Timely intervention by the central government brought fertiliser stocks in focus after the union government decided to increase the fertilizer subsidy outlay for the year by 14,775 crore.

This will take the fertilizer subsidy outlay for 2021-22 to Rs 94,305 crore from a budgeted outlay of Rs 79,530 crore.

The government also increase the subsidy for diammonium phosphate (DAP) fertilizer from Rs 500 to Rs 1200 per bag, an increase of 140 percent which will put focus on companies such as Coromandel International and Chambal Fertilisers are likely to benefit the most from this move.

The additional subsidy burden on the government will be Rs 147.7 billion. A higher subsidy is aimed at keeping market prices at the past year’s levels, Elara Cpital said in a note.

In CY20, the selling price of DAP was Rs 24,000 per tonne, which increased to Rs 38,000 per tonne this year, due to the sharp rise in prices of phosphoric & sulphuric acid and ammonia.

All major fertilisers companies among our coverage, such as Coromandel International and Chambal Fertilisers are likely to benefit, the note added.

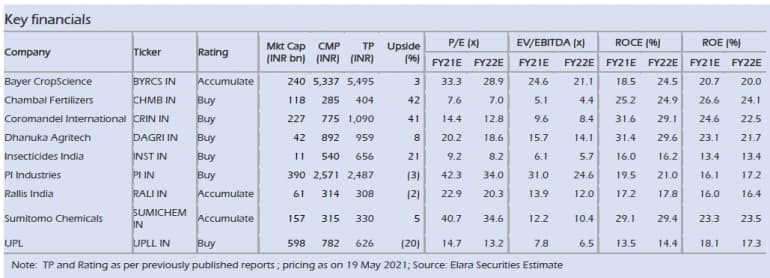

Elara Capital has a buy rating on Chambal Fertilisers as well as Coromandel International with a target price of Rs 404, and Rs 1090 respectively which translates into an upside of over 30 percent each in both the counters from May 20 closing price.

The government’s timely intervention will benefit farmers as well as the fertilisers industry. The government’s decision to bear 50% of the cost of DAP fertilisers will reduce the market price to the past year’s level of Rs 24,000/tonne, making it more affordable.

As a result, Elara Capital expects healthy volume growth in FY22 on the back of the forecast of a normal Monsoon and low fertilisers prices. “Margin of fertilisers companies will sustain, in our view, as raw material cost escalation has been offset by higher subsidy,” it said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.