Nifty50 rallied by over 9 percent in the September quarter (June 30-September 30), and now all eyes are on the December quarter, which began from October 1.

The December quarter started with some fireworks as both Sensex and Nifty50 reclaimed crucial resistance levels in October.

Two key events in the December quarter are US elections and the Q2 earnings as most economic activities re-open under the Unlock.

The economic growth and corporate earnings took a hit in Q1 due to the coronavirus-induced lockdown.

Although most experts do not see a major upside in the benchmark indices taking into account the recent rally of about 50 percent from the March lows, the stock-specific action is likely to continue.

Let's look at some names that have been consistent performers in last three years.

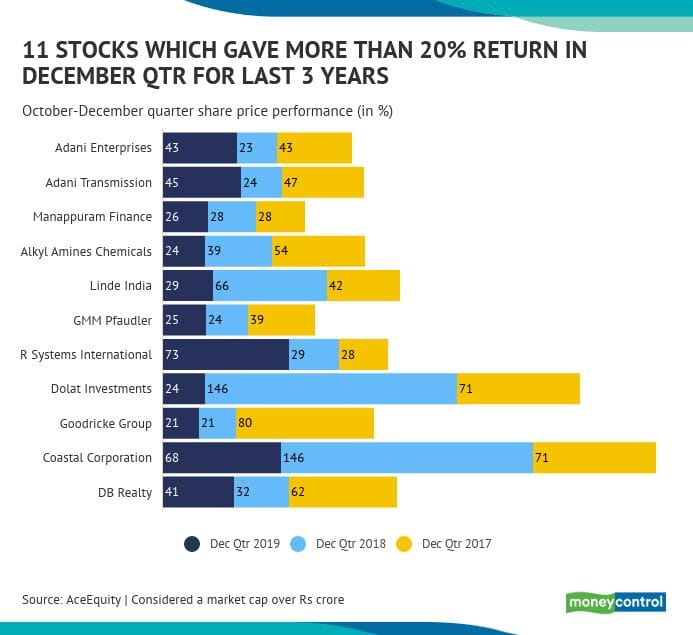

In the Q3 of past three financial years, as many as 11 stocks (with a market cap of more than Rs 100 crore) rallied 20-140 percent.

Stocks that gave double-digit returns consistently in the last quarter of the previous three calendar years include DB Realty, GMM Pfaudler, Dolat Investments, Alkyl Amines, Manappuram Finance, Adani Transmission, and Adani Enterprises.

Experts are of the view that the December quarter of 2020 is likely to be a tough quarter largely on account of the outbreak of COVID, and consistent rise in the infections across the globe which has fuelled the possibilities of another wave of lockdowns, but there could be few exceptions.

“While there is not much of a relation between stock performance & financial performance of the company in December quarter, some of the names like Adani Transmission, Manappuram Finance, Alkyl Amines, Linde India are expected to continue to do well as these are backed by strong fundamentals and have multi-year triggers for growth ahead,” Paras Bothra, President of Equity Research, Ashika Stock Broking told Moneycontrol.

“Even though the valuations might appear stretched for some, nevertheless should be accumulated at corrections,” he said.

Most of the stocks are from the small & midcap space, and some of them have rallied so far in 2020 because the smart money is chasing growth in the broader market space. But, at the same time, investors should remain cautious and do their own research before putting money because of low liquidity.

“Many of these stocks are small caps and are not widely covered by research houses given the poor track record of financials and concerns over corporate governance,” Arjun Yash Mahajan- Head Institutional Business at Reliance Securities told Moneycontrol.

“It does not necessarily mean that all these stocks will continue to deliver similar returns during the period you mention given investors these days are more cautious about taking bets on small caps,” he said.

How is the next 6 months likely to pan out?

The Nifty50 rallied by about 30 percent in the last six months but it still hasn’t turned positive for the year 2020. Experts advise investors to watch out for sectors that are beneficiaries of COVID-19, as well as the opening of the economy.

“Recovery will be hopefully better in H2, along with festival season coming that quarter. Partial unlock is in progress but recovery plays are positioned in such a way that operational costs would still equivalent to running with full customer capacity,” Pritam Deuskar, Founder of Wealthyvia.com told Moneycontrol.

“Psychologically it may take some period to return to pre-COVID. If somebody takes a view of two-three years then hotels, multiplex, travels are recovery plays to consider,” he said.

Taking cues from the past instances, markets trade with positive bias after the US election. December quarter would witness high volatility but positive momentum would continue, suggest experts.

On the other hand, if earnings or US elections outcome does not pan out as per expectation or if there is a rise in the number of COVID cases there could be a knee jerk reaction on the downside, and thus investors should stagger their buying, they say.

“With the reopening of the economy in a phased manner, sectors impacted would recover but at a gradual pace. We suggest investing in a staggered manner to play the unlocking theme,” Ajit Mishra, VP Research, Religare Broking told Moneycontrol.

“Needless to say, they should maintain their preference for the stocks having prudent management, decent financial growth plans, and low leverage,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.