The market regained some lost ground in Friday's trading session but it lost over a percent in the week ended March 26 on the back of weak global cues and worries over the second covid wave.

Next week would be a truncated one for the Indian markets as markets will remain shut on March 29 for Holi and on April 2 on account of Good Friday.

Last week, BSE Sensex fell 849.74 points or 1.70 percent to end at 49,008.5 and while the Nifty50 declined 236.7 points or 1.6 percent to close at 14,507.3 levels dragged by media, auto, and energy stocks. However, pharma stocks provided some support as the index added nearly 2 percent.

The broader indices had outperformed the benchmark indices with the BSE Midcap index was down 0.3 percent and Smallcap index fell 1 percent.

The coming week is a holiday-shortened one and we expect volatility to remain high. It marks the beginning of a new month also so macroeconomic data i.e. core sector and auto sales numbers will remain in focus. Besides, updates related to the COVID situation in India and cues from the global markets will also be closely tracked by the participants," said Ajit Mishra, VP Research, Religare Broking.

"The negative bias in Nifty would reverse on the breakout above the short-term moving average (20 EMA) which currently lies around 14,760 levels. On the flip side, the next major support exists at 14,000. We feel traders should limit leveraged positions until we see some clarity emerging," he added.

Here are 10 key factors that will keep traders busy next week:

Coronavirus and Vaccination

The recent surge in the new COVID cases in India and the rapid vaccination drive will remain on the investor's radar in the coming week.

Maharashtra, Punjab, Chhattisgarh, Karnataka, Gujarat, and Madhya Pradesh have accounted for 79.57 percent of the new COVID-19 cases are reported in India.

India recorded 62,258 new coronavirus infections in a day, the highest single-day rise so far in 2021, taking the nationwide COVID-19 tally to 1,19,08,910, according to Union health ministry data updated on March 27.

Of these, Maharashtra reported the highest daily new COVID-19 cases at 36,902. It is followed by Punjab with 3,122 while Chhattisgarh reported 2,665 new cases.

A total of 26,05,333 beneficiaries were vaccinated against the novel coronavirus in India on March 26, Union Health Ministry's latest provisional report has said, even as infections continue to spike in the country.

The Maharashtra Chief Minister's Office said on March 26 that night curfew will be imposed in the state from the night of March 28.

The night curfew has been imposed in Maharashtra in view of the alarming rise in the number of coronavirus infections being reported daily.

Rakesh Jhunjhunwala-backed Nazara Technologies Listing

Rakesh Jhunjhunwala-backed mobile gaming company Nazara Technologies is expected to get listed on the exchanges on March 30.

The public offer had been subscribed 175.46 times, with bids received for 51.25 crore equity shares against the issue size of 29.20 lakh equity shares.

The portion set aside for retail investors has been subscribed 75.29 times and that of employees 7.55 times. The company reserved Rs 2 crore worth of shares for its employees. Non-institutional investors' portion was subscribed 389.89 times, while qualified institutional buyers had bid for 103.77 times of the shares set aside for them.

Nazara Technologies has a presence in India and across emerging and developed global markets such as Africa and North America, is going to raise around Rs 583 crore through the issue that is an offer for sale by existing selling shareholders.

Auto Sales for March

Auto companies are going to declare their monthly sales number for the month of March on April 1.

In the month of February, the companies reported better numbers on the back of robust demand.

According to East India Securities, two-wheeler demand is soft and expected to remain the same in the coming months, impacted majorly due to the higher cost of acquisition.

Bookings growth in the passenger vehicles continues to remain robust across all OEMs, but supply-side constraint remains a challenge. Within commercial vehicle segments, seeing improvement in Tippers, long haulage trucks, and ILCV segments, while cargo trucks, buses remain under pressure, it added.

Gold and Oil Prices

Strength in bond yields and the dollar index is keeping gold prices under pressure. Dollar index prices rallied above four-month high and bond yields continued a recovery rally.

"Gold prices found support from Fed comments. The third wave of coronavirus in the Eurozone is providing safe-haven support to gold prices as it is negative for economic growth and indicating that dovish policies will stay for a longer period," said Abhishek Bansal, Founder Chairman, Abans Group.

Gold prices are likely to face stiff resistance near 20 days EMA at $1737 and 50 days EMA at $1770 while it may find support level around $1705 and $1690.

A rally in the dollar index has pushed crude oil prices lower but it is likely to trade near $60 on mixed fundamentals. The rising number of global coronavirus cases and third wave in the Eurozone have decreased the chances of fast economic recovery and limited energy consumption in the region.

