In a volatile week, the benchmark Nifty touched a lifetime high of 15,915 but erased gains and closed below 15800 levels. Meanwhile, the broader market, especially the smallcaps, continued their good run.

The S&P BSE Sensex and the Nifty50 closed 0.8 percent lower each for the week ended July 2, compared to a 0.2 percent fall seen in the S&P BSE Midcap index, and a 2.2 percent gain seen in the S&P BSE Smallcap index.

Experts see the Indian market continuing its strong momentum amid the reopening of the economy, a pick-up in vaccination drive and low interest rates.

"In the medium term, we expect FPI flows to India to remain strong, driven by recovery in growth. Positive export outlook led by a revival in the global economy coupled with low interest rates in the domestic market is expected to augur well for India," said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

"Besides decline in COVID cases and vaccination drive, expectations of increased consumer spending and normal monsoon rainfall is likely to drive the domestic demand. Also, we expect the upcoming festive season to also boost the domestic demand," he added.

Here are 10 key factors that will keep traders busy next week:Coronavirus and VaccinationIndia’s brutal second wave of COVID-19 pandemic is receding but the cases of Delta plus variant, classified as a variant of concern (VOC), are increasing in the country. So far, the country has recorded over 3.05 crore confirmed COVID-19 cases, including 4,01,050 deaths. A total of 2,96,05,779 people have recuperated from COVID-19 so far. There are 4,95,533 active COVID-19.

The cumulative number of COVID-19 vaccine doses administered in India has crossed 34.46 crore, according to the Union Health Ministry.

IPOs and ListingClean Science and Technology and GR Infraprojects will launch their initial public offering (IPO) on July 7.

Clean Science and Technology's price band for the issue, which will close on July 9, has been fixed at Rs 880-900 per share.

The company plans to raise Rs 1,546.62 crore through the public issue which consists of a complete offer for sale by existing selling shareholders including promoters Ashok Ramnarayan Boob, Krishnakumar Ramnarayan Boob, Siddhartha Ashok Sikchi, and Parth Ashok Maheshwari.

GR Infraprojects' Rs 963-crore public issue will also open for subscription on July 7, at a price band of Rs 828-837 per share. The offer will close on July 9.

The IPO of 1,15,08,704 equity shares comprises a complete offer for sale by existing selling shareholders including promoter.

The recently concluded IPO of India Pesticides will commence trading on the exchanges with effect from July 5.

It had been subscribed 29.04 times. Investors had bid for 56.07 crore equity shares against the IPO size of 1.93 crore shares.

EarningsInvestors will keep an eye on the upcoming earnings season as companies are going to announce their June quarter earnings from next week.

Tata Consultancy Services, Avenue Supermarts, Delta Corp, Alliance Integrated Metaliks, Asian Hotels (North), Simplex Projects, Kwality, Shyam Metalics and Energy, Integrated Capital Services, Madhucon Projects, PTC Industries are

FII SellingForeign institutional investors (FIIs) have been net sellers for the last three months but the outflows have subsided over the period.

In the months of April, May, and June, FII sold equities worth of Rs 12,039.43 crore, Rs 6,015.34 crore and Rs 25.89 crore , respectively.

Last week, FIIs sold equities worth Rs 5,416.84 crore, while domestic institutional investors (DIIs) bought equities worth Rs 6,418.3 crore.

Gold and Crude Oil:Crude oil prices will remain in focus as OPEC+ will resume talks on Monday after failing to reach a deal on oil output policy for a second day running on Friday because the United Arab Emirates blocked some aspects of the pact.

The standoff could delay plans to pump more oil through to the end of the year to cool oil prices that have soared to 2-1/2 year highs.

Crude prices also found support from delays in Iran's nuclear talks. The seventh round of talks with world diplomats over Iran's nuclear program has been delayed with no resumption date fixed.

"WTI Crude oil prices are likely to trade firm while above the key support level of 20 days EMA of $72.14 and 50 days EMA of $69.08, while it may face resistance around $76.5 and $77.8," said Abhishek Bansal, Founder Chairman, Abans Group.

Rupee and DollarLast week, the Indian rupee remained under pressure and touched a 2-month low against the US dollar. It ended 56 paise lower at 74.74 on July 2 against its June 25 closing of 74.18.

"Rupee witnessed weak trend as OPEC+ delayed production info, which indicates at no increase in production which can make Crude expensive going ahead. The range for rupee can be 74.60 - 75.10 in coming sessions ahead," said Jateen Trivedi, Senior Research Analyst at LKP Securities.

The US dollar hit a fresh three-month high versus other major currencies on Friday, as traders wagered strong US labour data could lift it even further.

"The USDINR spot has continued the uptrend last week, and we likely need a catalyst to fuel another extension higher. After the big beat on US ADP employment the focus is on nonfarm payrolls data, as a strong candidate with enough impetus to accelerate US Dollar buying pressure," said Rahul Gupta, Head Of Research- Currency, Emkay Global Financial Services.

"In USDINR spot the next week’s trading range will continue to be 74-75.25 with sideways bias," Gupta added.

Composite and Services PMI:The Markit Composite PMI and Markit Services PMI (June) will be announced on July 5.

According to the monthly IHS Markit India Services Purchasing Managers’ Index (PMI), the services PMI stood at 46.4 in May, down from 54 in April. In PMI parlance, a print above 50 means expansion, while a score below that denotes contraction.

The seasonally adjusted Nikkei India Composite PMI Output Index, which calculates growth after considering manufacturing and services indices relative to the size of GDP, fell to 48.1 in May from 55.4 in April, signalling a slowdown in private sector output growth.

Technical viewNifty formed a Hammer pattern on the daily charts on July 2, while on the weekly scale it formed a bearish candle which resembles a bearish belt hold pattern.

It looks critical for the index to sustain above 15680 levels, atleast on closing basis, to retain positive bias though trend may continue to remain sideways.

"In the next session if bulls manage to push the index beyond 15755, strength shall expand towards 15839 levels, whereas, the inability of bulls to sustain above 15700, on intraday basis, may once again push the index towards 15600 levels," said Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.

"Traders are advised to remain neutral in next session by shifting focus towards stock specific opportunities," he added.

F&O CuesThe Option data suggests an immediate trading range in between 15600 to 15900 zones.

Maximum Put OI is at 15500 followed by 15000 strike while maximum Call OI is at 16000 followed by 16500 strike. Call writing is seen at 16100 then 16200 strike while Put writing is seen at 15000 then 15500 strike.

"Nifty has to hold above 15700 zones to witness an up move towards 15850 and 15900 zones while on the downside support can be seen at 15600 and 15500 zones," said Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services.

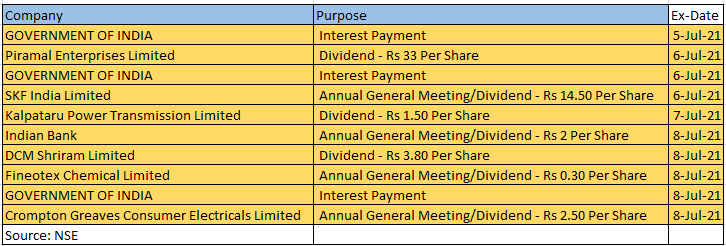

Corporate ActionHere are key corporate actions taking place in the coming week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.