent Systems, and Hexaware Technologies.

DII: Decreased allocation in a gas distribution such as GAIL India (200bps) and Mahanagar Gas (85bp) and NBFCs such as Bharat Financial, Ujjivan, and Equitas. Contrary to FIIs, DIIs added midcap IT names.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.