The market extended its strong northward journey for the third consecutive week as bulls stayed strong over Dalal Street, rising more than a percent despite some selling pressure from FIIs, backed by the rally in auto, oil & gas, metal, and pharma stocks. The weekly gains were also influenced by strong DII inflows, softer oil prices, the previous week's significant fed funds rate cut, and China's economic stimulus.

According to experts, the overall sentiment may remain positive amid likely consolidation, with a focus on Manufacturing & Services PMI numbers, monthly auto sales, US jobs data, and Federal Reserve Chair Jerome Powell's speech in the coming truncated week.

The Nifty 50 sustained above 26,000, rising 388 points or 1.5 percent to hit a new closing high of 26,179, and the BSE Sensex closed above the 85,000 mark for the first time, climbing 1,028 points or 1.2 percent to 85,572. The broader markets continued to underperform benchmarks, with the Nifty Midcap 100 index gaining just 0.3 percent and the Nifty Smallcap 100 index falling half a percent.

"A visible trend is that this rally was predominantly led by large-cap stocks, which are relatively fairly valued compared to mid and small caps, which are showing signs of exhaustion," Vinod Nair, Head of Research, Geojit Financial Services. said.

According to him, a risk to the rally is elevated valuations.

Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services expects the positive momentum to continue in the market driven by frontline stocks.

On the sectoral front, the focus could shift towards IT & banking space as companies would be releasing their pre-quarterly updates next week.

The market will be shut on October 2 for Gandhi Jayanti.

Here are 10 key things to watch:

Fed Chair Powell Speech, US Data

Globally investors will focus on the speech by US Federal Reserve Chair Jerome Powell on September 30, especially after the substantial 50 bps rate cut in the September meeting. FOMC through its 'dot plot" already signalled a further 50 bps cut in interest rates in the next two policy meetings in the current year, followed by a 100 bps cut in 2025 amid the belief that the risks related to employment and inflation are broadly balanced.

The monthly JOLTs job openings & quits, unemployment rate, non-farm payrolls, vehicle sales, and factory orders data from the US will also be watched.

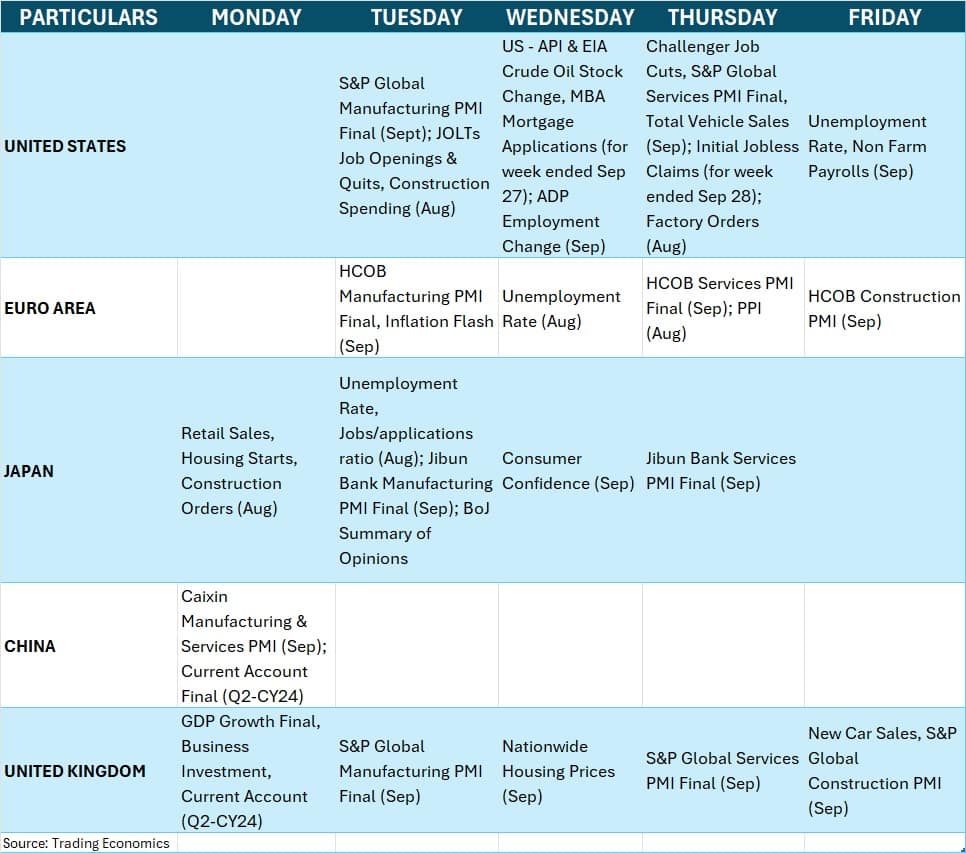

Global Economic Data

Additionally, the focus will also be on the Manufacturing & Services PMI final numbers for September from the US, China, Japan, Europe, and other regions.

