Prashant Jain

The last few weeks have witnessed one of the sharpest corrections in the capital markets. The severity of which has caught even seasoned investors off guard. The trigger was, of course, the coronavirus outbreak and its consequent impact over short, medium and long term. COVID-19 has dominated the attention of one and all to such an extent that nearly 50 percent fall in crude oil prices has been overshadowed and did not receive the attention it deserved.

In all fairness, this fall in equity markets is not without precedence -- the around 50 percent fall in 1992, around 40 percent in 2001, around 60 percent in 2008 were comparable in intensity and in breadth to the present one, though there are several differences too.

COVID-19 and the sharp fall in oil prices will have a material impact on world economy, including Emerging markets (EMs) and India over the short, medium and long term. However, the impact is not likely to be uniform across geographies and time.

The sharp fall in discretionary spending in large economies of the West and in Asia along with the sharp fall in oil prices will materially impact countries with high dependence on merchandise exports and crude oil exports.

India, fortunately, unlike most other Ems, is not a large exporter and is, in fact, a large net oil importer. Our merchandise exports in 2019 were $331 billion (around 12 percent of GDP) and net oil imports were around $86 billion (Source: CMIE).

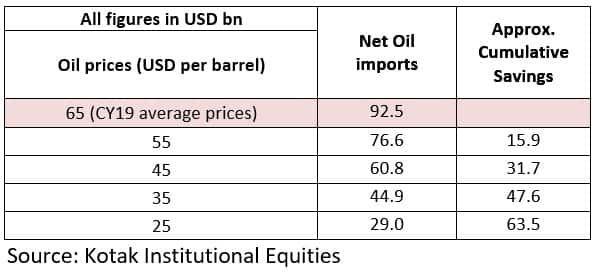

Further, our exports have low exposure to discretionary items - electronics, automobiles, luxury goods etc. Following table summarises the net impact on India's net oil imports for different levels of oil prices in FY21.

Assuming a ballpark 50 percent value addition in total exports (excluding oil), even if exports fall by around 15-20 percent, the impact should be set off by savings in oil. Thus, India may not be worse off in the current environment on the external front unless oil prices move up sharply and sustain at those levels.

Assuming a ballpark 50 percent value addition in total exports (excluding oil), even if exports fall by around 15-20 percent, the impact should be set off by savings in oil. Thus, India may not be worse off in the current environment on the external front unless oil prices move up sharply and sustain at those levels.

That takes gets us to the next question: if we may not be worse off then why are markets behaving the way they are?

For one, the impact of the lockdown will be a material one in the short run, especially on discretionary consumption. There will also be an adverse impact on wages, especially in the unorganised sector and that is likely to adversely impact non-discretionary consumption as well.

The impact on profitability is higher than the impact on sales due to fixed costs in businesses.

Sectors that should be relatively less impacted are large banks, pharma, oil refining and marketing, utilities, EPC, etc. In any case, impact is not likely to be material in the long term for these sectors.

The fall in discretionary consumption in India should also reduce imports of large import items like electronics (gross import of $59 billion) and gold (gross import of $31 billion).

The key reason for the sharp fall in markets is the unprecedented intensity of FII selling in the last few weeks. In March, FPIs sold nearly $8.3 billion, 0.4 percent of total market capitalization - highest intensity ever of selling in a month.

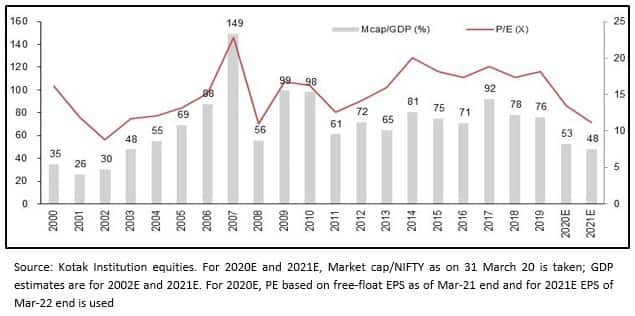

This is so because India is clubbed with other EMs, even though it stands to gain in the current environment -- at least in the medium term. Thus, the sharp fall is an opportunity for long-term investors, in my opinion. Post the fall, market cap to GDP is near 50 percent -- only twice in he last 30 years have markets traded so cheap, last being during global financial crisis.

One reason why majority of investors earn below average returns in equities is because their investments are directly proportional to sentiment and the environment-- the better the environment, the better the sentiment, the higher the past returns, the higher are the investments and vice versa.

This tendency to invest more in good times and less or nothing in challenging times is the key culprit for subpar returns over the long run. Valuation at the time of investments, generally, is one of the most reliable indicator of long term returns (as against news/sentiments etc, which investors most focus on) -- low starting valuations invariably lead to above average returns over the medium to long term.

However, this is easier said than done. Fear and pessimism dominate at such times and to overcome fear of investing at such times, investors should start by asking questions like-- will COVID-19 still make headlines after one year? Will life and therefore economic activity come back to near normal after one year? Does India lose more due to fall in exports or does it gain more due to lower oil prices? Will FIIs continue to sell forever? Have the best investments of the past been made around 9/11, Lehman crisis, taper tantrums, European debt crisis, and when FIIs were large sellers or no?

The answer to most of these is quite evident and so is what investors should do. Situations, such as the current one, present an opportunity for the discerning and patient investors.

In my opinion, a sensible way to invest in these markets is to phase out one's total investible surplus of risk capital over few months.

One significant tranche can be deployed now in largecap/ multicap funds because markets are down around 30 percent and there is a likelihood that as we gain control over the COVID-19 situation, things will come back to normal.

The other portion should be kept on hold for now -- just in case situation becomes worse before becoming better and should be invested either way after a few weeks or months. I will leave you with a final thought which legendary investor Warren Buffet said, "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

(The author is Executive Director & Chief Investment Officer at HDFC Asset Management Company.)

Disclosure: The views expressed by Mr. Prashant Jain are as of April 3, 2020. The views are based on internal data, publicly available information and other sources believed to be reliable but involve uncertainties that could cause actual events to differ materially from those expressed or implied in such statements. Stocks/Sectors referred above are illustrative and not recommended by HDFC Mutual Fund / AMC. The Fund may or may not have any present or future positions in these sectors. The above should not be construed as an investment advice or a research report or a recommendation by HDFC Mutual Fund/HDFC AMC to buy or sell the stock or any other security covered under the respective sector/s. In view of the individual circumstances and risk profile, each investor is advised to consult his / her professional advisor before taking decisions regarding investments in any securities. HDFC Mutual Fund/AMC is not guaranteeing any returns on investments made in the Scheme(s). Past performance may or may not be sustained in future. Neither HDFC AMC and HDFC Mutual Fund nor any person connected with them, accepts any liability arising from the use of this information.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.