Finally bulls have taken a rest after significant run up that had taken the Nifty50 to over 18,600 levels and the BSE Sensex above 62,000 mark for the first time. As a result, bears turned active that hammered the street and dragged down benchmark indices around 3 percent from record high levels before settling down with around a percent loss on week-on-week basis.

The inflationary pressure reflected in quarterly earnings and rising US bond yields seem to have hit sentiment of the market that fell for four consecutive sessions till October 22. FIIs & DIIs both turned net sellers for the week. The Nifty50 corrected 223.65 points to close at 18,114.90 and the BSE Sensex lost 484.33 points to 60,821.62 in the week ended October 22 as all sectoral indices, barring Bank, closed in the red, with Metal, FMCG, Pharma, Realty being biggest losers with more than 5 percent loss each.

The major selling was seen in broader markets which had outperformed frontliners in the run up. The BSE Midcap index was down more than 4 percent and Smallcap index fell more than 5 percent during the week.

The market on October 25 will first react to Reliance Industries and ICICI Bank earnings came out over the weekend that generally starts after closing of market hours on October 22. The market after a sell-off in previous week is expected to see some range bound and consolidation trend in the coming week amid expiry of monthly contracts, with focus on September quarter earnings and likely support from Bank Nifty that crossed 40,000 mark, experts feel.

"The market may struggle to hold its footing next week and is likely to stay range bound. After exceeding the 40,000 mark for the first time this week, Bank Nifty is likely to be in the limelight next week as various banks will announce their results," Yesha Shah, Head of Equity Research at Samco Securities.

She further said given the improvement in economic activity, enhanced collection efficiency and stabilized asset quality, a favourable earnings outlook from this industry can be expected. Furthermore, with the monthly expiry coming up next week, market volatility may linger."

Here are 10 key factors that will keep traders busy next week:

We are the in middle of September quarter earnings season as total 700 companies will release their quarterly earnings next week including 20 companies from Nifty50 which have 26.70 percent weightage in the index (as of September 30, 2021) which are Bajaj Finance, Bajaj Finserv, Kotak Mahindra Bank, ITC, L&T, Axis Bank, Maruti Suzuki, Titan Company, Adani Ports, Tech Mahindra, NTPC, Indian Oil Corporation, SBI Life Insurance Company, Bajaj Auto, Shree Cement, BPCL, IndusInd Bank, Dr Reddy's Labs, Cipla, and UPL.

Among others, Lupin, Aditya Birla Sun Life AMC, Colgate-Palmolive (India), Coforge, CSB Bank, HDFC Asset Management Company, Indus Towers, ABB India, Ambuja Cements, Canara Bank, Adani Enterprises, Punjab National Bank, Zee Entertainment Enterprises, CarTrade Tech, DLF, Blue Star, InterGlobe Aviation, Karnataka Bank, Marico, RBI Bank, SBI Cards and Payment Services, Tata Power, Adani Power, Apollo Tyres, Bandhan Bank, Cadila Healthcare, Escorts, Exide Industries, GAIL India, Oberoi Realty, Vedanta, Voltas, and Rossari Biotech will also announce quarterly earnings in the coming week.

India, as expected, crossed 100 crore vaccination in the passing week, at 101.3 crore now including 68.48 lakh COVID-19 vaccine doses which were administered in the last 24 hours ended on October 23 at 8 am. With this, now nearly 30 percent of total vaccinated people have completed their both COVID-19 doses. As a result and with the awareness, the country managed to cap the daily addition of COVID-19 cases below 20,000 for more than two weeks now, with falling active cases and increasing recoveries, which helped the government to ease restrictions across the country, ultimately supporting the growth, experts feel.

But the street will continue to watch the COVID-19 numbers, especially after the spread of delta plus COVID-19 mutation in the United Kingdom and sudden spike of cases in Beijing and other provinces of China, the world's second largest economy. For the time being, the COVID-19 graph in the United States, South Africa, Iran, Japan, Canada, Mexico, Malaysia, Colombia, Indonesia, Israel etc has been declining but countries including the United Kingdom, Russia, Germany, Poland, Netherlands, Chile, Belgium, Romania etc have seen cases rising again.

FIIs as well as DIIs preferred to take profit off the table last week, especially due to margin worries on rising inflationary pressure seen in earnings of several companies and after a one-way rally in stock market. But experts feel it is a usual thing and so far there is no panic kind of situation in the market due to expected strong economic growth and corporate earnings in the longer term which can continue supporting the market.

Foreign institutional investors have net sold Rs 7,353 crore worth of equity shares and domestic institutional investors net offloaded Rs 4,504 crore worth of shares in the week ended October 22, taking the total outflow to nearly Rs 10,000 crore and Rs 5,000 crore in October month so far. Hence the mood of institutional investors will be closely watched next week.

Indian Rupee, US Dollar Index and Bond Yields

The Indian rupee was range bound and has not seen major change on week-on-week basis amid rising oil prices and weak equity markets, but the US dollar index (which measures the value of US dollar against a basket of world's six leading currencies) fell 0.4 percent during the week to close around 93.58, closely watching the economic data. Overall experts feel the rupee is expected to remain range bound next week too and the US dollar index is likely to get support at lower levels with rising inflation expectations, increasing US bond yields and better-than-expected earnings.

