Chemical companies in India are clearly looking at the bigger picture. Even as they face a continued global demand slowdown, they are not holding back on capital expenditure to enhance capacity, despite this adding to stress on their balance sheets. However, the near-term pain could mean long-term gain given that the outlook for the country's chemicals sector is robust, especially helped by the capacities coming onstream now.

The impact of destocking in Europe and the US has significantly dented global demand, while a decline in Chinese demand has prompted companies there to offload inventories in other regions. This has collectively resulted in a downward pressure on prices.

"In several of the segments, despite a poor global demand, China appears to have been raising its production in 2023, putting downward pressure on realisations, especially for domestic players," brokerage firm Prabhudas Lilladher highlighted.

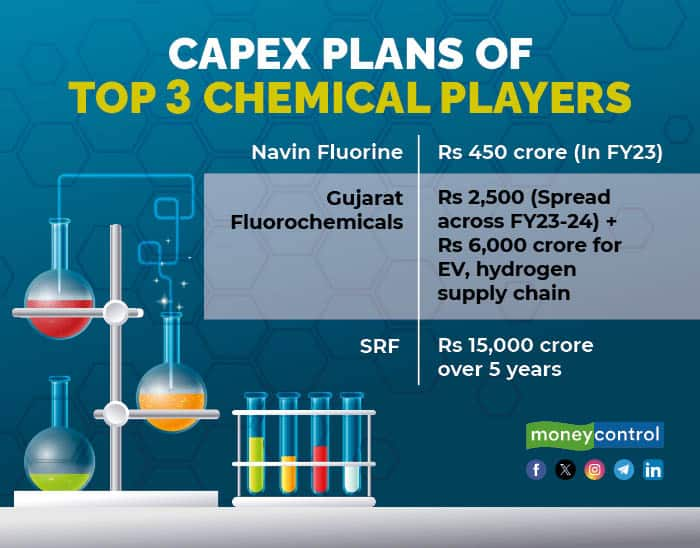

The weak demand environment also coincided with a time when domestic chemical players were going big on capacity expansion to reap the benefits of the growing China+1 sentiment. But in the face of the demand slowdown, chemical players are now feeling the heat of the ongoing capital expenditure, which is weighing on their margins.

Slow demand, margin pressure drive bearish ratings on chemical stocks

Anticipating prolonged pressure on demand and margins for the chemicals sector, Prabhudas Lilladher, like many other brokerages, opted for a cautious view.

The firm has a 'hold' rating on Gujarat Fluorochemicals, Jubilant Ingrevia, Clean Science Technology and Fine Organic Industries. It has a 'reduce' call on SRF, Vinati Organics, Aarti Industries, Deepak Nitrate and NOCIL. The brokerage has a 'sell' recommendation on Laxmi Organic.

In contrast, Navin Fluorine emerged as the only chemical stock garnering an upgrade to 'buy' from the brokerage, largely due to the recent correction in the stock price.

The concerns of further pressure on the sector become clearer when one looks at their Q3 report card.

Chemical companies’ revenues, margins hit

In the fiscal third quarter, 8 out of 22 chemical companies recorded their lowest quarterly sales since the COVID-19 outbreak. Four companies’ sales were close to their lowest quarterly numbers since the pandemic. Additionally, 16 of these companies reported a year-on-year decline in revenue.

Also Read | Indian chemical players had big hopes riding on China+1, but reality dashes them

Furthermore, 12 companies witnessed a drop in gross margins compared to the same quarter last year, with 8 of them also reporting a sequential decline.

The situation was more challenging concerning EBITDA (earnings before interest, taxes, depreciation and amortisation) margins primarily due to the aggressive capex undertaken. Eighteen companies reported a year-on-year decline while 11 showed a sequential contraction in EBITDA margins.

Pain to continue for a few more quarters

The sector was once among India's brighter prospects due to China+1 and a slump in European specialty chemicals production. However, changing dynamics globally suggest that pain due to muted demand and pricing pressure is likely to persist till at least the first quarter of FY25, meaning there is still a long way for the stock prices of chemical companies to recover from a correction that began last year.

AK Prabhakar, head of research at IDBI Capital, said the six-month outlook for the sector is not encouraging for investors. "One or more quarters of bad results will be possible. People who have long-term views need not worry,” he said.

Long-term outlook bright

While the near-term pressure is most likely to persist, analysts as well as industry participants are bullish on the sector's long-term growth trajectory, also helped by the capacity expansion under way.

Maulik Patel, chairman and managing director at chemicals company Epigral, is already seeing green shoots emerging in the domestic market and anticipates global demand to normalise by the end of the first half of FY25. That is when he expects the increased capacity of the domestic chemical industry to begin yielding results.

Patel also justifies the capex undertaken by chemical majors even as demand remained muted. He believes the capex will push India up the ladder when competing with China, which is the world's largest producer of chemicals.

"China is strong in the specialty chemical space as it commands a fully vertical integration of production. In that context, Indian chemical companies stood at a disadvantage if they did not move towards the path of vertical integration. Hence, the recent capex unleashed by the industry will help in presenting itself as an alternate vendor to China when demand revives," Patel said in an interaction with Moneycontrol.

Patel is also betting on the domestic demand to aid a recovery in the industry. "FY24 turned out to be a tumultuous year for the chemical sector. But now we expect to see improvement in FY25 as demand comes back, while FY26 is likely to turn out much better," Patel said.

Also Read | Speciality chemical stocks: When will the pain end?

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.