Crude oil prices receiving support from the continued closure of the Suez Canal as a container ship remains aground and continues to block ship traffic through the canal.

FII Selling

Foreign investors remained net sellers in the cash segment of the Indian equity markets in the last week.

Foreign institutional investors (FIIs) were net sellers of more than Rs 6,000 crore shares during the week, however domestic institutional investors (DIIs) were net buyers of more than Rs 4,500 crore in the same period.

In the month of March till now the FIIs bought equities worth Rs 2,161.66 crore and DIIs purchased equities worth Rs 941.89 crore.

Rupee and Dollar

With currency holidays the truncated next week, expect market participation to be muted in the forex market.

“At this point, fx market is trying to get some more global news that will be the next catalyst. So, unless any nation stops the vaccine rollout, the rapid vaccination drive by the US will keep the risk appetite higher,” said Rahul Gupta, Head Of Research- Currency, Emkay Global Financial Services.

“However, lockdown in Europe and upbeat US data will limit any fall in USDINR spot. Thus we expect the spot to trade within 72.20-72.80,” Gupta added.

Indian rupee witnessed the volatile trade in the last week but ended flat at 72.51 per dollar on March 26, against its March 19 closing of 72.51 per dollar.

“During the week the dollar index was the biggest factor that dragged the sentiment of the market. It was at 91 levels from there it all the way moved to 92.80 on Friday,” said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

“It’s a cause of concern for emerging markets as it controls liquidity flow for the emerging market. In the coming week, again the trend of the market would largely depend on the trend of the dollar index,” he added.

Technical view

With the sharp bounce in Friday's session, the Nifty50 formed Doji formation on daily charts where a small bearish candle for a second consecutive week with the cut of 1.6 percent last week.

At this juncture, the only solace for bulls appears to be the fact that Nifty is consistently gaining support from its 13-week exponential moving average on weekly charts whose value for next week is placed around 14425 levels. Hence, sustaining above this level on the weekly closing basis is critical for bulls to avoid bigger cuts, said Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.

In the next trading session if bulls manage to push the index beyond 14573 levels then Nifty can head to test its 20-day ema (14756) whereas on the downsides 14414 shall be an important support point as close below this level can resume the weakness with initial targets placed around 14264 levels, he added.

F&O Cues

Since it is the beginning of new series, option data is scattered at different strikes.

On option front, maximum Put OI is at 14000 followed by 13500 strikes while maximum Call OI is at 15000 followed by 16000 strike. Option data suggests an immediate trading range in between 14000/14200 to 14800/15000 zones.

"From the options space, uniform activity can be seen at ATM Calls and Put strikes with no major difference in OI base. Along with it, richly valued options are clearly suggesting expectations of volatility next week as well, said ICICI Direct.

"We believe that levels in the range of 14700-14900 would be crucial for any change of trend. On downsides, we expect recent lows near 14300 to provide immediate support to the index, it added.

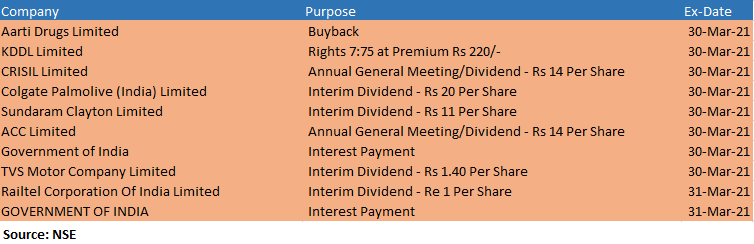

Corporate Action

Here are key corporate actions taking place in the coming week:

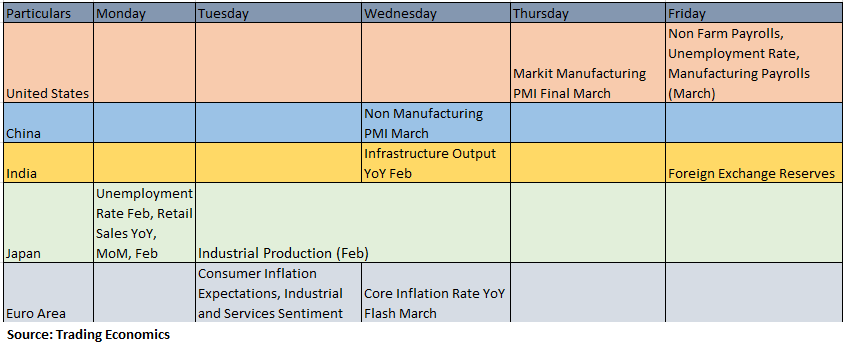

Global Cues

Here are key global data points to watch out for next week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.