The market shed nearly 2.7 percent during the week ended September 26 after more than 4 percent rally in previous three weeks, with broad-based selling pressure after US President Donald Trump significantly increasing fee on new H-1B visa applications to $100,000 and imposing 100% tariff on pharmaceutical products. FII outflow and geopolitical risks stemming from US trade actions also weighed on sentiment, which pressured the rupee, however, the gold continued to attract safe-haven demand which reached new record high of $3,824.6 per troy ounce.

In the coming truncated week, the market may see some bounce back after sharp sell-off, but overall, the sentiment is expected to remain weak amid consolidation with focus on RBI monetary policy, US jobs data, and FII flow, along with further developments with respect to India-US trade deal talks and US shutdown. The August low (24,337) will be closely watched next week.

The Nifty 50 plunged 672 points (2.65 percent) to close at 24,655, and the BSE Sensex shed 2,200 points (2.66 percent) to 80,426, while the Nifty Midcap and Smallcap 100 indices hit hard, falling 4.6 percent and 5.1 percent, respectively.

Siddhartha Khemka - Head of Research, Wealth Management at Motilal Oswal Financial Services expects the markets to remain under pressure in the near term, tracking global headwinds, key macroeconomic data, and potential development around the India–US trade talks.

According to Vinod Nair, Head of Research at Geojit Investments, investors’ attention will centre on upcoming US economic indicators, while on the domestic front, the RBI’s policy decision and industrial production figures will play a pivotal role in guiding sentiment.

The sustainability of current market valuations hinges on a visible recovery in corporate earnings and resolution of India-US trade frictions, he said.

The market will remain shut on October 2 for Mahatma Gandhi Jayanti and Dussehra.

Here are 10 key factors to watch next week:

RBI Monetary Policy

The market participants will keep an eye on the interest rate decision by the Reserve Bank of India Monetary Policy Committee (RBI MPC). Most economists expect the central bank to hold repo rate steady at 5.5 percent on October 1 as it has already frontloaded with 100 bps cut this year to support the economic growth that grew 7.8 percent in Q1FY26. The consumer inflation remained under control at 2.07 percent in August against RBI's threshold limit of 4 percent (+/-2 percent), though increasing from 1.61 percent in July 2025.

Further, according to economists, the government already announced GST rate cut to boost consumption along with tax cuts in budget, which limited the need for further policy action by the central bank which has been focussing on the transmission of previous rate cuts and global factors including intermittent Trump tariff shocks and geopolitical tensions.

The commentary post RBI policy by Governor Sanjay Malhotra, and economic and inflation projections for further quarters and full year will also be watched.

Domestic Economic Data

On the same date, HSBC Manufacturing PMI numbers for September will also be released. The manufacturing PMI dropped to 58.5 in September as per preliminary estimates, against 59.3 in August.

Further, industrial production data for August will be announced on September 29, followed by fiscal deficit numbers for August and external debt for Q1FY26 which are scheduled on September 30.

Foreign exchange reserves for week ended September 26 will be released on October 3.

US Jobs Data

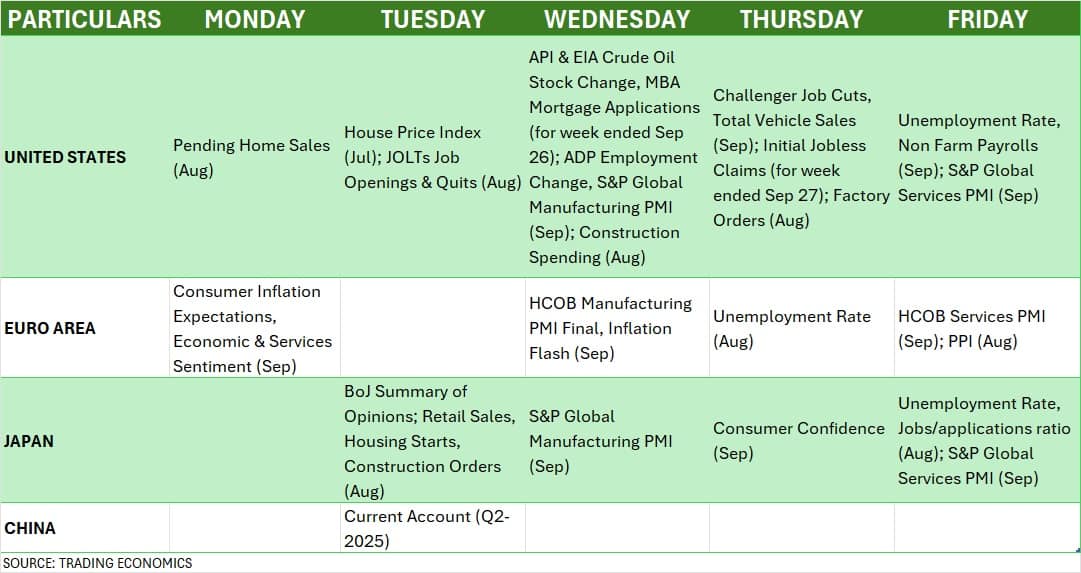

Globally, all eyes will be on the monthly US jobs data scheduled next week including unemployment rate, non-farm payrolls, Challenger job cuts and ADP employment change for September, and JOLTs job openings & quits for August, along with monthly vehicle sales and factory orders.

