The market maintained northward journey for the second consecutive week ended January 3, though it failed to sustain all gains due to sell on rally strategy adopted by the participants tracking strong US dollar, high valuation, consistent FII outflow, weakening Indian rupee, and rising oil prices. The buying in auto, FMCG, pharma, and oil & gas stocks along with buying in DIIs inflow supported the market.

In the coming week starting from January 6, the market sentiment may remain positive amid likely volatility, with focus on the December quarter earnings season, several data points from the US and FOMC meeting minutes. Further, the beginning of earnings season will increase stock-specific action.

The Nifty 50 rose 0.8% during the week to 24,005, and the BSE Sensex climbed 0.67% to 79,223, while the Nifty Midcap and Smallcap 100 indices outperformed the benchmark indices, rising 1.67% and 1.48%, respectively.

In the near term, Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services expects markets to witness stock/sector specific action on the back of pre quarterly business updates released by companies, ahead of their Q3 results.

Further, the investors are likely to align their portfolios based on pre-budget expectations, Vinod Nair, Head of Research at Geojit Financial Services said. The key data points such as the FOMC minutes, US non-farm payroll and unemployment rate will influence market sentiment, he added.

Here are 10 key factors to watch next week:

All eyes will be on the December quarter (Q3FY24) earnings that will be kicked off by Tata Consultancy Services (January 9) and Avenue Supermarts (January 11) next week. Overall, the September 2024 quarter numbers were subdued, which was one of key reasons caused selling pressure in the market, hence the market participants will focus on sequential numbers.

Among other companies, Tata Elxsi, Indian Renewable Energy Development Agency, One Mobikwik Systems, CESC, GM Breweries, Transformers and Rectifiers (India), GTPL Hathway, Yash Highvoltage, GNA Axles, PCBL and Valecha Engineering will also release quarterly earnings in the coming week.

FOMC Meeting Minutes

Globally, the focus will be on the minutes of FOMC meeting held in December, wherein the central bank cut interest rate by 25 bps, taking the total to 100 bps cut in 2024, but signalled caution about the 2025 outlook with possibility of only two rate cuts instead of four cuts mentioned earlier with focussing on Trump policy announcements and inflation data.

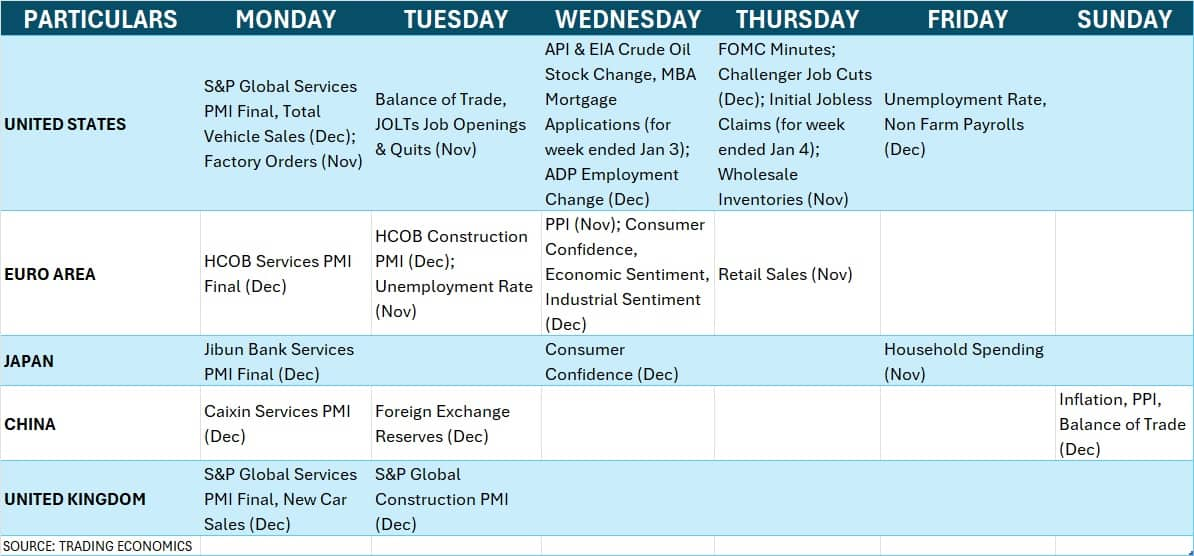

Apart from that, several economic data points like unemployment rate, non-farm payrolls, JOLTs jobs openings & quits, ADP employment change, Challenger job cuts, vehicle sales, and factory orders from the United States will also be watched as that will help the market participants assess the interest rate outlook for 2025.

Global Economic Data

Further, on the global front, investors will keep an eye on the Services PMI numbers for December by several developed and developing nations. Inflation, and PPI from the China; unemployment rate, PPI and retail sales from the Euro zone; and household spending data from the Japan will also be watched by the participants.

Oil Prices

The action seems to have back in the oil prices after the ups and downs within the range of $5 a barrel for more than couple of months, as the Brent Crude Futures, the international oil benchmark, closed at $76.51 a barrel, the highest level since the mid of October, up 3.7% for the last week on hope of stimulus package from the China to boost economic growth and further interest rate cuts from the US for 2025.

In fact, there was downward sloping resistance trendline breakout in the oil prices, with formation of long and strong bullish candlestick pattern on the weekly charts. Further, the prices surpassed 10, and 20-week EMAs (Exponential Moving Averages), signalling positive trend. Hence, keep an eye on oil prices, as any increase in prices further can send caution signal for bulls given the India being the net oil importer.

