October 22, 2018 / 15:36 IST

Market at Close

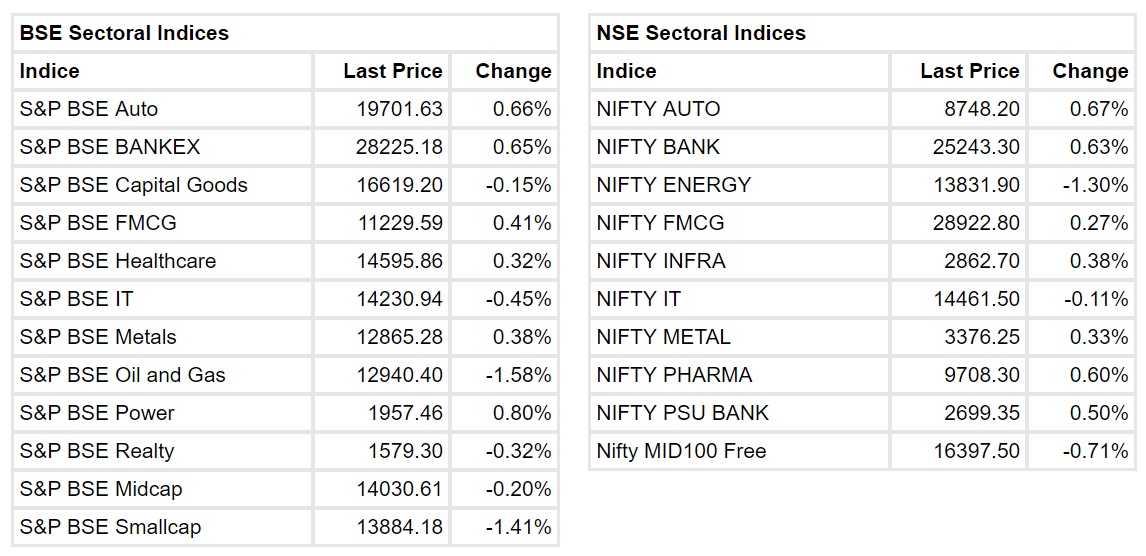

Weakness in the last hour of trade dragged equity benchmarks to low points. The Nifty ended the session below 10,250-mark, while the Sensex shed over 180 points. Against this, the market had a strong start, with the Sensex and Nifty having risen a percent each.

Financials gave up all of their gains and were a lag on the benchmarks. Along with them, energy, IT, and metals were the big losers. Sell-off in midcaps, too, added to the weakness, with the Nifty Midcap index falling over a percent lower.

At the close of market hours, the Sensex closed down 181.25 points or 0.53% at 34134.38, while the Nifty fell 58.20 points or 0.56% at 10245.30. The market breadth was negative as 832 shares advanced, against a decline of 1,758 shares, while 980 shares were unchanged.

ICICI Bank, NTPC, Indiabulls Housing and Eicher Motors are the top gainers, while IndusInd Bank, Reliance Industries, and BPCL lost the most.

October 22, 2018 / 15:24 IST

Rupee Update:

The rupee is trading around 73.42 per US dollar in the afternoon session. Image: Bloomberg.com

October 22, 2018 / 15:18 IST

October 22, 2018 / 15:16 IST

Market Update

The Sensex is down 200.60 points or 0.58% at 34115.03, while the Nifty is down 71.20 points or 0.69% at 10232.30. The market breadth is negative as 771 shares advanced, against a decline of 1,712 shares, while 1,085 shares were unchanged.

October 22, 2018 / 15:10 IST

ALERT |

State Bank of India’s Board has approved raising up to Rs 20,000 crore through securities in FY19.

October 22, 2018 / 15:07 IST

JUST IN |

Hindustan Zinc has reported a net profit of Rs 1,815 crore, while its revenues are reported at Rs 4,777 crore for the September quarter.

October 22, 2018 / 14:58 IST

Jubilant Life Sciences Q2 numbers

: The company's consolidated net profit was up 64 percent at Rs 210.4 crore against Rs 128.3 crore, revenue rose 38.2 percent at Rs 2,269.5 crore versus Rs 1,642 crore, YoY.

October 22, 2018 / 14:47 IST

Result Reaction:

Shares of Kansai Nerolac Paints touched 52-week low of Rs 378.60, plunged more than 9 percent after company posted weak numbers in the quarter ended September 2018.

October 22, 2018 / 14:21 IST

MARKET OUTLOOK: MORGAN STANLEY ON BANKS

The higher interest rate trajectory, based on the position of Indian economy, amid NBFC turmoil is likely to improve large banks' positioning even more, Morgan Stanley said in a note.

In the large banks space, the global investment bank prefers ICICI Bank, HDFC Bank, State Bank of India and Axis Bank which could give 30-40 percent return in the next 12 months. Morgan Stanley turns underweight on Yes Bank and RBL Bank, and 'equal weight' on AU Small Finance Bank.

Read the full report here.

October 22, 2018 / 14:18 IST

October 22, 2018 / 14:04 IST

Schaeffler India Result:

The company's Q3 net profit declined 5 percent at Rs 90.7 crore against Rs 95.5 crore. Revenue was up 18.7 percent at Rs 1,191.5 crore versus Rs 1,004 crore, YoY.