Indian pharma companies reaped the benefits of increased demand after the coronavirus outbreak hit the world and brokerages believe that the pandemic remains a key upside trigger for the sector.

After logging strong gains in the calendar year 2020, pharma stocks have of late witnessed profit-booking. The Nifty Pharma is down 6 percent in the year 2021 versus an 8 percent gain in the Nifty50.

Analysts and brokerages, however, are positive on this non-cyclical sector, saying the outbreak has given India a chance to emerge as the global supply hub.

"China dominates global API supplies and has a higher share in antibiotics and vitamin products. However, the Indian government is now eyeing to make the best of the current opportunity, and the domestic pharma industry may gain with the production-linked incentive scheme for 53 critical bulk drugs ," Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities said.

Small and mid-sized suppliers were more likely to benefit as compared to leading API producers, he said, referring to active pharmaceutical ingredients, also known as bulk drugs, these are the raw materials for medicines. China accounts for 70 percent of India's API imports.

"While India is already a dominant player in supplying affordable quality medicines globally, multiple other opportunities await domestic pharma companies. This includes rising per capita spending on medicine in India due to factors such as aging population and penetrating the US non-oral solids generic market," he added.

The sector will continue to be attractive, as the US business is bound to see some stabilisation and even Indian business is showing some traction, he said.

Oza has warned of the risk of an increase in US Food and Drug Administration (FDA) inspections once the situation normalises, as several manufacturing plants are due for re-inspection.

The Indian pharma industry has evolved over the years and now boasts of the largest number of FDA-approved pharma units outside the United States.

The government has expanded a production-linked incentive (PLI) scheme to the pharma sector as well, with an outlay is Rs 15,000 crore.

The scheme is an effort to make the Indian industry globally competitive and geared towards the production of high-value drugs, leveraging its position as a country that exports low cost-pharma to more than 200 nations.

As per global brokerage firm Nomura, large listed players with a strong manufacturing base and intent to expand will benefit from the scheme.

As reported by CNBC-TV18, Nomura believes some 15-20 companies will be eligible for the PLI. Aurobindo Pharma, Dr Reddy's Labs, Lupin, Cipla, Cadila and Sun Pharma are likely to benefit from it.

Stocks to buy

While the long-term business outlook on the pharma sector remaining positive with better visibility for bulk drug companies, one should not bet blindly on the sector and be careful in picking stocks, say analaysts.

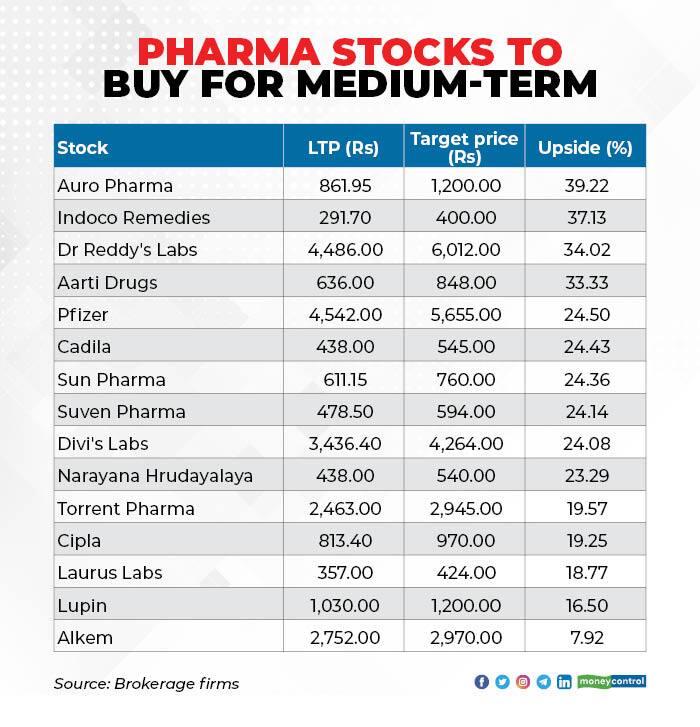

Based on the recommendations of various experts, here are 15 pharma stocks that can give up to 39 percent return in the medium term:

Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities

Cipla (target price Rs 950), Lupin (target price Rs 1,200) and Narayana Hrudayalaya (target price Rs 540).

Vinod Nair, Head of Research at Geojit Financial Services

Dr Reddy's Laboratories (target price Rs 5,712), Divi's Labs (Rs 4,264), Torrent Pharma (Rs 2,945), Cadila (Rs 545) and Suven Pharmacueticals (Rs 586).

Anand Rathi Share & Stock Brokers

Laurus Labs (target price Rs 424), Pfizer (Rs 5,655), Aarti Drugs (Rs 848), Suven Pharma (Rs 594) and Dr Reddy's Laboratories (Rs 6,012).

Prabhudas Lilladher

Aurobindo Pharma (target price Rs 1,200), Sun Pharma (Rs 760), Cipla (Rs 970), Lupin (Rs 950) and Indoco Remedies (Rs 400).

CapitalVia Global Research

Torrent Pharmaceuticals (target price: Rs 2,620 | Stop loss: Rs 2,390), Sun Pharma (target price: Rs 670 | Stop loss: Rs 574), Dr Reddy's Laboratories (target price: Rs 4,770 | Stop loss: Rs 4,370), Cadila (target price: Rs 490 | Stop loss: Rs 415) and Alkem Laboratories (target price: Rs 2,970 | Stop loss: Rs 2,700).

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.