Domestic Economic Data

Back to home, the market participants will focus on the final HSBC Services PMI numbers for December due on January 6. As per the preliminary estimates, the Services PMI climbed to 60.8 in December, up from 58.4 in November.

Further, the preliminary estimates for the full year growth will also be announced next week on January 7. The Reserve Bank of India has projected the economy to grow 6.6% in FY25, against 8.8% in FY24. Some analysts expect the likely increase in capex spending and revival in the rural demand may support growth numbers in the second half of FY25.

Industrial and manufacturing production numbers for November, and foreign exchange reserves for week ended January 3 will be released on January 10.

The activity at the FIIs (foreign institutional investors) desk will also be watched next week, as they remained net sellers to the tune of more than Rs 11,000 crore worth shares in the cash segment last week ended January 3, tracking the rally in US dollar ahead of likely US-favoured policies from the Trump administration and attractive US bond yields. In December, they net sold nearly Rs 17,000 crore worth shares, which were fully compensated by the DIIs who net bought Rs 34,200 crore worth shares in the same month, but there was sharp slowdown in their selling compared to November (nearly Rs 46,000 crore) and October (Rs 1.14 lakh crore).

But net net in the equity segment, they were net buyers in 2024 given their solid buying in the primary market on attractive valuations, though there was significant selling in the secondary market due to high valuations. NSDL data showed that FIIs net bought Rs 427 crore worth shares in equity in 2024.

On the other side, DIIs (domestic institutional investors) net bought Rs 9,254 crore worth shares last week.

The US Dollar index surpassed 109 mark intraday for the first time since November 2022, rising 0.85 percent for the week to finish at 108.92, extending uptrend for fifth consecutive week, while the US 10-year Treasury yield sustained above 4.5%, though closed 0.58% down during the week at 4.602% on Friday, snapping three-week gains.

Meanwhile, the relentless weakness sustained in the Indian rupee, which weakened by 0.44% during the week to 85.74 against the US dollar (the all-time closing low), extending fall for ninth consecutive week due to consistent FIIs selling, stronger dollar and spike in oil prices. "We expect a rupee to remain volatile in coming week amid volatility in the dollar index and volatility in the domestic equity markets and a pair could trade in the range of 85.5000-86.5500," Manoj Kumar Jain of Prithvifinmart Commodity Research said.

On the primary market front, there will be significant activity next week with seven new public issues hitting Dalal Street with six companies lined up for listings. From the mainboard segment, Standard Glass Lining Technology's Rs 410-crore IPO will open for public subscription on January 6, followed by Quadrant Future Tek's Rs 290-crore initial share sale and Capital Infra Trust's Rs 1,578-crore public issue on January 7.

In the SME segment, Indobell Insulation will be the first amongst four IPOs, opening on January 6, followed by B R Goyal Infrastructure, Delta Autocorp, and Avax Apparels and Ornaments which are slated for opening on January 7, while Parmeshwar Metal, and Davin Sons Retail will close their public issues on January 6, and Fabtech Technologies Cleanrooms' initial share sale on January 7.

On the listing front, Indo Farm Equipment from the mainboard segment is the only company scheduled for debut next week on January 7, while in the SME segment, there will be five listings - Technichem Organics, Leo Dry Fruits and Spices Trading, Parmeshwar Metal, Davin Sons Retail, and Fabtech Technologies Cleanrooms - on the BSE SME.

Technical View

Technically, the Nifty 50 continued upward journey for the second consecutive session, especially after formation of Bullish Harami kind of pattern formation (bullish reversal pattern) in the previous week, signalling positive trend, though there was High Wave kind of pattern formation last week, indicating indecision among buyers and sellers. Overall, the trend remains consolidative with a positive bias. If the index decisively surpasses and sustains 24,200-24,250 area, the rally towards 24,800-25,000 can't be ruled out, but below it, the rangebound action may sustain with crucial support of 23,700, experts said.

F&O Cues

As per the derivative data, the Nifty 50 is likely to see a 23,700-24,500 range in the coming week, as the decisive breaching it on either side can give firm direction to the index.

On the weekly options data front, the maximum Call open interest was seen at the 25,000 strike, followed by the 24,500 and 24,200 strikes, with maximum Call writing at the 24,500 strike, followed by the 25,000 and 24,400 strikes. On the Put side, the 23,700 strike holds the maximum Put open interest, followed by the 24,000 and 23,500 strikes, with maximum Put writing at the 23,700 strike, followed by the 23,500 and 23,300 strikes.

Meanwhile, the India VIX, the volatility index, was supportive for bulls as it closed below 14 mark. It gained 2.29% at 13.54 during the week, after 12.17% fall in the previous week.

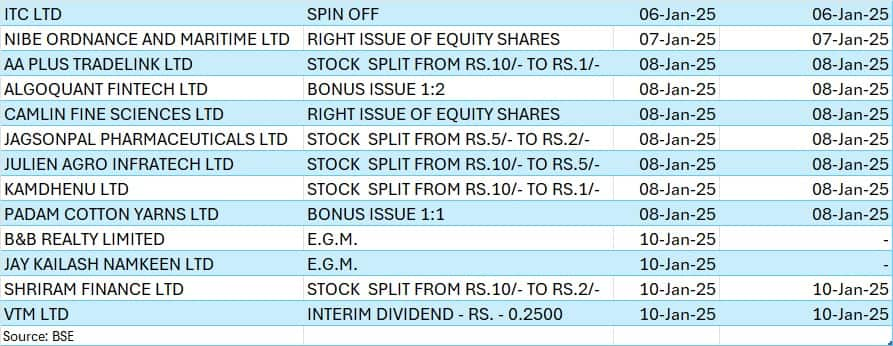

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!