The market clocked moderate gains despite selling pressure in the later part of the week ended April 25, rising 0.8 percent and continuing its upward journey for the second consecutive week.

Positive cues from the India-US bilateral trade agreement, newsflow of some softness in the US-China tariff war, and renewed buying interest from FIIs, along with subdued oil price, supported the market sentiment. However, the rising border tension between India and Pakistan capped gains and is likely to add some volatility in the market.

On Monday, the market will first react to Reliance Industries' fourth quarter earnings firing on all cylinders, and growth in China's Q1-2025 industrial profits Overall, in the coming truncated week, the market is expected to see some more consolidation amid increasing volatility and before getting in to the new leg of upmove, according to experts.

The market participants will focus on a slew of data points, including the next lot of quarterly earnings, monthly auto sales, US jobs & economic growth, monthly manufacturing PMI numbers globally, and Bank of Japan interest rate decision, along with tariff developments.

The Nifty 50 rose 188 points to 24,039 and the BSE Sensex gained 659 points at 79,213, while the Nifty Midcap 100 and Smallcap 100 indices closed the week with 1.7 percent and 0.8 percent gains, respectively.

"News-flows indicated some softness in the US-China tariff war, while India is expected to be closer to signing a trade deal with the US. Geo-political developments between India and Pakistan could add volatility to the Indian market over the next few days," Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services, said.

According to him, stock/sector-specific action would continue on the back of ongoing Q4 earnings announcements.

The market will remain shut on May 1 for Maharashtra Day.

Here are 10 key factors to watch out for this week:

The March 2025 quarter earnings season will be in full swing, entering in fourth week starting from April 28. Nearly 190 companies will release their earnings scorecard, including key Nifty 50 names like UltraTech Cement, Bajaj Finserv, Bajaj Finance, Kotak Mahindra Bank, and State Bank of India.

In addition, several other key corporates like Ambuja Cements, Avenue Supermarts, Bharat Petroleum Corporation, Adani Power, Vedanta, Aditya Birla Sun Life AMC, Adani Green Energy, Adani Total Gas, Hexaware Technologies, IDBI Bank, Indian Railway Finance Corporation, Oberoi Realty, PNB Housing Finance, TVS Motor, Trent, Vishal Mega Mart, Bandhan Bank, Coromandel International, CRISIL, Exide Industries, Federal Bank, Indus Towers, Indian Oil Corporation, Jindal Steel & Power, JSW Infrastructure, Varun Beverages, Marico, and Indian Bank will also announce their earnings next week.

US GDP, Jobs Data

Globally, apart from newsflow related to US-China trade developments, the focus will be mainly on the US economic data, including Q1CY25 GDP growth estimates, real consumer spending, PCE prices, unemployment rate, JOLTs job openings & quits, non-farm payrolls, factory orders, and vehicle sales.

According to economists, the GDP growth is likely to be significantly lower in the first quarter of 2025, compared to 2.4 percent growth in December quarter of 2024, due to policy uncertainty and new tariff rates for all trade partners by the Trump administration, while the unemployment rate for April is expected to be steady at 4.2 percent.

Global Economic Data

Further, the manufacturing PMI numbers by several key nations, along with GDP flash data for Q1-2025 from Europe, and the Bank of Japan's interest rate decision will also be watched.

Domestic Economic Data

Back home, the market participants will focus on industrial and manufacturing production numbers for March due on April 28, followed by fiscal deficit data for March on April 30.

Further, the final HSBC Manufacturing PMI for April and foreign exchange reserves for the week ended April 25 will be released on May 2. Preliminary estimates (flash) suggested that the manufacturing PMI increased to 58.4 in April, compared to (actual) 58.1 in the previous month.

Auto Sales

Auto companies, including Tata Motors, Bajaj Auto, Hero MotoCorp, TVS Motor, M&M, Escorts, Maruti Suzuki, and Eicher Motors, will also be in focus in the later part of the week as they will start releasing their monthly sales volume data for April, effective May 1.

The market participants will keep an eye on the mood of FIIs (foreign institutional investors), whether they will continue their buying interest or opt for selling after consistent buying in the last two weeks. FIIs have net bought Rs 17,796 crore (as per provisional figures) for the last week, which significantly cut down their net selling for the current month to Rs 2,175, from nearly Rs 35,000 crore reported before they started buying consistently in the last two weeks.

