The market managed to eke out gains in a volatile week ended April 8 that saw several key developments. HDFC twins merger decision lifted sentiment on Monday followed by a correction in the next three days amid the US Fed's hawkish tone and Ukraine-Russia tensions. And on the last day there was renewed buying interest given the status quo on policy rates maintained by the Reserve Bank of India with a focus on inflation and growth.

The BSE Sensex rose 170 points to 59,447 and the Nifty50 jumped 114 points to 17,784 while there was strong outperformance in the broader space with the BSE Midcap and Smallcap indices rising more than 3.5 percent.

The coming holiday-shortened week is likely to be action-packed with the beginning of corporate earnings season, inflation and industrial output data, and Ukraine-Russia developments. So experts expect the volatility to continue with availability of stock-specific opportunities due to earnings season.

"Indications are in favour of further consolidation in Nifty but the earnings season would offer ample trading opportunities across the board," Ajit Mishra, VP - Research at Religare Broking, said.

He further said, "Since we’re seeing a mixed trend across sectors, traders should prefer stocks that are showing higher strength. Investors should closely watch earnings and align their portfolios accordingly."

The market will remain shut on April 14, for Mahavir Jayanti & Dr. Baba Saheb Ambedkar Jayanti, and April 15, for Good Friday.

Here are 10 key factors that will keep traders busy next week:

The key event to focus coming week onwards will be the March quarter earnings season that will be kicked off by IT companies. The country's largest IT company Tata Consultancy Services will release its quarterly earnings on April 11 followed by Infosys on April 13. Leading private sector lender HDFC Bank as well as ICICI Prudential Life Insurance will disclose numbers on April 16.

Experts largely expect moderation in sequential revenue growth of IT companies due to the seasonality factor in Q4FY22 after strong sequential growth in previous two quarters, with pressure on margin from elevated wage increases, but demand outlook is expected to remain healthy.

"While largely the consensus is that revenue growth will soften sequentially, important factors that D-Street will track are margins, revenue guidance, and attrition numbers," said Yesha Shah, Head of Equity Research at Samco Securities.

Among others, Birla Tyres, Delta Corp, Kesoram Industries, Lasa Supergenerics, Anand Rathi Wealth, Hathway Cable & Datacom, Tinplate Company of India, Den Networks, Alok Industries, and Integrated Capital Services will also release the earnings scorecards next week.

Inflation and Industrial Output

Consumer Price Index (CPI) inflation for the month of March will be closely watched by the Street on Tuesday as the Reserve Bank of India (RBI) is keeping a close watch on inflation numbers along with growth, especially after higher commodity prices and elevated crude oil prices amid Ukraine-Russia tensions. Last week in monetary policy, the central bank increased inflation forecast to 5.7 percent for FY23 and lowered growth estimates to 7.2 percent while assuming oil price at $100 a barrel.

In March 2022, experts feel CPI inflation is expected to surpass RBI's target range of 4 percent (+/-2 percent) on increasing fuel costs. It was at 6.07 percent in February.

"We expect headline CPI inflation to climb to 6.5 percent YoY in March, driven by the pass-through of international commodity and energy prices. On a sequential basis, food prices remain under control but imported inflation, led by higher energy costs, will be be the major driver as core inflation hits a 10-month high," Rahul Bajoria, MD & Chief India Economist at Barclays India, said.

Still, the RBI will likely stress supply-side drivers and emphasise the use of fiscal levers to tame price pressures, he feels.

Industrial output for February will also be announced on the same day, while balance of trade for March and foreign exchange reserves for the week ended April 8 will be released on Friday.

Oil Prices

Energy cost is the major element of our import bill as well as a key focus area for RBI, so the oil price movement will be closely watched in coming weeks. Experts feel elevated oil price is a cause of concern till it drops way below $100 a barrel.

International benchmark Brent crude futures settled the week at $102.78 a barrel, down 1.5 percent week-on-week on plans by countries to release stockpiles, as well as fears over oil demand after rising Covid cases in China, the world's second largest economy.

Member nations of the International Energy Agency (IEA) will release 60 million barrels over the next six months, with the United States matching that amount as part of its 180 million barrel release announced in March, as per CNBC reports.

The other key event that will remain in focus would be the Ukraine-Russia war as investors and traders will keep a close watch for any development in the crisis.

Russian forces have already withdrawn from the northern part of Ukraine, especially from Kyiv, partly due to stiff resistance from Ukrainians, and shifted focus on eastern and southern parts. There was a missile attack on a train station in Kramatorsk in the eastern part of Ukraine, killing more than 50 people.