The US bond yields hit 1.7 percent (for the first time since May 2021) during the week, before settling at 1.64 percent, up from 1.57 percent on week-on-week basis, continuously tracking the US economic data (including employment) which will help US Federal Reserve to decide when to start withdrawing stimulus measures in a gradual manner. Most experts feel the US Fed could start tapering in November or December, and the rising US bond yields could spoil the global equity market mood. The Fed will hold the next two-day policy meeting in the first week of November 2021.

Oil Prices

The oil prices in the international markets continued to rise, with Brent crude futures hitting fresh three-year high of $86.10 before settling with 0.8 percent gains during the week at $85.53 a barrel amid tight supply and rising expectations that higher coal & gas prices due to shortages could increase the demand for oil as an alternative fuel to improve the energy situation in China and Europe.

The rising oil price is a major concern for India which is a net importer, hence the street will closely track the prices going ahead.

The primary market will be in action as two IPOs - Nykaa and Fino Payments Bank - will hit Dalal Street next week. Falguni Nayar-promoted FSN E-Commerce Ventures, which runs Nykaa and Nykaa Fashion platforms, will open its Rs 5,351.92 crore public issue on October 28 and will close the subscription on November 1.

The offer comprises a fresh issue of Rs 630 crore and an offer for sale of over 4.19 crore equity shares by investors and promoter selling shareholders. The price band for the offer has been fixed at Rs 1,085-1,125 per equity share.

Fino Paytech-promoted Fino Payments Bank, which offers a diverse range of financial products and services, will open its public offer for bidding on October 29 and will close on November 2. The price band for the offer is expected to be announced next week.

Technical View

The Nifty50 formed bearish candle on the daily as well as weekly charts as it fell 0.35 percent on October 22 and over a percent during the week, indicating nervousness in the market in short term with likely support around 20-day simple moving average (SMA), but experts feel the long term structure is expected to remain positive.

"Markets are taking cues from volatile global equities and investors back home are booking profits after the recent upsurge even as tug of war continues between bulls and bears intra-day. Technically, on weekly charts benchmark Nifty has formed a bearish candle which supports temporary weakness, although medium-term structure is still positive," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He feels for positional traders 20-day SMA or 17950 would be the key support level. "On the flip side, 18,300 and 18,425 may act as a decisive resistance level. For day traders, 18,050 would be the sacrosanct support level and above the same, a pullback rally could be seen up to 18,300-18,350 levels. On the flip side, dismissal of 18,050 could trigger one more leg of correction up to 18,000-17,975," he said.

Meanwhile, Bank Nifty traded quite strong especially after crossing 40,000 mark for the first time last week and it was the only gainer among sectors, closing with 2.5 percent gains at 40,323.65 for the week, which experts feel can extend to 41,000 mark in coming sessions.

"For Bank Nifty, 40,500 is an important hurdle because it coincides with upsloping trendline resistance on the monthly chart where we could see some profit booking. But if it manages to sustain above this level then we can expect a further rally towards 41,000-41,500 levels," said Santosh Meena, Head of Research at Swastika Investmart. On the downside, "39,500-39,300 is an immediate and strong support zone, below this, 38,800-38,500 will be the next important support area," he added.

F&O Expiry Week

The futures & options contracts for September will expire in the coming week on October 28, so it could cause some volatility in the market during next week as traders close the current month positions and rollover positions to next month.

Option data indicated that the Nifty50 could see an immediate trading range of 18,000 to 18,500 levels in coming sessions, with 18,050 acting as a key support in the last two sessions.

Maximum Call open interest was seen at 18200 followed by 18500 & 18400 strikes, while maximum Put open interest was seen at 17500 followed by 18000 & 18200 strikes.

Maximum Call writing was seen at 18300, then 18200 & 18800 strikes with unwinding at 17700 & 18900 strikes, while Put writing was seen at 17500, then 18000 & 18100 strikes.

"At the inception of the series, the 18000 Call strike held the highest Call base and moved above this given sharp up move towards 18600. Hence, we believe these levels should extend support on downsides. However, breach of these levels may push the index towards 17,600 in coming sessions," said ICICI Direct.

"The volatility index has again suggested caution in the market and after recent outperformance a leg of profit booking cannot be ruled out," the brokerage added.

India VIX, which measures the expected volatility in the market, increased by 11.29 percent to 17.55 from 15.77 on a week-on-week basis.

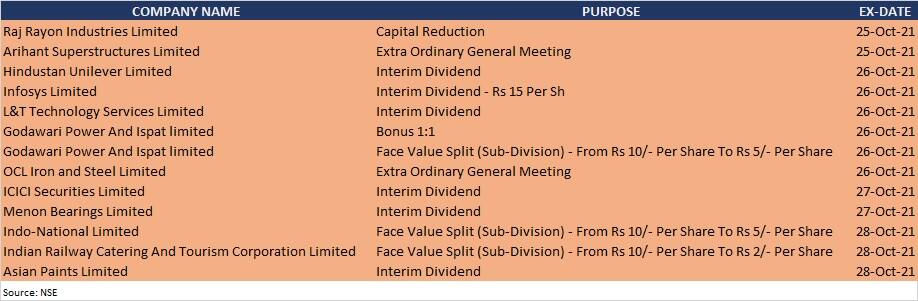

Corporate Action

Here are key corporate actions taking place in the coming week:

Among others, infrastructure output and fiscal deficit for September, and foreign exchange reserves for the week ended October 22 will be released on October 29.

Global Cues

Here are key global data points to watch out for next week:

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.