The declining US dollar index below 100 mark (up 0.18 percent for the last week closing at 99.59 zone but corrected more than 11 percent from its January swing high of 110.176) amid fear of slowing US economic growth following tariff war seems to be key reason for flowing FIIs funds to India which is expected to be growing at more than 6 percent along with likely recovery in corporate earnings.

Meanwhile, domestic institutional investors (DIIs) have net bought Rs 1,132 crore worth of shares last week despite intermittent profit booking, taking the total buying for the current month to Rs 22,250 crore.

With the improved market sentiment, the action is back in the primary market as the mainboard segment will see the first IPO - Ather Energy - in the last more than 2 months. The electric vehicle maker will open its Rs 2,981-crore initial public offering (IPO) for subscription during April 28-30 with a price band at Rs 304-321 per share.

The SME segment will also see more action compared to the mainboard segment as four IPOs - Wagons Learning, Arunaya Organics, Kenrik Industries, and Iware Supplychain Services - will hit Dalal Street next week, while Tankup Engineers will debut on the NSE Emerge on April 30.

Technical View

Technically, the Nifty 50 is expected to consolidate in the coming week, especially after the formation of a Shooting Star kind of pattern on the weekly charts (the bearish reversal pattern. Next week will be closely watched for the pattern confirmation), though the overall trend remains positive. The immediate support levels are 23,850 (the last week's low) and 23,750 (23.6 percent Fibonacci retracement from April low to high), followed by 23,300 (20-week EMA or midline of Bollinger bands) being crucial support. However, the resistance is placed at 24,365, the high of recent rally).

F&O Cues

The weekly options data indicated that the Nifty 50 is expected to trade in the 23,500-24,500 range in the short term and the 23,800-24,300 range in the immediate term.

The maximum Call open interest was observed at the 25,000 strike, followed by the 24,500 and 24,300 strikes, with the maximum Call writing at the 24,500 strike, followed by the 25,000 and 24,400 strikes. On the Put front, the 23,500 strike holds the maximum open interest, followed by the 24,000 and 23,800 strikes, with the maximum Put writing at the 23,500 strike, followed by the 23,800 and 23,200 strikes.

Meanwhile, the bulls need to be cautious given the rising volatility due to border tension between India and Pakistan after the recent Pahalgam terror attack. The India VIX, the fear factor, jumped 10.93 percent during the last week to 17.16 levels, climbing above all key moving averages, after 23.08 percent decline in the previous week.

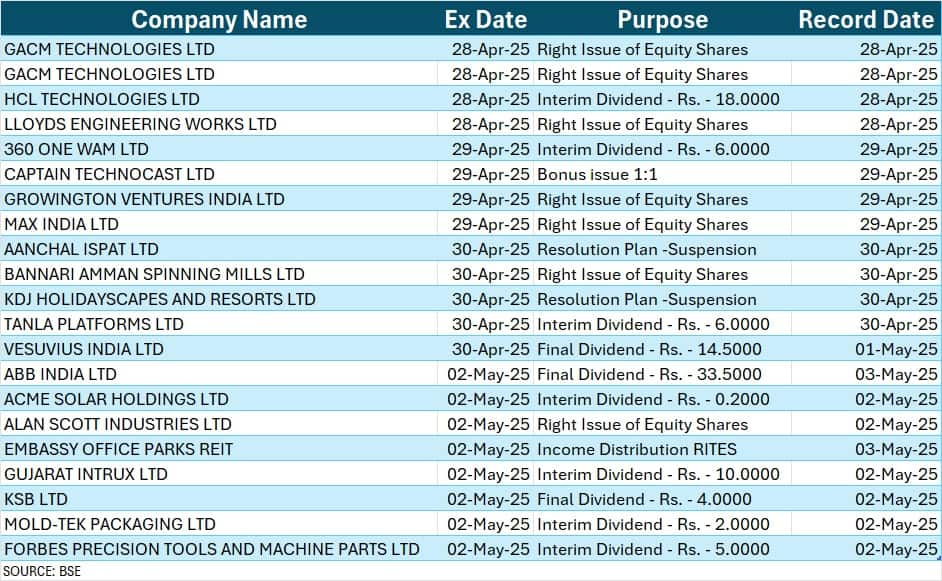

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.