The market stayed upbeat throughout the week ended on July 14 with the Dalal Street bulls charging the benchmark indices to fresh record highs on the back of positive global cues and rotational buying across sectors.

After a flattish start, the benchmarks oscillated in a narrow range for most of the week but a strong close in the final session helped the index end higher. Consequently, the benchmark indices, Nifty and Sensex, managed to gain over a percent each to close at 19,564.50 and 66,060.90 points.

A sharp surge in the IT pack was the key highlight on the sectoral front and metal, realty and pharma also posted decent gains, though underperformance of banking stocks capped the rally. Buying continued in the midcap and smallcap space with both the indices edging higher in the range of 1.25-1.85 percent.

For the next week, most analysts believe the market may see some consolidation while earnings will dictate individual stock reaction. Global and domestic cues, FII and DII activities, progress of monsoon, and crude oil prices will be the key factors that will drive the markets in the coming days.

Let's check out the 10 key factors that will determine the market dynamics next week:

The earnings season will gather pace in the coming week and become the single largest factor in stock movement. The major announcements scheduled for the next week include CRISIL, LTI Mindtree, HDFC Bank, Tata Elxsi, IndusInd Bank, ICICI Prudential, Tata Communications, CanFin Homes, HUL, Infosys and Mphasis.

Monsoon progress

The monsoon has been revving up at a fast clip with heavy rain battering northern India, especially the mountainous region. This has led to flash floods, landslides and fatalities. Economically, perhaps the most damaging has been crisps that have been destroyed.

Traders will keep an eye on the progress of monsoon. If it continues in the same fashion, the resultant economic losses will be severe for the country, and, in turn, for companies across various sectors.

Inflation print

India’s retail inflation surpassed the anticipation with a rise for the first time in five months to 4.81 percent in June after hitting a 25-month low of 4.25 percent in May. The rise was mainly due to a surge in food prices and is expected to persist in July.

Tomato prices have become a sore point for people while other vegetables have also become costlier. Sustained high prices will likely push inflation higher sending RBI policymakers in a spot who are trying hard to bring inflation to the 4 percent level.

Yet another busy week is waiting to unfold in the primary market with two public issues to be rolled out for bidding and four listings lined up for bourses.

In the mainboard segment, high-end computing solutions provider Netweb Technologies India will open its initial public offering on July 17, with a price band of Rs 475-500 per share.

The second IPO of the next week will be Asarfi Hospital, from the SME segment. This issue will also open on July 17 and the closing would be on July 19, with a price band of Rs 51-52 per share.

All four listings – AccelerateBS India, Kaka Industries, Drone Destination and Ahasolar Technologies – will be taking place in the SME segment, while there will be no listing in the mainboard segment.

Foreign investors have been pouring money in India for several months now, and the trend continued so far in July as well. They have net bought equities worth Rs 30,660 crore in the first fortnight of the month. This marks the fifth straight month of positive inflow. Analysts believe this is the biggest positive driver for the market to keep making new highs.

Oil prices

Oil prices fell more than a dollar a barrel on Friday as the dollar strengthened and oil traders booked profits from a strong rally, with crude benchmarks recording their third-straight weekly gain. Brent crude futures settled at $79.87 per barrel, down $1.49, or 1.8 percent, while the US West Texas Intermediate crude futures fell $1.47, or 1.9 percent, to settle at $75.42 a barrel.

Next week, however, the rally could resume as easing inflation, plans to refill the US strategic reserve, supply cuts and disruptions could support the market, according to Rob Haworth, senior investment strategist at US Bank Wealth Management, who was quoted in a Reuters report.

Technical view

Ajit Mishra, SVP - Technical Research, Religare Broking, said the performance of the banking and IT pack would largely dictate the trend going ahead. A decisive close above 31,600 in the Nifty IT index and sustainability above 44,500 in the Nifty Bank would further fuel the momentum.

"As Nify has ended a week-long consolidation phase, it now looks set to test 19,750 and eventually march toward a new milestone of 20,000. In case of a decline, 19,100-19,3000 would provide the cushion. Participants should align their positions accordingly while maintaining their focus on stock selection and risk management,” he added.

F&O Cues & India VIX

Option data clearly indicated that 20,000 can be a possibility for the Nifty in coming weeks, but in near term, 19,600-19,700 can act as a resistance area, while the 19,500-19,300 is expected to be support area.

