Top investment advisors are finding value in pockets for the near-to-medium term, with auto shares in pole position. In conversation with Moneycontrol, Ashutosh Tiwari, the Managing Director - Research at Equirus said we have now entered a phase that is a stock pickers' market. Navigating through inflation, rate hike and crude oil will be crucial to place one's bets. Here's the interview:

Bears controlled the market in the first half of CY22. Do you expect similar kind of trend in second half too, or will we see a sharp recovery after September quarter?

Considering the uncertainty in inflation, rate hike and oil prices, we don't expect sharp up move in the markets in near term, it's expected to remain sideways. We believe that it will be stock pickers' market for some time, rather than a broad-based one.

Auto space has seen significant run up despite market volatility. Do you think the party is yet to get over in the auto space?

Autos are coming out of a three-year down cycle and therefore we expect it to do well over next 2-3 years. Passenger vehicle (PV) demand was strong over last few quarters but supplies were impacted by the global chip shortage. As chip availability improves gradually, we expect PV volumes to recover as well, in the coming quarters.

The 2-wheeler demand was impacted by rural slowdown, but we have seen some green shoots over last 2-3 months and expect recovery to continue going ahead. Commercial vehicles (CVs) are also coming out of a sharp down cycle, with replacement demand helping the recovery.

We believe that auto is the sector to be for next 2-3 years and the stocks here will make a lot of money.

Even after 24 percent correction in 2022 so far in the IT space, should one still wait some more before picking stocks? Or has the time come to start accumulating with in this space?

If inflation rate in US doesn't start coming off, Fed might need to take more aggressive rate hikes than anticipated as of now, which can push US into a recession. It's the fear of this recession which is keeping IT stocks under pressure, as sales growth and pricing of services will depend on that.

However, on the positive side, INR depreciation versus USD will cushion margin to some extent, despite pricing pressure. Due to the uncertainty on demand next year, we believe that IT stocks will remain sideways over next 6-9 months.

Do you think the recession in the US is just a fear?

Historically, Fed has to take policy rates beyond inflation rate to tame price rise. Fed rates are still far behind inflation, and hence if inflation doesn't start coming off, Fed might need to go for aggressive rate hike. That can impact demand, and thus trigger a recession in US. It's still early to call whether US will go into recession or not, but there is a likelihood.

What are the pockets to pick in the recent correction and volatility, and why?

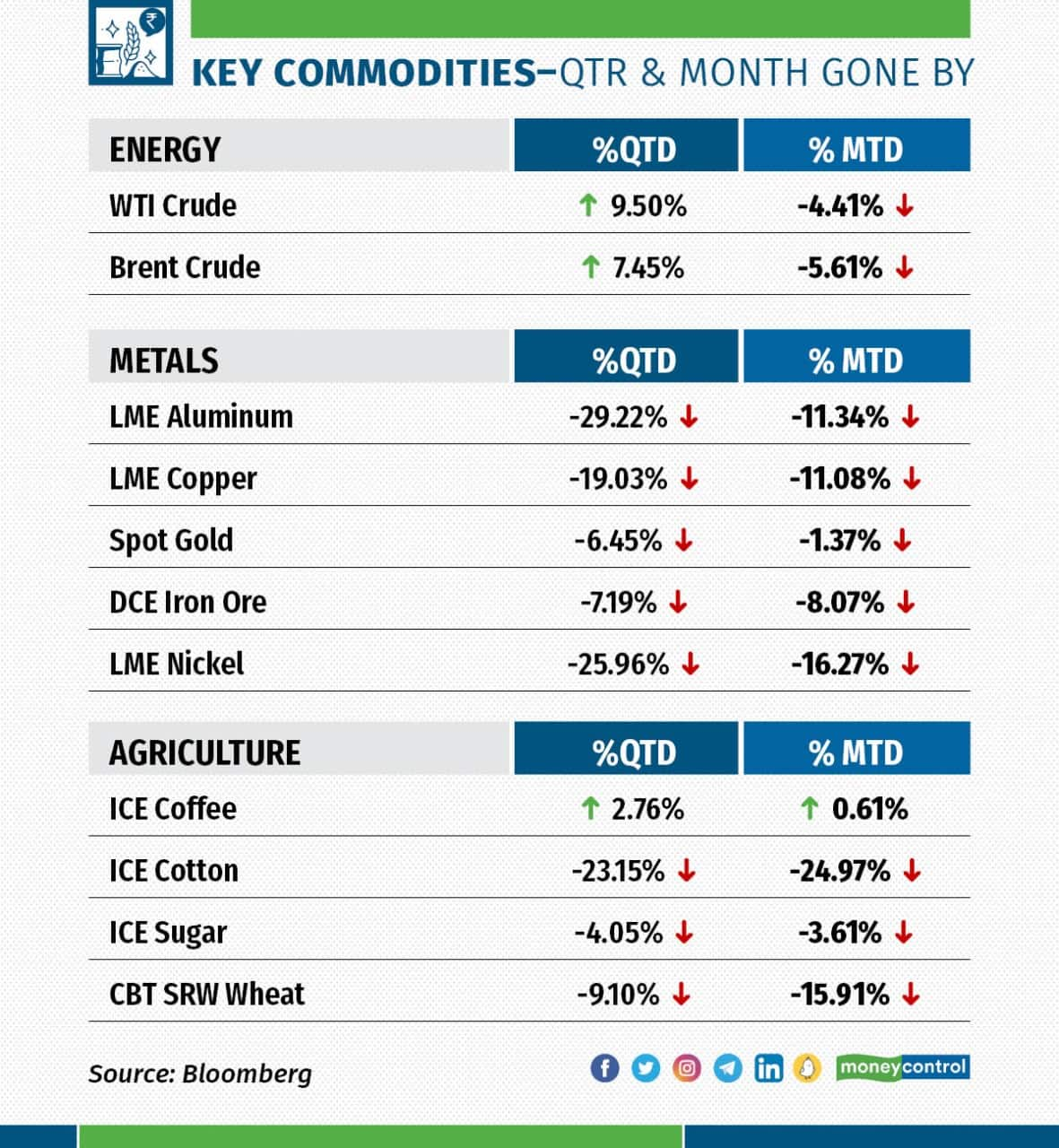

Auto is clearly one sector which looks good as it coming out of a down cycle, and recent fall in steel and aluminium prices are positive for margins. Apart from it, we like industrials as capex recovery is likely in India, and it is also benefitting from the China + 1 theme.

Cement sector also looks interesting. Even if we assume margin pressure over next two quarters and moderate recovery in EBITD per tonne post that, the sector is still trading at valuations which are close to 5-year lows.

India's valuation premium with respect to MSCI Emerging Market has corrected sharply but still higher than the long-term average. Do you think the premium is likely to sustain?

India is benefitting from higher retail flows in markets through direct as well as institutional route, as they have tested higher returns in equities versus other investment opportunities like debt and gold. Unless we see very sharp negative movement in the markets, domestic flows should remain strong, keeping valuations higher than the historical average.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.