The US says the Russian forces carried out the attack with short-range missiles, but Moscow denied. Russian air attacks over Ukraine's south and east are expected to increase in the coming days, though Moscow continues to face stiff Ukrainian resistance. Meanwhile, British Prime Minister Boris Johnson is promising more aid to Ukraine, warning that Russian President Vladimir Putin will intensify pressure in the eastern Donbas region. (CNBC reported)

The foreign institutional investor (FII) inflow of previous week completely reversed in the passing week, majorly due to hawkish statement by US Federal Reserve Governor related to faster policy tightening to tame inflation. The US 10-year treasury yield, the important benchmark, climbed from 2.36 to 2.7 percent week-on-week while the US dollar index, which measures the value of US dollar against a basket of six leading currencies, jumped to 100 levels intraday on Friday (for the first time since May 2020) before settling at 99.79, up 1.2 percent over 98.62 week-on-week.

Hence, the Street will closely watch the mood at FII desk in coming weeks. FIIs have net sold Rs 6,337 crore worth of shares during the week, against an inflow of Rs 5,590 crore in the previous week, while domestic institutional investors (DIIs) remained supportive and tried to offset maximum FII outflow as they have net bought Rs 4,161 crore worth shares.

Global Data Points

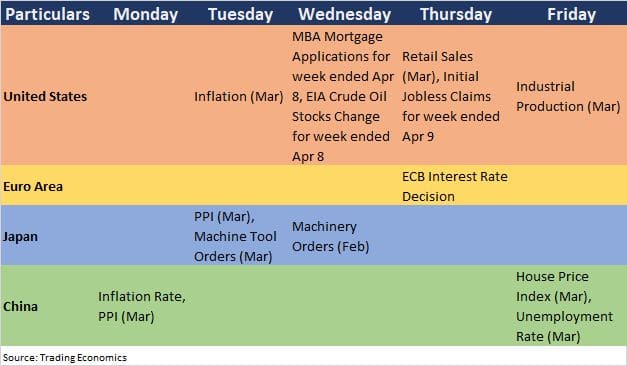

Globally investors will keep an eye on US inflation numbers that will be released on Tuesday, which experts feel could bring some volatility in markets, while European Central Bank will announce its monetary policy decision on Thursday.

Here are global data points to watch out for next week:

Technical View

The Nifty50 was volatile but smartly defended 17,600 levels (as well as held above 10-day exponential moving average of 17,635) which could act as a support for the index as breaking of the same could bring selling pressure, while the index may face strong resistance around 18,100, the recent high, experts feel.

The index formed a bullish candle on daily charts on Friday and saw Doji kind of pattern formation on the weekly scale as it gained 0.8 percent and 0.6 percent respectively.

"A Doji type candle pattern was formed on Nifty (not a classical one) as per weekly timeframe chart at the crucial overhead resistance of downsloping trend line. This market indicates presence of strong resistance around 18,100-18,200 levels and until the high of that Doji is surpassed decisively on the upside at 18,115 levels, the chances of weakness from the highs can't be ruled out," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said.

He feels the short-term trend of Nifty is in the process of forming a higher bottom reversal after a minor weakness.

"Further sustainable upmove from here could only confirm higher bottom and that could pull Nifty towards the hurdle of 18,100 again. Any failure to sustain the highs could attract selling pressure emerging again from the highs. Immediate support is at 17,600 levels," he said.

F&O Cues

As per option data, experts expect the index to consolidate with support at 17,500 and resistance at 18,100 in the coming truncated week.

On the option front, there was a maximum Call open interest at 18,500 strike followed by 18,000 and 17,800 strikes, while maximum Put open interest was seen at 17,000 strike then 17,600 and 17,700 strikes on the weekly basis.

Call writing was seen at 18,500 strike followed by 18,400 and 18,200 strikes with Call unwinding at 17,900 strike, while there was Put writing at 17,600 strike then 17,500 & 17,000 strikes.

"On the options front, significant Call writing is visible at ATM and OTM strikes with highest Call base at 18,000 strike. On the other hand, due to sharp upmove seen on Friday, significant additions were also seen at ATM Put strikes," said ICICI Direct.

Considering the truncated next week, the brokerage believes the Nifty should consolidate with positive bias while stock-specific movement is likely to be seen amid quarterly results.

India VIX

Volatility cooled off significantly and remained below the crucial 20 mark throughout last week, indicating continuity in buying interest. India VIX, the fear index, fell four percent to settle at 17.68 week-on-week.

"Despite some increase in volatility among global peers, India VIX subsided significantly and is currently hovering below 18 and closed at its lowest levels seen since January. The sharp decline in volatility index suggests markets entering the result season with positive bias," said ICICI Direct.

CBOE Volatility index remained above 21 levels, settling higher at 21.16 on Friday, against 19.63 levels week-on-week.

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.