Oil Prices

The market participants will also keep an eye on the oil prices given the escalated geopolitical tensions in the Middle East, with the death of Hezbollah leader Hassan Nasrallah in an Israeli air strike. The international benchmark Brent crude Futures wiped out all its previous week's gains, falling 3.66 percent last week to $71.95 a barrel and trading below all key moving averages as expectations of increasing supply from Saudi Arabia and Libya overshadowed the efforts from China to boost its economy through stimulus and concerns over Hurricane Helene. Crude Futures remained below the $80 a barrel mark since the last week of July on a closing basis. Softer oil prices are favourable for oil-importing nations like India.

Domestic Economic Data

On the domestic front, the focus will be on the fiscal deficit and infrastructure output data for August, and current account and external debt numbers for the June quarter of 2024, which are all scheduled on September 30.

In addition, Manufacturing and Services PMI final data for September will be released on October 1 and October 4, respectively. According to preliminary estimates, Manufacturing PMI dropped to 56.7 in September from 57.5 in August, and Services PMI declined to 58.9, from 60.9 during the same period.

Bank loan and deposit growth numbers for the fortnight ended September 20, and foreign exchange reserves for the week ended September 27 will also be released on October 4.

Auto Sales

Auto sales data for the September month from original equipment manufacturers will also be eyed next week. Hence, auto stocks like Maruti Suzuki India, Tata Motors, Ashok Leyland, Hero MotoCorp, Eicher Motors, TVS Motor, Bajaj Auto, Mahindra & Mahindra, Escorts, etc. will be in focus. Most experts expect soft data from all segments.

The market participants will also watch the activity at the institutional desk. After significant inflow in the previous week, foreign institutional investors (FIIs) flow turned weak for the last week ended September 27, but domestic institutional investors (DIIs) remained strong buyers amid stable economic data points and good monsoon. Experts feel the FIIs may be inclined to Eastern Asian peers given the stimulus and attractive valuations like China.

FIIs have net sold Rs 3,933 crore worth of shares in the cash segment during the last week, but remained buyers to the tune of Rs 22,404 crore in September, while there was a massive buying of Rs 15,962 crore from DIIs for the week, taking the total inflow for the month to Rs 24,212 crore.

On the primary market front, there won't be major action in the mainboard segment given the no new openings, but the activity at the SME desk will remain strong. Diffusion Engineers will close its Rs 158-crore initial public offering (IPO) and list on the bourses next week on September 30, and October 4, respectively, while Manba Finance and KRN Heat Exchanger will debut on the BSE and NSE on September 30, and October 3, respectively.

In the SME segment, Paramount Dye Tec, Subam Papers, and NeoPolitan Pizza and Foods will open their public issues on September 30, while Nexxus Petro Industries, Forge Auto International, Sahasra Electronics Solutions, and Divyadhan Recycling Industries will close their IPOs on September 30. The subscription for Saj Hotels, and HVAX Technologies IPOs will close on October 1.

Further, the trading in Rappid Valves India, and WOL 3D India shares will commence on September 30, while Thinking Hats Entertainment Solutions, Unilex Colours and Chemicals, and TechEra Engineering shares will list on October 3. Shares of Nexxus Petro Industries, Forge Auto International, Sahasra Electronics Solutions, and Divyadhan Recycling Industries will debut on October 4.

Technical View

Technically, the overall trend remains positive for the coming week given the continuation of higher highs-higher lows formation and Three White Soldiers formation, although initially some consolidation can't be ruled after the recent strong run-up taking the momentum indicator RSI (Relative Strength Index) near overbought levels on the daily and weekly charts, and given Long-Short ratio rising to nearly 80 percent. On the levels front, the 26,000 is an important support to watch next week, followed by 25,800 being the key support, while the 26,300 is expected to be immediate resistance followed by 26,500 being the key hurdle.

F&O Cues, India VIX

The weekly options data suggested that 26,000 is likely to be immediate support for the Nifty 50, followed by 25,500 being the key support, whereas, on the higher side, 26,400-26,600 is the area to watch.

On the Call side, the maximum open interest was observed at the 27,000 strikes, followed by the 26,000 and 26,600 strikes, with maximum writing at the 27,000 and then the 26,800 and 26,400 strikes. On the Put side, the 26,000 strike holds the maximum open interest, followed by the 25,000 and 25,500 strikes, with maximum writing at the 26,400 strikes, and then the 26,300 and 25,500 strikes.

Volatility remained at the lower zones, reaching to fresh multi-month low, which favours bulls. The India VIX dropped 6.47 percent for the week to 11.96, the lowest closing level since April 2024.

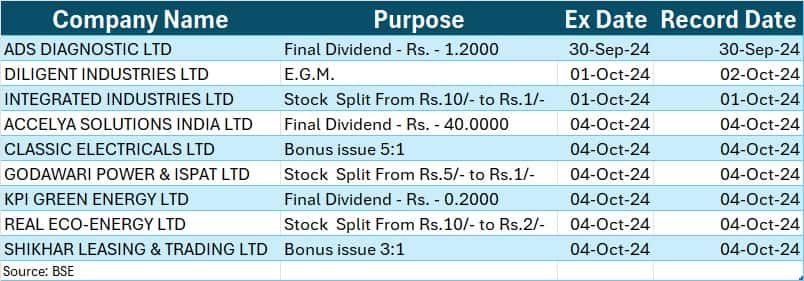

Corporate Action

Here are key corporate actions taking place in the coming truncated week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.