Jobs data is one of the critical factors for making interest rate decision by the US Federal Reserve which recently expectedly cut fed funds rate by 25 bps in September policy meeting. According to economists, unemployment rate is expected to remain steady at 4.3 percent in September compared to previous month.

Global Economic Data

Apart from US jobs data, manufacturing & services PMI numbers by several nations including Japan, European countries for September along with Europe's consumer inflation expectations and Japan's consumer confidence data for the same month will be released next week.

US Government Shutdown Update

The focus will also be on further updates with respect to US government shutdown as the date is approaching fast. The last date for the government funding is September 30. Congress needs to clear or extend a spending bill before October 1 to prevent a US government shutdown. President Donald Trump will meet with the top four congressional leaders at the White House on September 29 to avoid the government shutdown, reports NBC News.

Back home, the market participants will keep an eye on the activity at FIIs (Foreign Institutional Investors) desk as FIIs turned aggressive sellers in the last week ended September 26, offloading Rs 19,570 crore worth shares against Rs 1,327 crore worth of selling in previous week (taking total outflow to Rs 30,142 crore for current month), especially after Trump sharply increasing H-1B visa costs, and imposing 100 percent tariff on pharmaceutical products. Valuation concerns and tepid earnings growth also caused FIIs outflow.

DIIs (Domestic Institutional Investors) buying has been playing supportive role for the market but FIIs selling has been capping major upside in the market, in fact, keeping the market away from its record high for a long period now.

In the passing week, DIIs failed to compensate the aggressive FIIs outflow, buying Rs 11,827 crore worth shares, taking the total net purchases to Rs 55,736 crore for current month.

Meanwhile, the Indian rupee saw consolidation breakout and hit a new low of 88.87 against the US dollar during the week, before ending at new closing low of 88.63, weakening 0.63 percent on week-on-week basis, while the US dollar index remained below 100 mark for several weeks now, though rising 0.55 percent for the week to 98.182.

The primary market remained strong despite pressure in the secondary market, with 21 public issues worth more than Rs 4,450 crore hitting Dalal Street next week including five - Glottis, Fabtech Technologies, Om Freight Forwarders, Advance Agrolife, and WeWork India Management - from the mainboard segment.

In the SME segment, investors will see total 16 initial public offerings (IPO) next week, which all will be launched in the first two days. Chiraharit, Sodhani Capital, Vijaypd Ceutical, Om Metallogic, Suba Hotels, and Dhillon Freight Carrier will open their public issues on September 29, while Sunsky Logistics, Munish Forge, Sheel Biotech, Infinity Infoway, Shlokka Dyes, Shipwaves Online, Greenleaf Envirotech, Valplast Technologies, BAG Convergence, and Zelio E-Mobility IPOs will be opened for subscription on September 30.

Apart from this new issues, 11 SME companies like KVS Castings, Rukmani Devi Garg Agro Impex, MPK Steels, Ameenji Rubber, Manas Polymers & Energies, DSM Fresh Foods, Bhavik Enterprises, Chatterbox Technologies, Gujarat Peanut & Agri Products, Earkart, and Telge Projects, along with three mainboard IPOs - Pace Digitek, Trualt Bioenergy, and Jinkushal Industries will close their IPOs in initial two days of next week, while NSB BPO Solutions will be available for subscription till October 7.

Meanwhile, Trualt Bioenergy, Jinkushal Industries, Jain Resource Recycling, Epack Prefab Technologies, BMW Ventures, Seshaasai Technologies, Jaro Institute of Technology Management, Anand Rathi Share & Stock Brokers, Solarworld Energy Solutions, Atlanta Electricals, and Ganesh Consumer Products from the mainboard segment will be available for trading on the BSE and NSE in coming week.

In the SME segment, the trading in Chatterbox Technologies, Gujarat Peanut, Earkart, Telge Projects, Praruh Technologies, Gurunanak Agriculture India, Justo Realfintech, Systematic Industries, Ecoline Exim, Matrix Geo Solutions, True Colors, Aptus Pharma, BharatRohan Airborne Innovations, Solvex Edibles, and Prime Cable Industries will commence on the bourses next week.

Technical View

Technically, the Nifty 50 formed long bearish candle on the daily charts after wiping out significant gains of previous three weeks, and reaching at 78.6 percent Fibonacci retracement of recent rally (24,600). The technical and momentum indicators also remained bearish. Hence, if the index decisively closes below it next week, the 24,400-24,300 (200 DEMA and August low) can't be ruled out given the rising bearish sentiment, however, on the higher side, 24,750-24,900 can act as a resistance zone, according to experts.

F&O Cues

The monthly options data indicated that the Nifty 50 is expected to be in the 24,500-25,000 range in the immediate term, with 24,000-25,500 being the broader range.

The maximum Call open interest was placed at the 25,000 strike, followed by the 25,500 and 25,100 strikes, with the maximum Call writing at the 24,800, 24,900 and 24,700 strikes, while the 24,500 strike holds the maximum Put open interest, followed by the 24,600 and 24,000 strikes, with the maximum Put writing at the 24,500, 24,600 and 24,650 strikes.

Meanwhile, the India VIX, the fear index, spiked 14.62 percent during the week to 11.43, signalling caution and discomfort for bulls.

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.