The maximum weekly Call open interest was at 20,000 strike, followed by 19,600 and 19,700 strikes, with Call writing at 19,800 strike, then 20,100 and 19,700 strikes. On the Put side, the maximum open interest was at 19,500 strike, followed by 19,400 and 19,300 strikes, with Put writing at 19,400 strike, then 19,500 and 18,900 strikes.

India VIX, which measures the expected volatility for the next 30 days in the Nifty50, dropped by 2.33 percent from 10.94 to 10.68 levels, the lowest level since December 2019. Low VIX means low volatility thus making the trend more favourable for bulls.

Global markets

Global markets have also been rallying keeping the morale high in the domestic market. For the last week, the Dow was up 2.3 percent, the S&P 500 gained 2.4 percent and the Nasdaq 3.3 percent. The S&P 500 remains up 17 percent for the year to date.

The positive tone of the US market is also helping in keeping the upward bias and a breakout above 34,600 in the Dow Jones Industrial Average (DJIA) will further boost the sentiment, said Mishra.

Here are key global economic data points to watch out for next week:

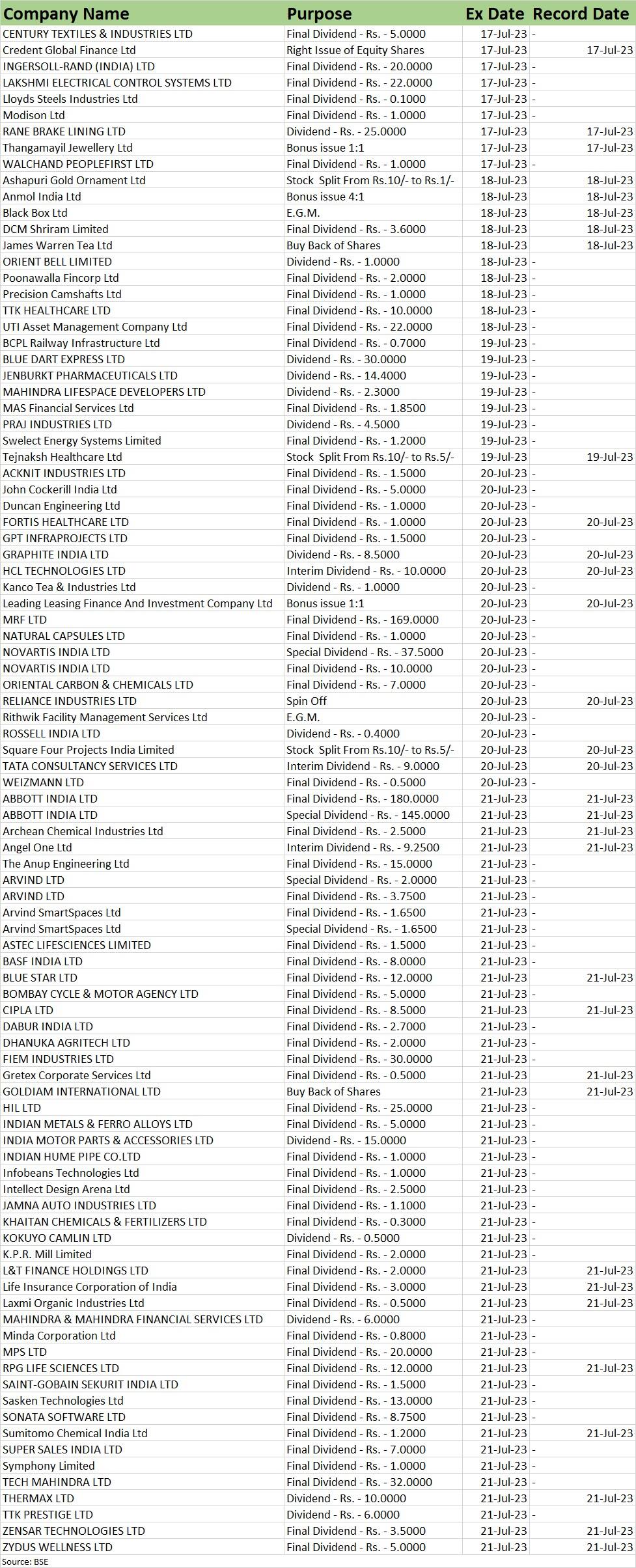

Corporate Action

Here are key corporate actions taking place in coming week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.