Anshu Kapoor, who heads the investment management wing at Edelweiss Wealth Management, doesn't believe that the US economy is slipping into an imminent and inevitable recession.

"Rather than a pessimist, I would be a realist and say that the odds are still balanced," Kapoor says in an interview with Moneycontrol.

On the recent sharp corrections, he says the market has seen reasonable contraction in valuation and time correction because of interest rates and inflation movement over the last eight months. However, with coordinated steps taken by global central banks, we could be out of this situation, he believes.

"Markets are forward looking. So we should get back to normalised growth in next 2-3 quarters which will reverse the outflows from equity markets globally," he says. Excerpts from the interaction:

Do you think risk of recession is rising in the US?

It's never as good as it appears, and never as bad as it feels.

Investing sentiment and market cycles oscillate between euphoria and pessimism. Just like we could not predict the economic recovery after COVID, it's hard to say if we are indeed headed for recession. Governments and global central banks have earlier shown the ingenuity and resolve to solve seemingly impossible situations and I am hopeful that the US and other global economies can still ward off recession.

Have a look at the US 10-year treasury chart above. Is today's yield of around 3 percent unnatural? If the markets and US economy have seen even higher yields earlier, why is there so much noise today about a possible recession?

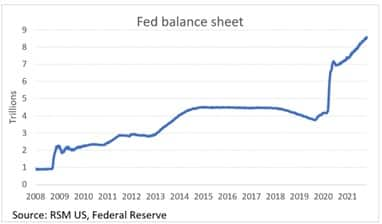

The first part of the answer lies in monetary tightening. Let me explain my point further with the below chart.

Unlike in previous market upheavals, the US Federal Reserve is raising interest rates and reducing its balance sheet sizably. Withdrawal of liquidity is further forcing interest rates up.

Now, let’s see the following chart to assess the puzzle's second piece -- inflation:

In a normal inflation scenario, the US Fed and other central banks can measure their interest response. It ensures availability of enough time to assess how the economy is responding - contracting too fast or correcting gradually. Unfortunately, with inflation running red hot at a 40-year high, the Fed doesn't have the luxury to raise interest rates slowly.

We are apparently at a position that market participants haven't seen in decades! The uncertainty is fueling dramatic volatility and stoking fears of a possible recession.

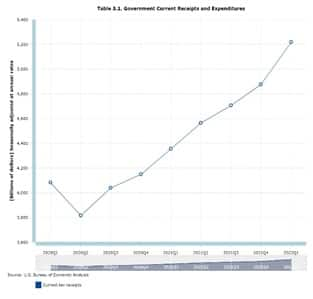

So, what are the positives? See the charts below:

The US government's revenues, as for other major economies, are at an all-time high. It points to a resurgent economy and booming stock markets, as seen last year. Also, spending by customers in the US on goods and services is at an all-time high, which is encouraging. Savings rate, exports growth, etc., are other data points showing buoyancy.

To summarize, I am not in the camp that sees imminent and inevitable recession. Rather than a pessimist, I would be a realist and say that the odds are still balanced.

To conclude: we cannot predict; we can be prepared!

Can we say that we are near the bottom, especially after severe correction and consolidation phase of last more than 8 months?

Absolutely, we have seen reasonable contraction in valuation and time correction because of interest rates and inflation movement over last 8 months. However, with coordinated steps taken by global central banks, we could be out of this situation. Markets are forward looking - we should get back to normalised growth in next 2-3 quarters which will reverse the outflows from equity markets globally.

What are the sectors where you still have a 'stay away' signal?

Most sectors have witnessed sharp downgrades and therefore contraction in valuation. We would avoid sectors which can relatively underperform. And therefore, we believe best of commodities and FMCG is behind us.

Do you think the second half of 2022 will be much better than first half for the market?

One year from now we will start looking at FY25, which will coincide with general elections in India and hopefully, much lower inflation environment. Both will be very supportive for the markets. Also, FII selling has been at an unprecedented level over last 8 months and once that reverses one can expect much higher returns over next 12-18 months.

Do you expect RBI to take a pause in 2023 after rate hikes in 2022? Do you see any sign of inflation peaking out in coming months?

Most metal and agri-commodity prices have seen reasonable correction over last 1-2 months. However, for India, crude is the key commodity and that too has seen almost 15 percent correction from its peak. If this trend continues, the RBI inflation target will be back in the target range and they might look to pause and monitor the situation before any further action.

How does the market investment strategy for long-short funds makes it different from the rest?

Long-short funds work on two core principles:

1. Minimising losses over maximising gains

Currently, the market risks have been triggered by challenges in the economy, geopolitics, liquidity and sentiment. These are pervasive features of modern markets and a long-short strategy helps in limiting an investor’s downside. In other words, in sharply falling markets, investors in long-short funds will experience a lower fall. The reduction in downside trajectory is achieved by systematically hedging the portfolio and by being agile in lowering the overall exposure, called net delta, in technical parlance.

By falling less than the market in turbulent times, and by swiftly catching the uptrend, these funds aim to outperform market cycles.

2. Not mirroring the benchmark (Nifty or others)

Such funds do not mirror the benchmarks (Nifty 50 or others). Therefore, portfolio allocations are swiftly moved to stocks in sectors that are likely to perform in a particular cycle. For example, in today’s environment, the portfolio allocation could be over-weight real estate, banks and underweight consumption – with no regard to how these sectors weigh in the Nifty.

Long-short funds typically target a performance range rather than only focusing on the NIFTY or any other benchmark, which aligns with investors’ goals of wealth maximization.

What is the scope in AIF investment for retail investors in India?

AIF in India is at a very nascent stage. Over last few years we have seen investors realising the importance of differentiated solutions and increasing their allocation. We believe retail too will contribute towards the growth of this category as volatility increases considering ongoing risks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.